stock screener gap up

Uncovering Opportunities: A Deep Dive into Stock Screener Gap Up Analysis

Gap-up stock movements can present enticing trading opportunities, but require meticulous analysis and understanding. This comprehensive guide delves into the world of stock screener gap up strategies, providing insights and actionable steps for investors seeking to capitalize on these price jumps.

Understanding the "Gap Up" Phenomenon

Gaps in stock prices are sudden jumps that transcend the normal trading range. A gap up signifies that the stock opened significantly higher than its previous closing price. This often indicates heightened investor enthusiasm, which makes stock screener gap up identification a prime target. But what factors cause this price discontinuity and why should traders prioritize stock screener gap up research?

What Causes Stock Gaps Upward?

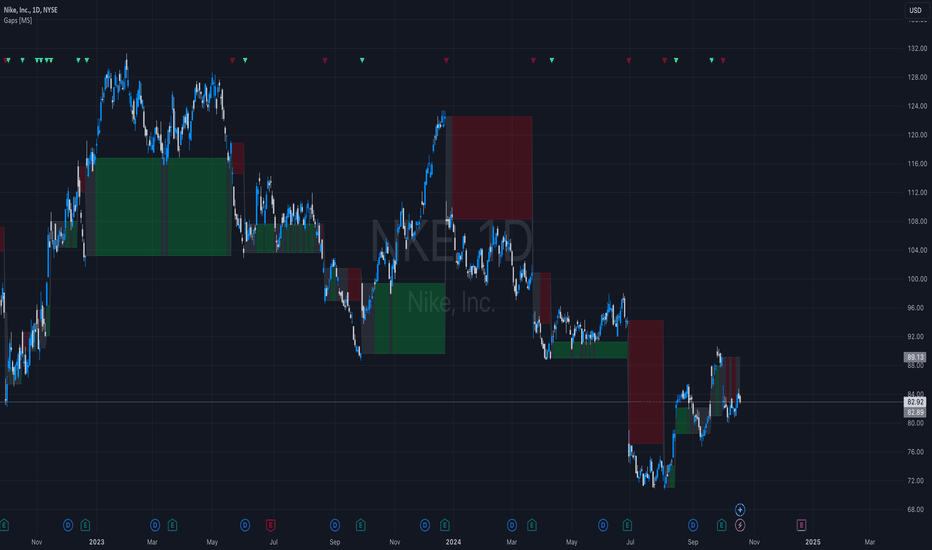

Source: tradingview.com

Gap up openings are rarely arbitrary. Factors such as robust earnings reports, positive news releases, favorable analyst recommendations, unexpected positive market sentiment or industry developments can ignite bullish buying. Analyzing stock screener gap up events necessitates investigating the possible catalyst behind these sudden price jumps. A stock screener gap up analysis will give you critical background information and a deeper understanding of potential motives. Stock screener gap up tools are indispensable to finding and isolating relevant occurrences.

How to Identify Stock Screener Gap Up Opportunities

A successful stock screener gap up strategy hinges on the correct tools and application techniques. Efficiently utilizing online stock screeners is essential.

Utilizing Stock Screener Tools for Gap Up Hunting

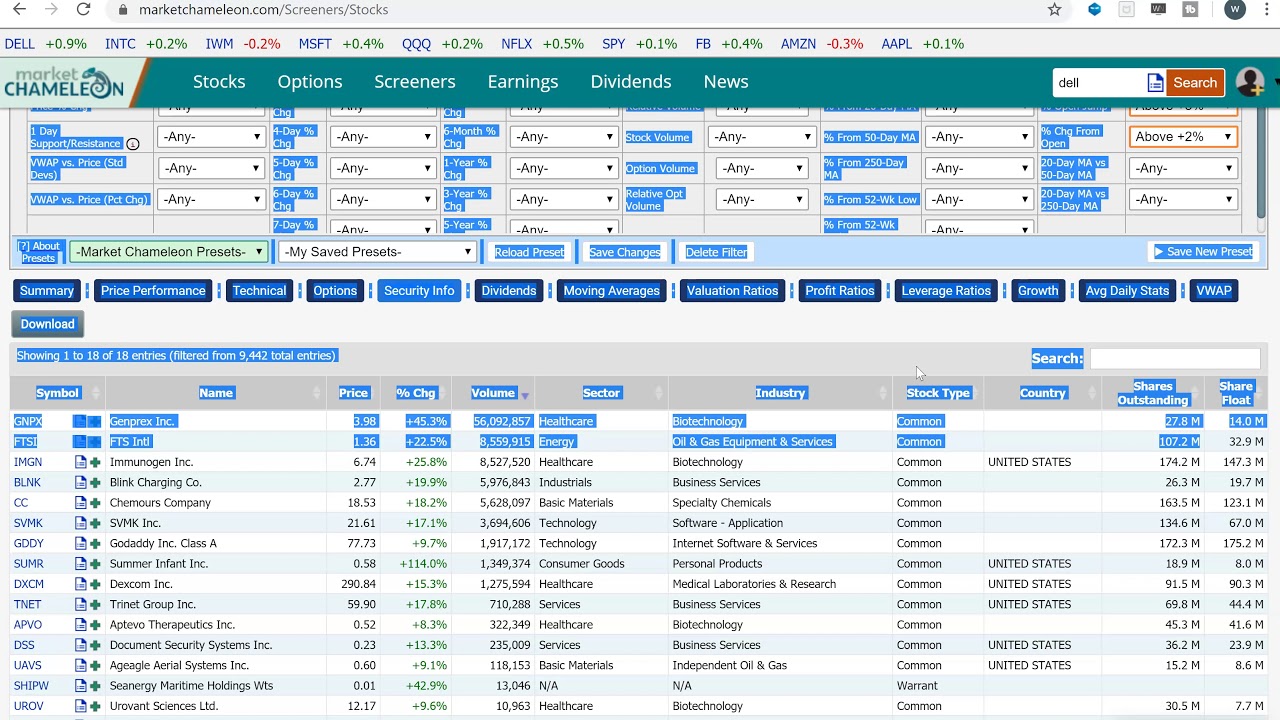

Source: ytimg.com

Online platforms dedicated to stock screening, such as those featured in the stock screener gap up category, can readily find instances of stock price gap-ups within a timeframe. Learn how to specify criteria on these stock screener gap up engines – filter by timeframes, percentage increases, sector or company, to focus on relevant gap up opportunities. Employ stock screener gap up functionality to target the most suitable matches for your investment philosophy. Identifying a gap-up through a stock screener gap up search requires practice. Stock screener gap up data is key to your findings.

Refining Your Stock Screener Gap Up Search Strategy

A stock screener gap up filter might produce a multitude of results. To sift through them, hone in on potential triggers. For example, check for press releases related to recent financials or new product announcements from companies whose stock demonstrated a stock screener gap up. Identifying strong industry-related themes and news around these instances often highlights opportunities in a stock screener gap up evaluation. Your understanding of stock screener gap up dynamics directly impacts your decisions. A sound methodology when utilizing a stock screener gap up will assist you in your endeavors.

Examining Pre-Existing Conditions of Potential Gaps

Pre-Market Indicators: What Tells You Which Stock Might Exhibit Gap-Up

Consider factors beyond price movement. A strong pre-market increase in buy orders may suggest forthcoming gap-up opportunities. Reviewing publicly accessible discussions within financial forums is also beneficial for deciphering potential drivers behind price fluctuations that indicate possible stock screener gap up scenarios. Analyzing financial forecasts using a stock screener gap up will improve your investment evaluation and decision-making abilities. Dissecting pre-existing patterns around potential stock screener gap up candidates enhances your capacity for identifying hidden, yet high-growth, segments within a wider stock screener gap up scope.

Fundamental Analysis Coupled with Gap-Up Scanning

A balanced strategy blends fundamental analysis alongside a focused stock screener gap up investigation. Analyze historical financial statements and ratios alongside pre-market sentiment to anticipate patterns likely to exhibit a gap-up characteristic within stock screener gap up tools and platforms. By scrutinizing historical patterns in the pre-market to gauge probabilities within stock screener gap up parameters, more nuanced decision-making capabilities can be built. Stock screener gap up events may indicate substantial underlying value shifts that traditional fundamental analysis can help uncover.

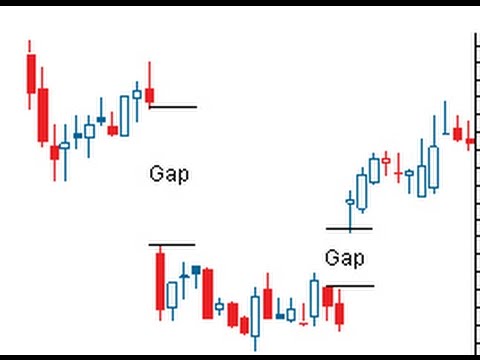

Source: ytimg.com

Analyzing and Valuating Gap Up Stocks

Analyzing the Driving Force Behind Gap-Up

A thorough review is required after finding the stock screener gap up occurrences. Determine the catalyst. Is it a significant earnings beat? Positive regulatory updates? Positive news? This deep-dive stock screener gap up evaluation ensures you target the right investment candidates. Understanding the market dynamics involved in a stock screener gap up aids your appraisal of likely market directions. The investigation for probable underlying issues concerning a gap up warrants an intense study into stock screener gap up principles.

Evaluating the Short-Term Potential & Risk

Source: barchart.com

Evaluating the immediate implications for the stock price movement after observing a stock screener gap up. Assess short-term risk. A stock screener gap up event often carries high risk if driven by unfounded reasons. Utilizing a diverse perspective during your scrutiny of the stock screener gap up data. Evaluate probable challenges of pursuing a strategy in connection with stock screener gap up events. Evaluate volatility by reviewing your stock screener gap up search data.

Navigating Trading Strategies around Gap Up Scenarios

Source: chartmill.com

Short-Term Trading with Gap-Up Actions

Focusing on trading patterns observed around a stock screener gap up, such as the following gap-up pattern is crucial. Understanding and effectively exploiting the trading nuances and probable exit strategy related to a stock screener gap up movement require a profound grasp of your investment objectives and possible loss tolerance. The dynamics inherent in stock screener gap up transactions and the identification of appropriate entry/exit points necessitate intensive study. Using stock screener gap up research can often reveal an abundance of applicable approaches. Understanding of gap up trades via your chosen stock screener gap up search should allow appropriate planning.

Risk Management during Gap Up Trades

Capitalize on identified stock screener gap up trading opportunities. Yet, develop a robust risk management plan to contain potential adverse consequences from investment inaccuracies and inappropriate market estimations relating to a stock screener gap up trend. Using stock screener gap up methodology appropriately for short-term profit must have risk containment strategies as an absolute requirement.

Backtesting Your Gap-Up Strategies

Thorough backtesting using historical data relevant to stock screener gap up occurrences can increase investment proficiency and minimize risk when approaching gap up investment scenarios. It’s vital to meticulously study and test different parameters based on your targeted market conditions by reviewing stock screener gap up scenarios for confirmation and efficacy analysis. Assessing the efficiency and correctness of your strategies related to the identification of a stock screener gap up occurrence is imperative for building an impactful and consistent investment method. Implementing such tactics allows improved success by carefully studying the historical results based on your unique strategies with reference to the search data found with a stock screener gap up.

Conclusion

A comprehensive approach to stock screener gap up analysis hinges on a multifaceted analysis—using fundamental valuation criteria alongside robust analytical tools. Rigorous backtesting and an aggressive risk management strategy are crucial to transforming observations of a stock screener gap up occurrence into sustainable profitable trades. Through careful consideration, proper execution, and thorough market analysis related to gap up events through a stock screener gap up study, successful investments within a stock screener gap up scope are more attainable.