stock screener query

Unlocking Investment Opportunities: Mastering the Stock Screener Query

Stock screening is a powerful tool for investors, enabling them to identify potential investments based on specific criteria. This detailed guide delves into the intricacies of stock screener queries, exploring how to construct effective searches and leverage this powerful feature to your advantage. A solid understanding of stock screener query language is essential to extracting relevant data and uncovering promising investment prospects.

Understanding the Fundamentals of Stock Screener Queries

A stock screener query is the bedrock of your search in a stock market analysis tool. It acts as a precise filter, sifting through countless possibilities and narrowing down options to a manageable set of potential candidates. Effectively crafting stock screener queries is paramount to avoiding extraneous data and locating companies matching specific criteria, such as sector-specific or revenue-focused profiles. Understanding different data parameters is fundamental to effective stock screener query implementation.

Defining Your Investment Criteria

This is arguably the most critical aspect of the stock screener query process. Before entering your stock screener query, meticulously define your investment objectives and criteria. Are you seeking high-growth stocks, dividend-paying stocks, or a blend of both? Are you focusing on a particular industry sector, such as technology or healthcare? This stage often defines the efficacy of the entire stock screener query exercise. Your stock screener query must reflect your individual investment approach.

Keyword Usage in Your Stock Screener Query: Maximizing Results

Effective stock screener queries employ a range of keywords. Using industry-specific jargon, key performance indicators (KPIs) and financial ratios in the stock screener query is vital for successful results. Start with broad terms and narrow them down by adding precise details for better accuracy. Your stock screener query needs to be specific to yield relevant stock screening outcomes. Understand what terms your chosen platform uses – they often have specific abbreviations and terminology within the stock screener query system. Testing your stock screener query by adding keywords and refining the search strategy.

Refining Your Stock Screener Query with Advanced Filtering

Stock screener queries aren't limited to simple keywords. More sophisticated screening can be achieved through numerical and relational operators to target a desired profile precisely, using a complex stock screener query. Examples include selecting stocks within specific price ranges (stock screener query focused), identifying stocks based on revenue growth, market capitalization, or even dividend yield. Utilize features for advanced stock screener queries offered by your platform and hone in on unique features for deeper filtering capabilities within the stock screener query interface.

Implementing and Using Stock Screener Queries Effectively

Source: ezstockscreener.com

Choosing the Right Stock Screener Tool

The first step in crafting accurate stock screener queries is choosing the right platform. Numerous tools are available offering different features, capabilities, and prices. Examine the features of different screener tools carefully before selecting the ideal platform to execute your stock screener query strategy. Each stock screener platform supports stock screener queries to some degree, and how to formulate the queries may vary based on the vendor you chose.

Step-by-Step Guide to Crafting a Successful Stock Screener Query

- Identify your financial goals: Define your risk tolerance and desired return.

- Specify the target industry/sector: Choose a sector or set of companies for your stock screener query focusing.

- Establish specific stock characteristics: Revenue growth rate, debt-to-equity ratio or historical stock price, dividend payout, P/E ratios are common characteristics considered during the stock screener query process. Your criteria are what drive your stock screener query.

- Compose your stock screener query: Craft the query within your selected platform, meticulously combining criteria in a clear, focused way, carefully constructing each section of your stock screener query. The resulting stock screener query string can be copied and reused.

- Execute and Analyze Results: Evaluate the screened list of stocks, identify stocks meeting your financial criteria using a clear process for your stock screener query.

Advanced Techniques for Stock Screener Queries

Combining Multiple Criteria in Stock Screener Queries

Advanced investors will likely apply numerous filtering criteria for refined analysis. By combining different stock attributes using AND and OR logic, users of stock screener queries gain tighter control over search parameters and better targeting of promising stocks, for greater clarity within the stock screener query system.

Utilizing Historical Data in Stock Screener Queries

Examine a company's historical performance through various data points, including financial results over the years, historical prices and dividends and more, enhancing your stock screener query capability, thereby understanding how stock performance evolves. The effectiveness of stock screener query techniques in predicting future results can be highly beneficial if done meticulously.

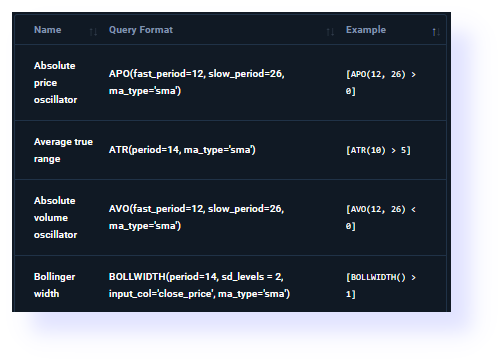

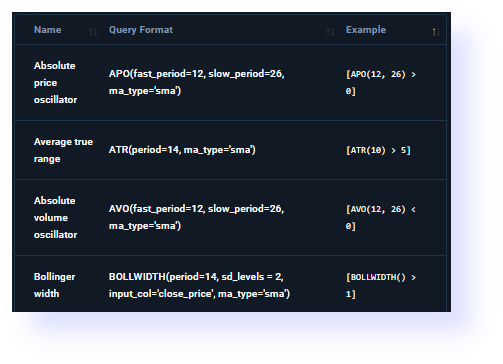

Understanding Metrics Within a Stock Screener Query

Source: dhan.co

Key Performance Indicators (KPIs) and Your Stock Screener Query

Identifying key financial ratios to focus on can optimize the effectiveness of stock screener queries. Look for specific values for return on equity, profit margins or revenue growth when employing stock screener query operations. Evaluate these financial statistics. Understanding their context in the stock screener query allows a deeper interpretation. Use these to filter and prioritize candidates during stock screener query deployment.

Source: learnstockmarket.in

Market Capitalization & Stock Screener Query Results

Market capitalization is frequently part of stock screener query algorithms. Your search will involve targeting specific market cap levels to ensure you discover a variety of candidates suitable for the investment strategies you are applying through a stock screener query system. Knowing these criteria and the potential results within the stock screener query process can aid in proper allocation and portfolio management. Refine stock screener queries using specific caps or ranges to align with investment criteria.

Utilizing Alerts and Monitoring for Continued Success with Stock Screener Query Results

The most critical aspect for ongoing successful stock screener query utilization. Setting up email or other notification systems to alert you about important price changes, or if metrics related to the stock change, within a specific interval is vital for maintaining the efficiency of your stock screener query system.

Stock Alerts Based on Stock Screener Query Refinement

Source: yimg.com

Periodic review of stock performance against criteria set through stock screener queries helps optimize ongoing portfolio management. The efficacy of using stock screener queries in such activities, by adding dynamic conditions, is noteworthy.

Utilizing a Dedicated Tracking Mechanism for Your Stock Screener Query Results

Maintaining a central location for your tracked companies for stock screener queries enables organized information for stock research. Tracking and evaluating these screened stocks using data gathered and reported through stock screener query filters for a deep and organized perspective. Consistent monitoring is paramount for any investor interested in stock selection and using a stock screener query platform.

This comprehensive guide has equipped you with a clear understanding of stock screener queries, how to use them effectively, and what aspects of stock screener queries can impact and enhance the overall success of the stock screening exercise. Proper application of a robust stock screener query strategy significantly enhances the quality of your investment selection process.