stock screener high volume

Unlocking Hidden Opportunities: Using a Stock Screener for High-Volume Stocks

High-volume trading can be a compelling strategy for investors seeking quick gains or substantial influence over a stock's price. However, navigating the vast sea of stock possibilities requires a targeted approach. A stock screener high volume tool becomes an indispensable asset, helping you filter through market noise and identify stocks exhibiting robust trading activity. This article explores the practical application of stock screeners for discovering high-volume stocks.

Understanding High-Volume Trading

Source: myqcloud.com

Before diving into the specifics of stock screener high volume strategies, let's understand the drivers behind high trading volume. High volume often suggests increased investor interest and heightened market sensitivity. Is it driven by news, announcements, or other factors affecting a stock? Knowing this can offer crucial insights into the stock's underlying conditions.

What is a Stock Screener?

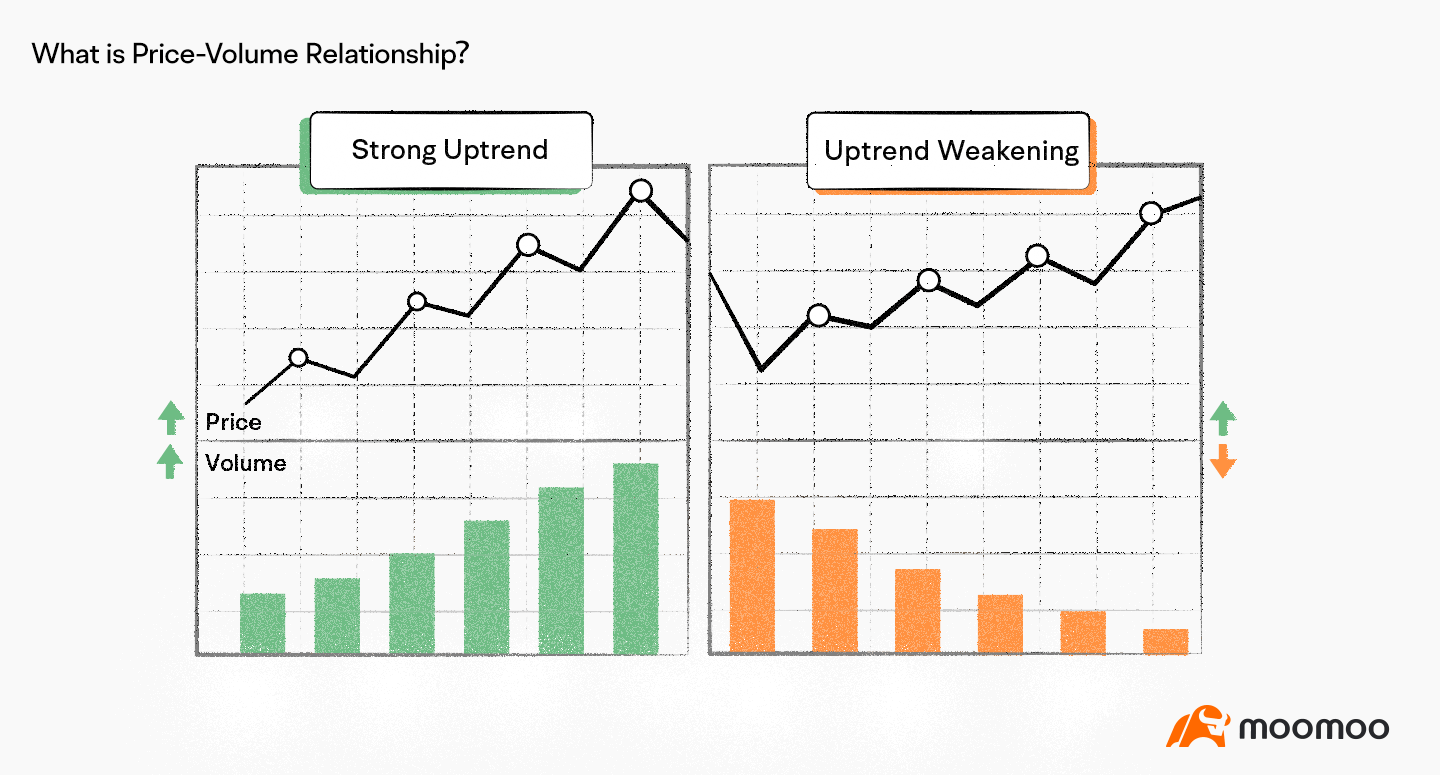

A stock screener high volume is a software or online platform that filters and ranks stocks based on specific criteria. You input parameters like daily volume, average trading volume over a period, trading history, and more. This process simplifies the daunting task of manually sifting through extensive data, giving investors a powerful advantage. In essence, it's an automated way to find stock screener high volume stocks meeting predetermined conditions.

How to Choose the Right Stock Screener for High Volume

Numerous stock screener high volume options are available. Consider factors such as the range of filters, accuracy, ease of use, and the cost structure. Different providers offer various functionalities. A stock screener high volume with adjustable criteria will likely enhance your ability to isolate truly valuable signals in a stock market surge. Your chosen tool should be user-friendly and permit easy entry for critical variables, allowing you to locate highly volatile stock screener high volume selections effectively. Ultimately, the key is to locate a suitable stock screener high volume for your individual needs.

Identifying High Volume Indicators on Your Screener

Source: staticflickr.com

Understanding the key parameters within a stock screener high volume is critical. What indicators do you look for, in order to recognize substantial trading activity? Common criteria include:

- Average Daily Volume: Higher-than-average daily volume generally indicates more investor interest. Analyze recent trading history for comparison and potential peaks.

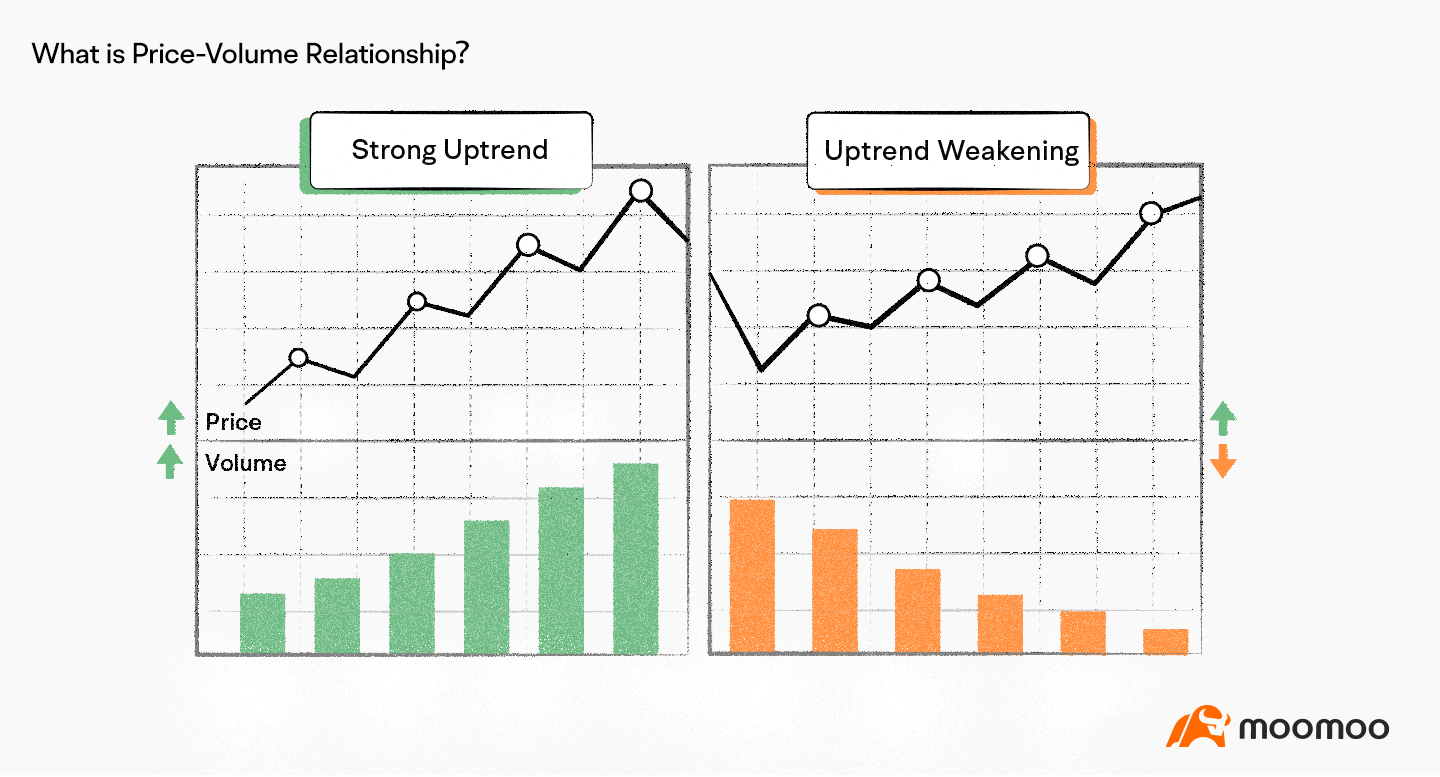

- Volume vs. Price Movement: Is the stock moving substantially in tandem with a rise or fall in daily trading volume? This can often pinpoint momentum and actionable trades. A stock screener high volume offering comparative analysis is important to pinpoint momentum, and this correlation is integral.

- Historical Trading Data: Observing how stock volume behaved over a longer timeframe will show potential market patterns in a stock screener high volume and highlight consistent activity for possible investing.

- Recent News and Market Trends: Any stock screener high volume worth its salt should permit filtering stocks that correlate to important market developments or corporate disclosures, for the more adept traders and investors to spot opportunities with a targeted strategy in place for analyzing data.

How to Use "High Volume" Filters Effectively

Source: stock-screener.org

A stock screener high volume is just a tool. Using its filters correctly involves defining appropriate thresholds. You're looking for high-volume stocks. If daily volume suddenly increases substantially (a surge in volume for a low or moderate volume stock), a well-thought out analysis can unearth a profitable insight using a stock screener high volume. A sudden decrease or sustained high volume will trigger alert indicators. Don't be blinded by volume alone! You must analyze company performance and financials along with the volume patterns. Remember, market behaviour and sentiment shifts influence the trading data within stock screener high volume tools.

Source: tradethatswing.com

Incorporating Additional Criteria to Refine your Stock Screening

Implementing specific criteria that a stock screener high volume helps to incorporate when pinpointing ideal opportunities requires looking at the big picture. This goes beyond just the stock's recent high-volume trading. Factors like:

- Price Volatility: Evaluate the typical volatility level before making inferences with a high-volume stock's value.

- Market Capitalization: Analyze the firm's market valuation. Are the price changes relative to its size and value or based on more market-driven forces like rumour or fear, that a good stock screener high volume should account for.

- Analyst Ratings: Assess whether analysts suggest that the high-volume period has real traction and if it aligns with projected business growth with a well-curated analysis from a reliable stock screener high volume tool. Your screening process can't omit fundamental evaluations.

- Technical Indicators: How do the patterns shown from the technical data provided from your stock screener high volume correlate with previous price data to inform investment insights.

How to Establish Trading Rules

A simple stock screener high volume rule: to screen high-volume stocks, may prove too basic in a quickly-changing market. Don't just chase high-volume spikes without well-defined and clearly identified entry and exit strategies to capture profitable trades, even using the best stock screener high volume.

Managing Risk with High-Volume Stocks

While stock screener high volume tools can identify potential opportunities, risk management is crucial. Be wary of speculative price action around high-volume surges as markets react rapidly and potentially impulsively. Understanding a stock's historical volume activity will prove very helpful as you use stock screener high volume. Don't chase unsustainable price action blindly, based solely on the fact that a stock has a consistently high volume. Diversification is a key strategy in your stock screener high volume arsenal.

Final Thoughts: Strategic Implementation

Source: co.in

Mastering a stock screener high volume approach is only part of the process. Patience, disciplined adherence to a solid strategy and appropriate financial awareness are vital for success in trading and investing in high volume stocks. It is always crucial to be careful with high-volume and constantly updating knowledge based on factors, like earnings, stock volatility or macroeconomic influences to ensure your stock screener high volume remains useful for investing purposes. It is best suited to skilled traders. Never depend on one piece of information; consider high-volume trading part of your overall strategy, while also continuously calibrating for current market situations. Don't forget the inherent uncertainty associated with stock market analysis that relies heavily on high-volume trends with a stock screener high volume.