stock screener high volatility

Uncovering High-Volatility Stocks with a Stock Screener

High-volatility stocks are often the domain of aggressive investors seeking potential for significant returns, but also significant risk. Understanding how to identify these stocks using a stock screener is crucial for navigating the complexities of the market. This article delves into various facets of utilizing a stock screener to pinpoint high-volatility stocks, along with crucial considerations.

1. What Does "High Volatility" Actually Mean?

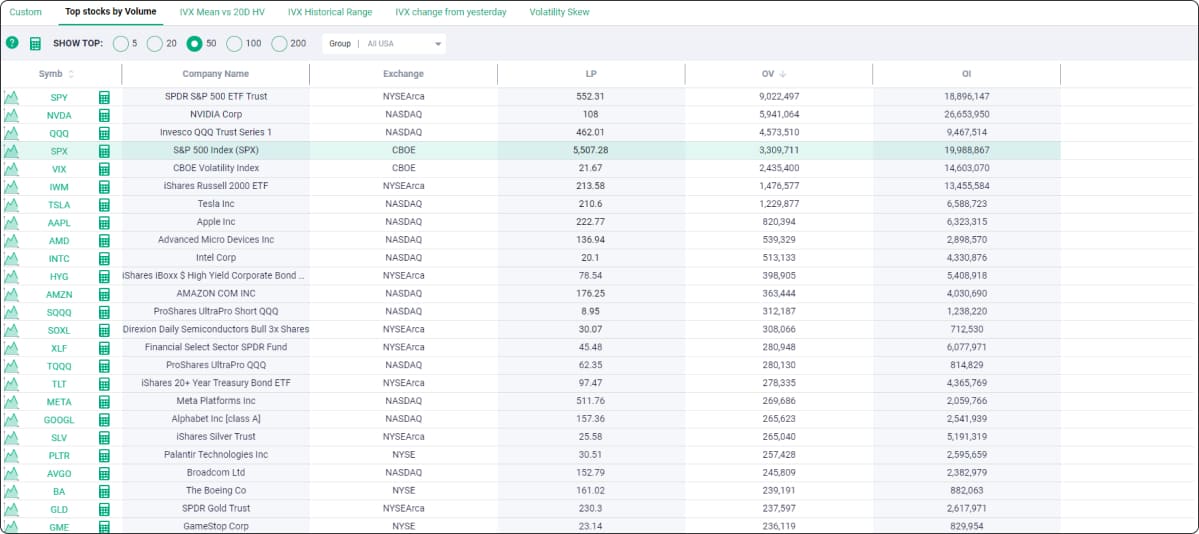

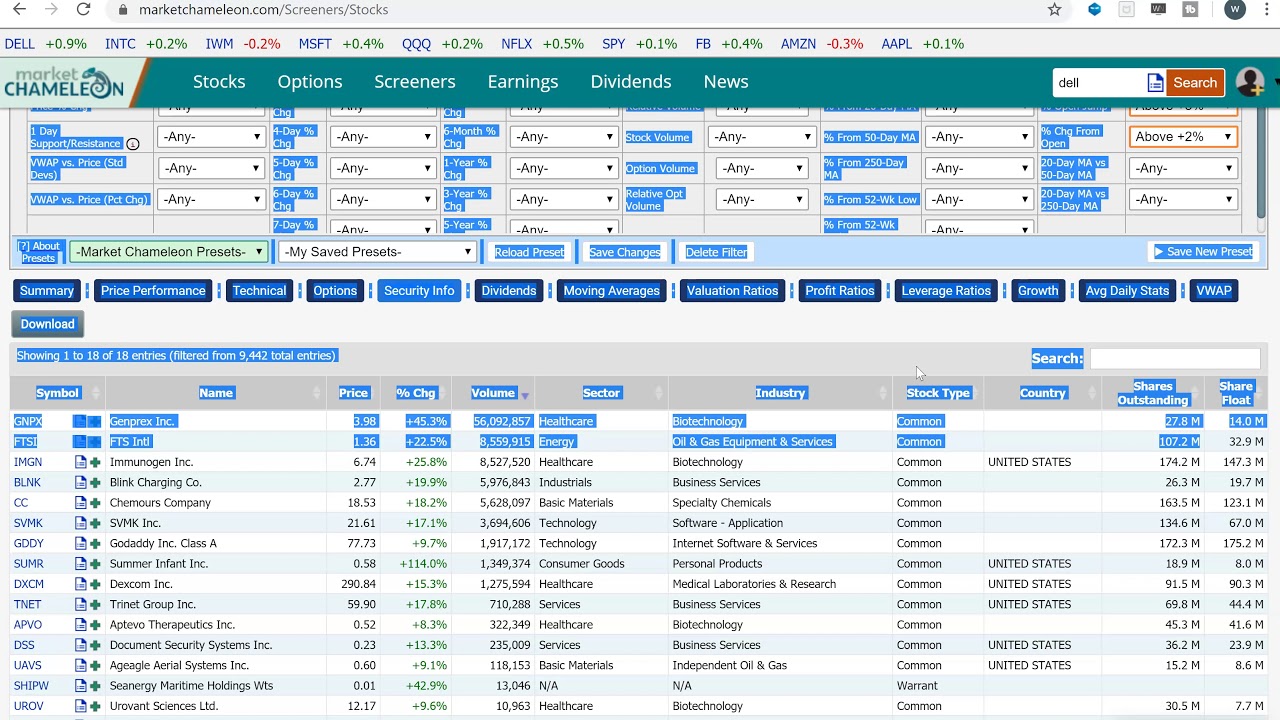

Source: ivolatility.com

High volatility in the context of a stock screener refers to the extent of price fluctuations within a specific time frame. A stock screener high volatility assessment measures the range of price movement over time, revealing how unpredictable a particular stock's performance may be. This unpredictability can create a dynamic trading environment, and identifying stocks within your targeted stock screener high volatility criteria is key.

2. Why Use a Stock Screener for High Volatility?

A stock screener is your ally in identifying high-volatility stocks. Manually scrutinizing a large number of stocks for volatility levels is impractical. A good stock screener can process vast amounts of data rapidly, flagging those stocks showing particularly pronounced price swings. It streamlines the process significantly, making it far more efficient compared to the alternative.

This significantly impacts your search strategy, saving you a huge amount of research time and focusing your energy on assets most aligned with your risk tolerance for a high volatility stock screener strategy.

3. Essential Metrics for Your Stock Screener High Volatility Search

To identify high volatility within your stock screener, key metrics must be accounted for and filtered in your tool. Common measures include:

- Standard Deviation: This quantifies the dispersion of historical stock prices from the average price. Higher standard deviation usually points towards more volatility. A stock screener high volatility search using standard deviation would use thresholds, higher values would indicate stocks susceptible to significant fluctuation.

- Range (High and Low Prices): Track the high and low prices over periods for accurate and relevant results for the stock screener high volatility approach you need. This provides insights into historical price fluctuations.

- Beta: Comparing a stock's price fluctuations against market trends helps gauge its responsiveness to overall market volatility. A higher beta often signals more sensitivity.

4. How to Configure a Stock Screener for High Volatility

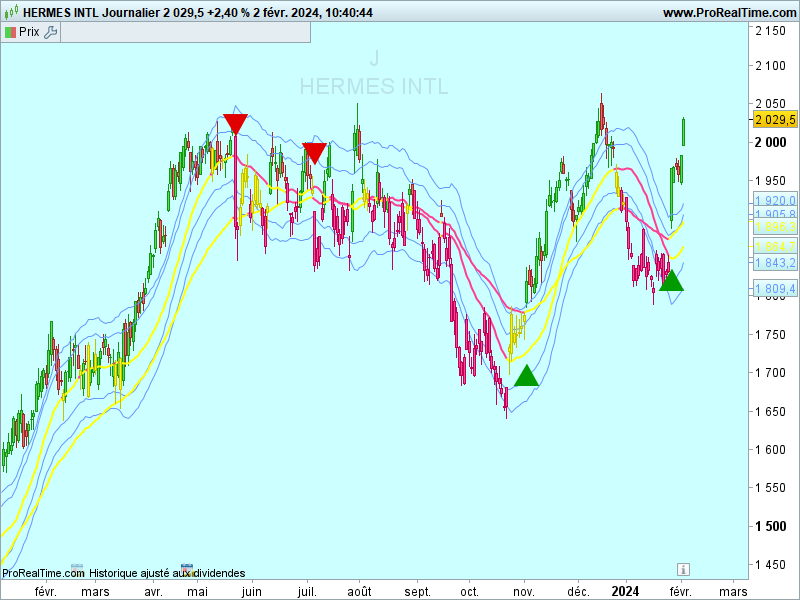

Source: rocketcdn.me

Setting up your stock screener for high-volatility stocks involves strategic filtering criteria.

- Select Your Timeframe: The period of historical data considered significantly impacts results. Using a short timeframe can present significant spikes in volatility with a stock screener high volatility approach. Opt for longer time frames to evaluate volatility consistently within your stock screener analysis, which better illustrates overall price trend fluctuation.

- Use Thresholds for Volatility Metrics: Establishing criteria like acceptable volatility or minimum acceptable deviations allows for greater accuracy, which ensures higher returns from stocks within your targeted stock screener high volatility searches. Use a specific stock screener high volatility approach for appropriate filters and comparisons.

- Narrow Down by Sector and Size: Pinpointing companies within the specific stock screener high volatility areas, particularly those susceptible to market trends. Selecting the most volatility-exposed segments could refine the approach, further filtering down for better results.

5. Identifying Potential Red Flags with a Stock Screener High Volatility Analysis

A stock screener high volatility approach necessitates an investigation beyond just volatility levels. Indicators like high debt-to-equity ratios, rapidly fluctuating sales, and unexpected earnings reports can influence stock volatility. Your screener should not only highlight potential high-volatility situations, but flag unusual or red flag situations and metrics within the targeted stock screener high volatility assets.

6. The Relationship Between Volume and Volatility (Stock Screener High Volatility Perspective)

High trading volume often accompanies high volatility. Use your stock screener to see volume alongside volatility measures.

7. Combining Data Sources (Leveraging Stock Screener High Volatility Filtering)

Complementary data sources like news reports can supplement stock screener data on high volatility stocks, giving further insight. Analyzing news impacting the target companies within a stock screener high volatility perspective will improve insights significantly.

8. Understanding Risk Tolerance (Matching with the Stock Screener High Volatility Stock Profiles)

Recognize your individual risk tolerance when evaluating stocks with a high volatility approach. Be realistic, given that these stock screener high volatility criteria tend to lead to greater price swings compared to more stable markets.

9. Stock Screener High Volatility: Beyond the Numbers

While the tools and metrics associated with high-volatility stock screener searching are critical, context and research outside of raw data must inform the final evaluation.

10. Risk Management and Diversification (Critical for a Stock Screener High Volatility Search Strategy)

Diversification and solid risk management principles are crucial components of a high-volatility investment approach using the stock screener tools and filters to target the asset class in question. Remember this methodology will typically be associated with greater risks versus stock screening.

11. The Role of Technical Analysis for Stock Screener High Volatility Candidates

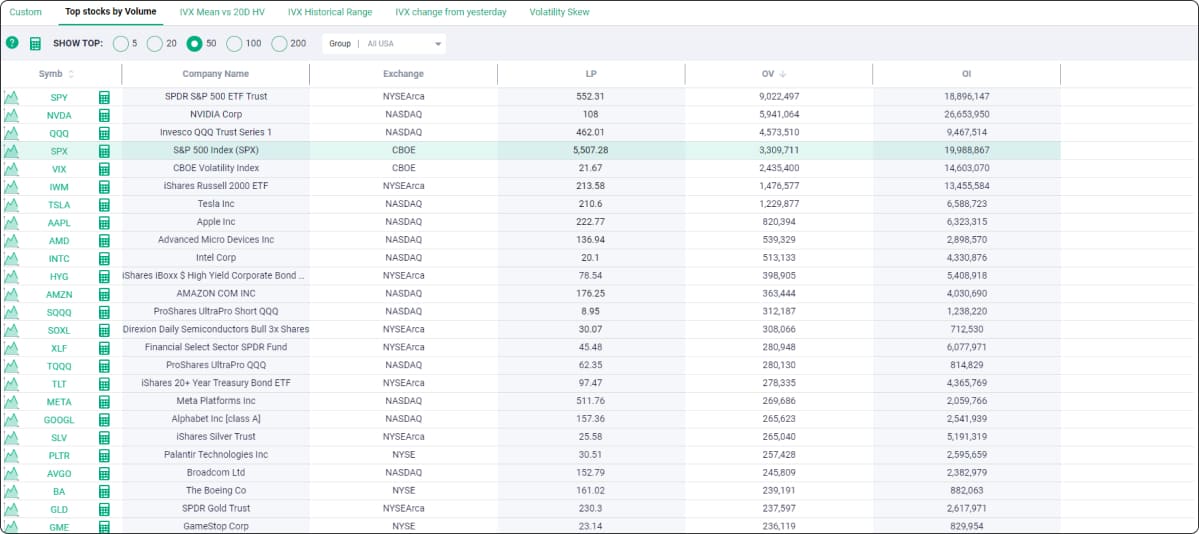

Source: ytimg.com

While stock screener analysis focuses on historical metrics, technical analysis studies current chart patterns to evaluate price trend, offering further insight into the target high volatility stock's likely response, when considering stock screener high volatility analysis.

Source: ytimg.com

12. Beyond High Volatility Stocks in Stock Screener Analysis: Exploring Additional Investment Approaches

For a comprehensive stock analysis, broaden your understanding to cover low volatility investments alongside your initial screener filter for a diversified investment portfolio. Evaluate whether it makes sense for your goals, investment profile, or any complementary high volatility strategy with different asset categories that require unique investigation with your stock screener analysis. This article has covered some methods within the general domain of finding stocks for a high volatility screening, a subject in investment portfolio management.

A critical and cautious investment approach is key when searching for high volatility opportunities through stock screener methodology. Using appropriate screening tools in a stock screener high volatility approach will dramatically aid in narrowing and managing the complexity and potential pitfalls inherent in markets prone to significant volatility. Remember, your investment decision should never rely solely on quantitative analysis or any particular filter on your stock screener tool. Further detailed, bespoke investigation and individual decision making are vital within stock market investment for a high volatility stock screener strategy, whether through particular quantitative indicators or filtering metrics used with your chosen stock screener tools.