stock screener historical data

Unveiling Market Trends: Leveraging Stock Screener Historical Data

Stock screener historical data provides invaluable insights into past market performance, enabling investors to identify trends, patterns, and potential opportunities. Analyzing this data can inform crucial investment decisions, enhance portfolio diversification, and ultimately contribute to more informed and profitable trading strategies. This comprehensive guide explores the intricacies of stock screener historical data, showcasing its diverse applications and practical implications for investors.

What is Stock Screener Historical Data?

Demystifying the Data

Stock screener historical data encompasses a vast collection of information related to the performance of various stocks over a specific time period. This data frequently includes key metrics like closing prices, trading volumes, highs and lows, dividend payouts (where applicable), and other crucial market indicators. The detailed insights available through these datasets greatly influence investment decisions. Leveraging stock screener historical data can be an effective tool. This detailed data is a cornerstone for analysis and potential investment decisions. This type of information enables users to recognize patterns, anticipate future price fluctuations and forecast trends, thereby giving investors an advantage. Utilizing this stock screener historical data is paramount to effective investment.

How to Access Stock Screener Historical Data

Source: stockstotrade.com

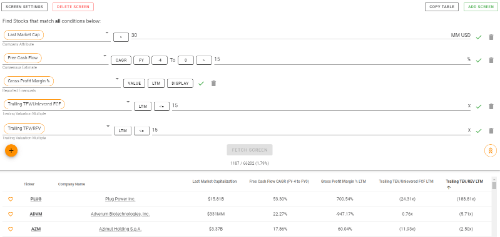

Finding the Right Tools

Numerous online platforms and software solutions specialize in providing access to stock screener historical data. Brokerage platforms, dedicated financial data providers (such as Refinitiv or Bloomberg), and specific stock screener applications all offer access to extensive repositories of stock screener historical data. It is important to meticulously research providers to assess their quality and the comprehensiveness of the information available in their data repository, as accuracy plays a pivotal role in the data analysis process. Selecting reliable tools ensures an insightful analysis and better-informed investment strategies. Using various sources and comparing findings enables a more robust and trustworthy use of the stock screener historical data.

Key Metrics & Their Importance in Historical Analysis

Deciphering the Metrics

A variety of metrics derived from historical stock screener data are essential for investment decisions. Price charts, for example, represent the key element for detecting past price movements, whilst trading volumes help identify buying or selling trends. Highs, lows, and ranges paint a historical snapshot of market movements for that particular security. Fundamental indicators – including financial ratios and financial performance – can indicate underlying strengths and vulnerabilities of a particular security. By carefully examining and interpreting various financial measures, investors are better positioned to leverage stock screener historical data for sound investment strategy. Stock screener historical data allows investors to ascertain a better understanding of the market.

Identifying Patterns & Trends

Source: pressablecdn.com

Uncovering Opportunities

Carefully examining stock screener historical data allows one to perceive intricate patterns, such as recurrent seasonal trends. Identifying the connection between market trends and specific indicators within a security is crucial for leveraging the stock screener historical data efficiently. By discerning underlying patterns, investors can detect repeating performance characteristics, identify price reversals, and potentially assess future stock behaviour based on the history that the data provides. Stock screener historical data analysis often reveal hidden gems or red flags associated with different stocks, allowing for calculated decisions. Investors can refine and refine their decision making, leveraging all of the data and insights available from the stock screener historical data.

The Role of Stock Split History and Dividends in Historical Data

Understanding Past Distributions

:fill(white):max_bytes(150000):strip_icc()/TradingView-2d26abcf35af4916932ca4f307fff59b.jpg)

Source: investopedia.com

The past distributions of dividends and the impact of stock splits are crucial parts of stock screener historical data. Stock splits provide context by helping evaluate historical performance based on adjusted values. Analyzing dividends can suggest consistent financial strength, an integral aspect for any solid long-term strategy. Stock screener historical data gives a complete understanding of the history, allowing investment professionals to identify these signals within data records. Through historical analyses, investors can pinpoint opportunities and mitigate potential risks with effective utilization of stock screener historical data.

Risk Assessment using Historical Data

Managing Potential Hazards

Source: slidesharecdn.com

Stock screener historical data offers insight into price volatility and market reactions. Through understanding the security’s price fluctuations in different economic conditions and various phases within market cycles (bear or bull markets), informed decisions about investments and risk assessment strategies are possible. A thoughtful consideration of these insights, provided within stock screener historical data, facilitates a measured approach towards possible risks. Recognizing and predicting patterns and risk assessment methodologies greatly benefit from these patterns found in the stock screener historical data. The inclusion of historical market events and their correlations with stock pricing trends empowers strategic approaches for effective management of investment risks.

Forecasting Potential Future Performance

Extracting Insights from History

While future performance isn't guaranteed, insightful use of stock screener historical data and market patterns often indicates some likely performance possibilities. This isn't a guarantee of the outcome, but evaluating historic data offers an analytical insight on likely scenarios and future patterns. Historical information and data trends may lead to investment insights that promote informed decision making and calculated risk analysis in the markets. Historical analyses enhance the effectiveness of forecast projections, ultimately guiding more sound strategic investment decisions when incorporating data from stock screener historical data.

Correlation between Macroeconomic Trends and Stock Performance

Understanding External Influences

By scrutinizing historical stock screener data alongside macroeconomic data (like GDP, inflation, interest rates), you can identify trends associated with specific conditions and assess their correlations. Using stock screener historical data provides crucial information regarding security performance linked to broad economic cycles or specific political contexts. Recognizing how these external influences may correlate with securities helps craft well-reasoned approaches. Examining these factors in stock screener historical data enhances insight into likely performance outcomes associated with each security and its relation to wider market forces. Understanding these correlations allows informed decisions, based on valuable insights within the stock screener historical data, with improved portfolio diversification and better strategies, and stronger likelihood for successful risk management.

:max_bytes(150000):strip_icc()/Screenshot2023-12-26215204-65f717c5cf68430aa71de5c54f0d3486.png)

Source: investopedia.com

Conclusion: Strategic Advantage

Leveraging stock screener historical data is pivotal in crafting strategic investment strategies. Analyzing patterns, assessing risks, forecasting potential, and identifying opportunities provides an insightful framework to navigating complex market conditions and enhancing returns. Applying the practical guidance offered within the data from stock screener historical data empowers you to create a comprehensive understanding that aids any investment professional and even the novice. Your investment decisions can be substantially improved by implementing effective utilization of the data contained within the stock screener historical data. Mastering this powerful tool elevates your chances for long-term investment success.