stock screener pe ratio

Unlocking Investment Opportunities: Using a Stock Screener PE Ratio

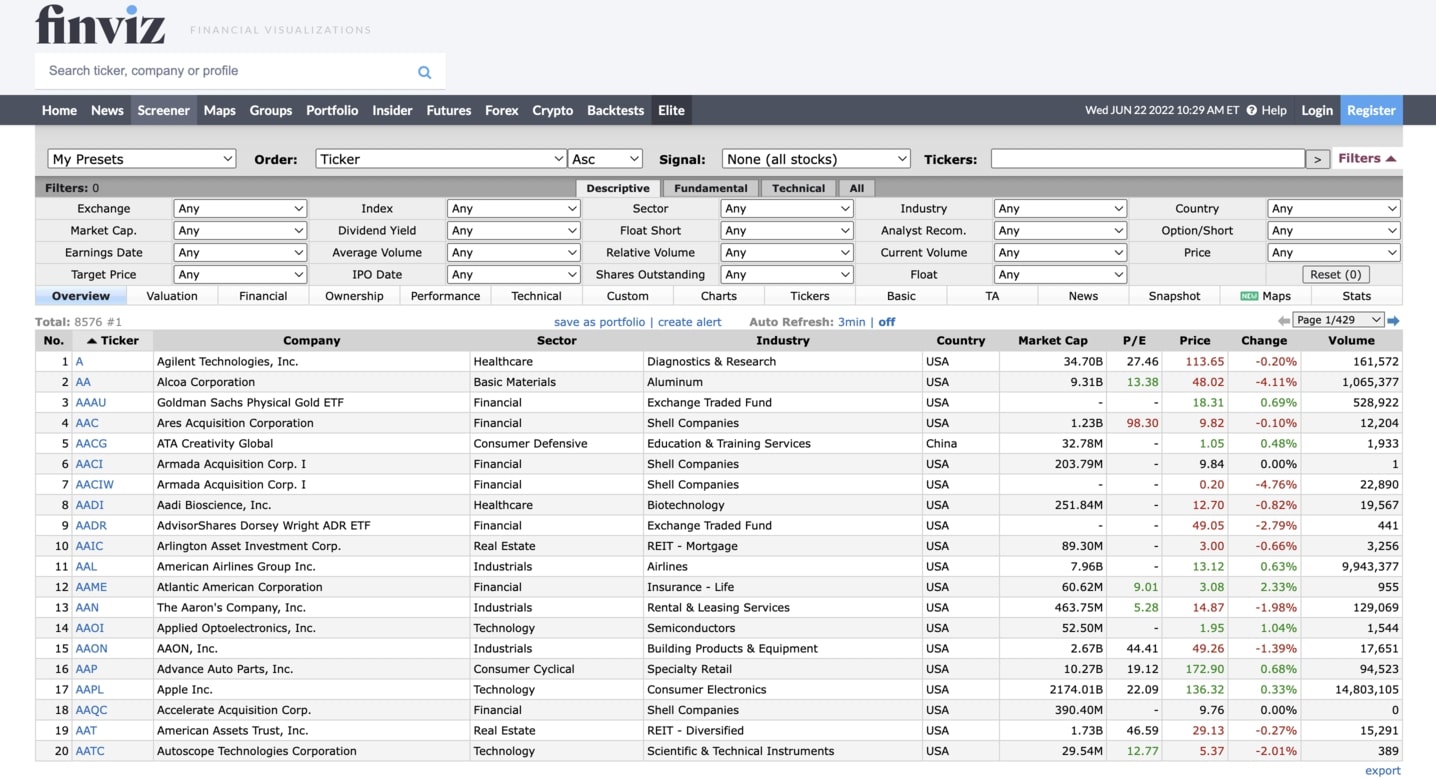

Source: ytimg.com

A stock screener PE ratio is a powerful tool for investors seeking to identify potentially attractive investments. This article delves into the concept of the Price-to-Earnings (PE) ratio and how stock screeners leverage it to find undervalued companies.

What is the PE Ratio and How Does it Work?

Understanding the Fundamentals

The Price-to-Earnings (PE) ratio, a key metric in fundamental analysis, essentially measures how much investors are willing to pay for each dollar of a company's earnings. A stock screener PE ratio can highlight companies that fit specific investment criteria, but you need to know what to look for. A stock screener PE ratio analysis helps sift through the market noise, and find opportunities. Understanding the concept of a stock screener PE ratio is the first step toward profitable investing. A high PE ratio suggests investors expect high future earnings growth. A low stock screener PE ratio could mean the stock is undervalued, or there might be significant concerns about the company's future earnings. But be aware, the usefulness of a stock screener PE ratio in your analysis should never stand alone! A deep analysis of other metrics is crucial.

Calculating the PE Ratio

The PE ratio is calculated by dividing the current market price of a stock by its earnings per share (EPS). A stock screener PE ratio analysis provides access to this key metric on a wide array of stocks. It's a common way investors measure valuation. The results often make a difference in the evaluation of any potential investment. A stock screener PE ratio will aid your filtering decisions. A thorough analysis can save you from many investment mistakes when combined with other crucial factors.

How PE Ratio Reveals Investment Opportunities (or risks)

The most important application of a stock screener PE ratio is in determining value. A stock screener PE ratio helps compare different companies, using the ratio for valuation. This way, investors get a view into potential investment opportunities, along with associated risks.

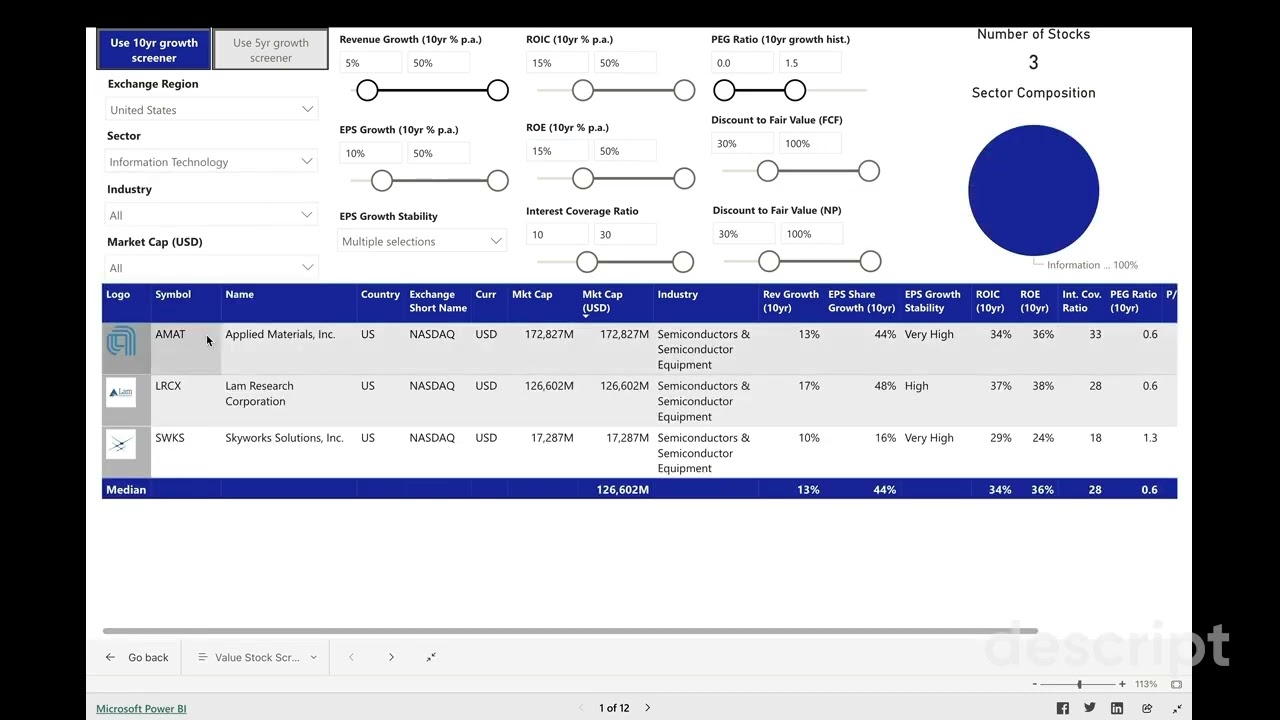

Source: investstrat.com

How to Use a Stock Screener PE Ratio Effectively

Identifying Value Stocks with a Stock Screener

A stock screener PE ratio allows filtering potential investments. By applying a low PE ratio cut-off, investors can home in on companies with relatively undervalued stocks in relation to their earnings. For your investment needs, an understanding of a stock screener PE ratio is necessary. Many stock screeners allow you to use this to refine your searches by setting specific limits.

Narrowing Your Search

How can you improve the quality of the data collected? A robust strategy involving a stock screener PE ratio involves applying advanced filters based on industry, market capitalization, and sector for focused, high-quality information that delivers a compelling return on investment. Setting parameters for a stock screener PE ratio is paramount for success! Understanding the characteristics of companies that are profitable, alongside using the tools at your disposal—like a stock screener PE ratio—improves your chance for profitable stock selection! A strong understanding of the implications and considerations behind a stock screener PE ratio provides substantial information needed to analyze companies thoroughly! A stock screener PE ratio will significantly enhance the decision-making process behind finding promising stock investments and potential risks.

Combining PE Ratio with Other Metrics

A stock screener PE ratio provides some clues, but using other critical metrics alongside it greatly improves your insights! Things like Price-to-Book (PB) ratios and the company's debt level should also be examined. By employing a strategy integrating both PE ratio analysis from your stock screener with other key factors, your success improves substantially.

Potential Pitfalls and Considerations

Overlooking Qualitative Factors

Using a stock screener PE ratio as a stand-alone tool could be a risk. There's also a danger in overgeneralizing the information or being misled into making faulty assumptions about the true value or the future trajectory of a stock, if other key qualitative aspects aren't considered. Other investment strategies besides those based solely on a stock screener PE ratio need further consideration in a full evaluation. Many overlooked aspects will often get factored in the stock analysis if a more comprehensive approach is taken rather than just relying on a stock screener PE ratio!

The Limitations of Historical Data

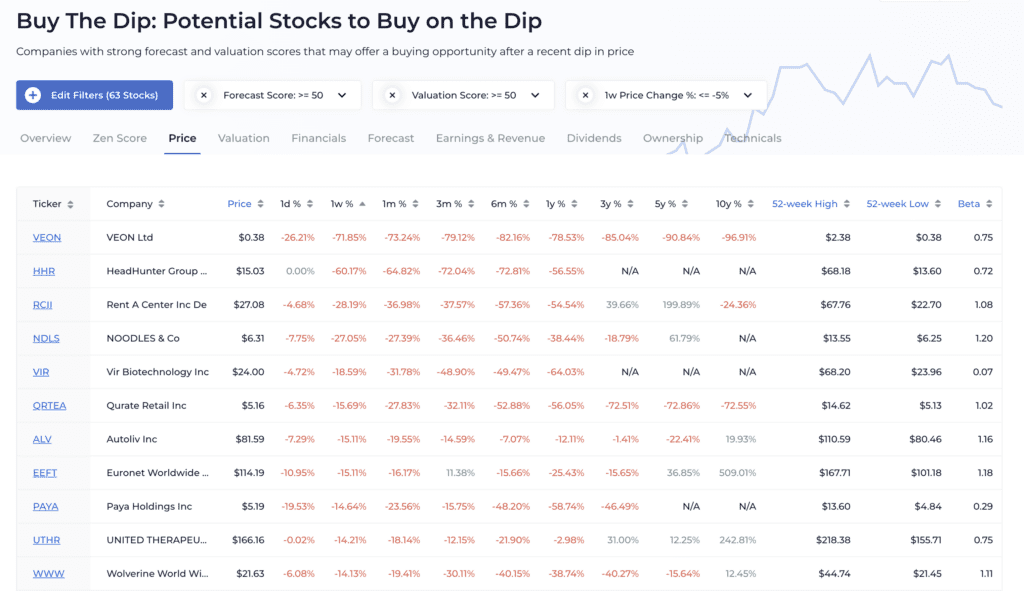

Source: beanvest.com

Data pulled from a stock screener PE ratio provides valuable historical perspective. But, what about evaluating future performance based on present economic projections or unexpected external changes? Recognizing these limitations is essential.

How Market Sentiment Affects the PE Ratio

Market sentiment plays a key role in influencing stock prices and thus, a company's PE ratio. Understanding a stock's PE ratio's correlation with market dynamics is essential for comprehensive stock screening, especially when utilizing tools like a stock screener PE ratio!

Incorporating a Stock Screener PE Ratio into Your Investment Strategy

Source: investmentzen.com

The Value of Using a Stock Screener PE Ratio for Stock Selection

Understanding stock screener PE ratio information gives significant insights for investors. Utilizing these features makes decisions for stock selection far more precise! Using PE ratio information for evaluating investment options when combined with a sound understanding and approach of stock screener tools greatly aids this task, and the result is often far greater accuracy. A stock screener PE ratio provides significant potential, as investors can significantly leverage this and streamline their screening process using various criteria.

Effective Risk Management When Considering a Stock's PE Ratio

In any investment strategy that integrates a stock screener PE ratio, you must always incorporate solid risk management measures! Evaluate each stock comprehensively. Assess the industry trends, and incorporate factors to mitigate your investment risk before any commitments.

Conclusion

Utilizing a stock screener PE ratio is a useful strategy when it’s incorporated within a wider investment analysis. Combine this with additional essential indicators, considering market factors, company performance, and qualitative assessments. It can, when appropriately integrated, facilitate successful investing, helping to locate potential value opportunities for those seeking investments aligned with the PE ratio. You've gained an edge over the market by utilizing an informed understanding of a stock screener PE ratio's power and potential in your decision-making.