stock screener intrinsic value

Unveiling Hidden Value: Using Stock Screeners for Intrinsic Value Analysis

Stock picking is a multifaceted process, often involving a blend of qualitative and quantitative analysis. Understanding a stock's intrinsic value – the true worth beneath the market price – is paramount for sound investment decisions. This article delves into how stock screeners can aid in the search for undervalued gems, providing actionable steps and highlighting the significance of considering intrinsic value when employing a stock screener.

What is Intrinsic Value, and Why Does It Matter for a Stock Screener?

Intrinsic value represents the economic worth of an asset. For stocks, it signifies what an asset would be worth in a fair marketplace devoid of speculative bubbles or temporary distortions. Identifying companies with strong intrinsic value is essential in stock selection as it empowers investors to evaluate how a stock screener intrinsic value assessment potentially aligns with a realistic worth. Determining this for a stock screener is frequently neglected by most analysts, leading to a misguided understanding of potential growth and returns. The stock screener intrinsic value calculation serves as a yardstick for gauging if market fluctuations have affected the perception of a company's real worth.

Understanding Fundamental Metrics Relevant to a Stock Screener Intrinsic Value Assessment

To effectively gauge intrinsic value using a stock screener, you must first understand fundamental financial metrics. These include earnings per share (EPS), revenue growth, debt-to-equity ratio, free cash flow (FCF), and return on equity (ROE). Each plays a role in constructing a complete picture of the underlying health of a business. An efficient stock screener intrinsic value process involves using these metrics as vital parts of the decision-making process, helping to determine undervalued opportunities.

How to Integrate Stock Screener Intrinsic Value Analysis into Your Workflow

Implementing intrinsic value analysis through a stock screener involves a careful methodology. A stock screener focused on intrinsic value helps prioritize undervalued opportunities in today's highly dynamic market.

Selecting the Right Stock Screener for Your Intrinsic Value Goals

Numerous stock screeners cater to diverse investment strategies. When focusing on intrinsic value, look for screeners with extensive fundamental data, including historical financial statements, analyst forecasts, and relevant valuation metrics. The efficacy of any stock screener depends significantly on how well-suited it is for identifying the target business parameters. Using a dedicated stock screener to prioritize stocks based on their intrinsic value significantly improves chances for favorable outcomes in the stock market.

Crafting Targeted Filters for a Stock Screener Intrinsic Value Assessment

Developing targeted filters within a stock screener is crucial. Begin with parameters relevant to your desired risk tolerance. Using the right filters on your stock screener intrinsic value evaluation significantly impacts investment strategies. Factors like market capitalization, growth trajectory, and potential for sustained profits should feature prominently in your search parameters to assess the intrinsic value of each stock candidate through your stock screener.

Incorporating Valuation Metrics in Your Stock Screener

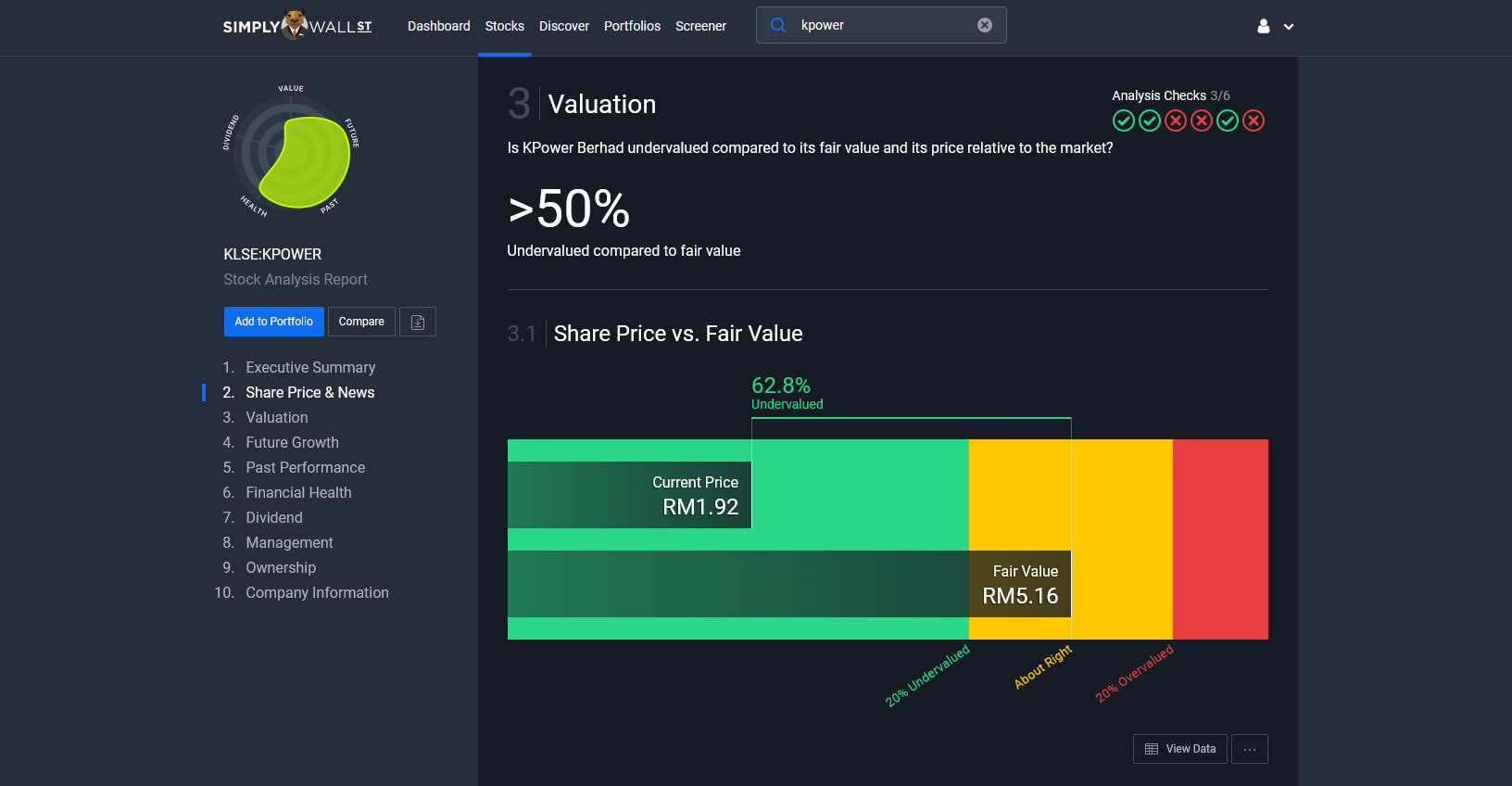

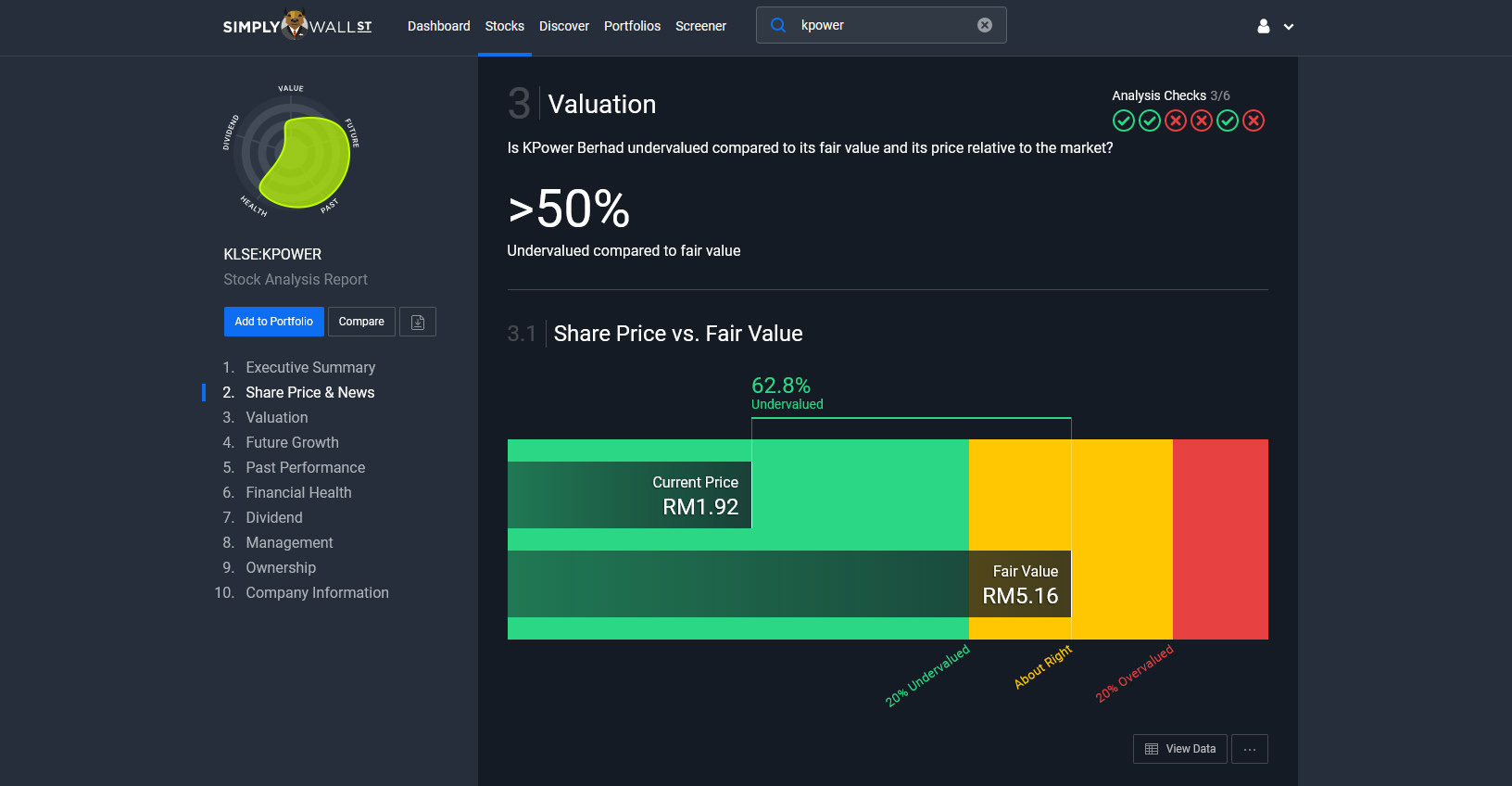

Fundamental analysis within your stock screener shouldn't overlook valuation techniques that help pinpoint stocks trading below their intrinsic value. Methods such as discounted cash flow (DCF) analysis or price-to-earnings (P/E) ratio comparisons can give a refined overview of the stock's worth relative to the market value given by the stock screener. The stock screener intrinsic value is crucial here because the screen should integrate valuations as well as the financial details already acquired.

DCF Analysis with Your Stock Screener

Source: geckoandfly.com

DCF (Discounted Cash Flow) analysis is often used alongside stock screeners for intrinsic value estimates. DCF models forecast future cash flows of a company and discount them back to present value based on an appropriate discount rate. A good stock screener intrinsic value investigation needs this critical approach.

Leveraging Relative Valuation Metrics (Like P/E Ratio) with Your Stock Screener

Applying a variety of valuation models via your stock screener to the companies of interest is a more robust methodology in comparing them based on a metric such as a P/E ratio or comparable companies. The stock screener intrinsic value method allows better comparisions based on market standards for stock value evaluations, ultimately helping one to analyze a wider range of company data more objectively.

Source: cloudinary.com

Implementing a Process for Evaluating Results From Your Stock Screener Intrinsic Value Method

Rigorous analysis requires careful evaluation of results. Consider combining multiple valuation metrics in your stock screener. Also check for any historical inconsistencies. Understanding these patterns alongside company management and outlook will provide greater insights with your stock screener intrinsic value method. Be aware that stock screeners, even the ones focused on intrinsic value, need constant human monitoring and filtering.

Utilizing Analyst Reports and Expert Opinions

Source: ytimg.com

Complement your analysis using your stock screener intrinsic value tool with analyst reports and opinions to gather independent viewpoints. Scrutinize whether multiple analyst ratings support the identified undervalued stock potential from your stock screener intrinsic value technique. Remember that external scrutiny is important.

The Role of Qualitative Analysis Beyond Stock Screener Intrinsic Value

Source: wisesheets.io

Intrinsic value through a stock screener can provide a solid foundation, but consider qualitative factors too. Investigate a company's leadership, competitive advantage, and long-term strategic direction. The success of using a stock screener on intrinsic value often depends on complementing it with careful due diligence. This goes hand in hand with assessing a stock screener intrinsic value effectively.

Risks and Pitfalls of Stock Screener Intrinsic Value Assessments

While a stock screener can significantly help with identifying opportunities, be mindful of inherent risks. Reliance on historical trends in your stock screener may prove problematic when considering intrinsic value over time, as conditions shift in various market environments. Any particular stock screener should only be one part of a larger and varied assessment. This includes looking into competitors and considering potential catalysts in evaluating intrinsic value in a particular stock via a stock screener. Market fluctuations or changing macroeconomic factors might significantly impact estimated intrinsic value, which should not be seen as immutable through a stock screener approach. Also understand market noise and how stock valuation will frequently have large swing reactions to sentiment in markets and economic uncertainties and potential unexpected outcomes in particular companies.

Conclusion: Combining Technology and Expertise with Stock Screener Intrinsic Value

By integrating stock screener intrinsic value methodologies, fundamental research, and valuation metrics with sound due diligence, investors can substantially enhance their portfolio construction processes. But it’s important to continuously evaluate results against evolving economic and market scenarios to maintain accuracy. No one stock screener is the perfect one for determining intrinsic value. Integrating other sources will make it possible to accurately understand the fundamental factors relevant to stocks of interest. The focus on stock screener intrinsic value allows the application of well-structured and proven research techniques when applied appropriately.