stock screener eps growth

Unveiling Growth Potential: A Deep Dive into Stock Screener EPS Growth

Stock picking can be daunting, but understanding a company's earnings potential is key to long-term investment success. This article explores the crucial role of stock screener EPS growth in identifying promising investment opportunities. We'll equip you with the knowledge and tools to effectively use stock screeners to uncover companies exhibiting robust earnings per share (EPS) growth, a vital indicator of a company's financial health.

What is EPS Growth? Understanding the Crucial Metric

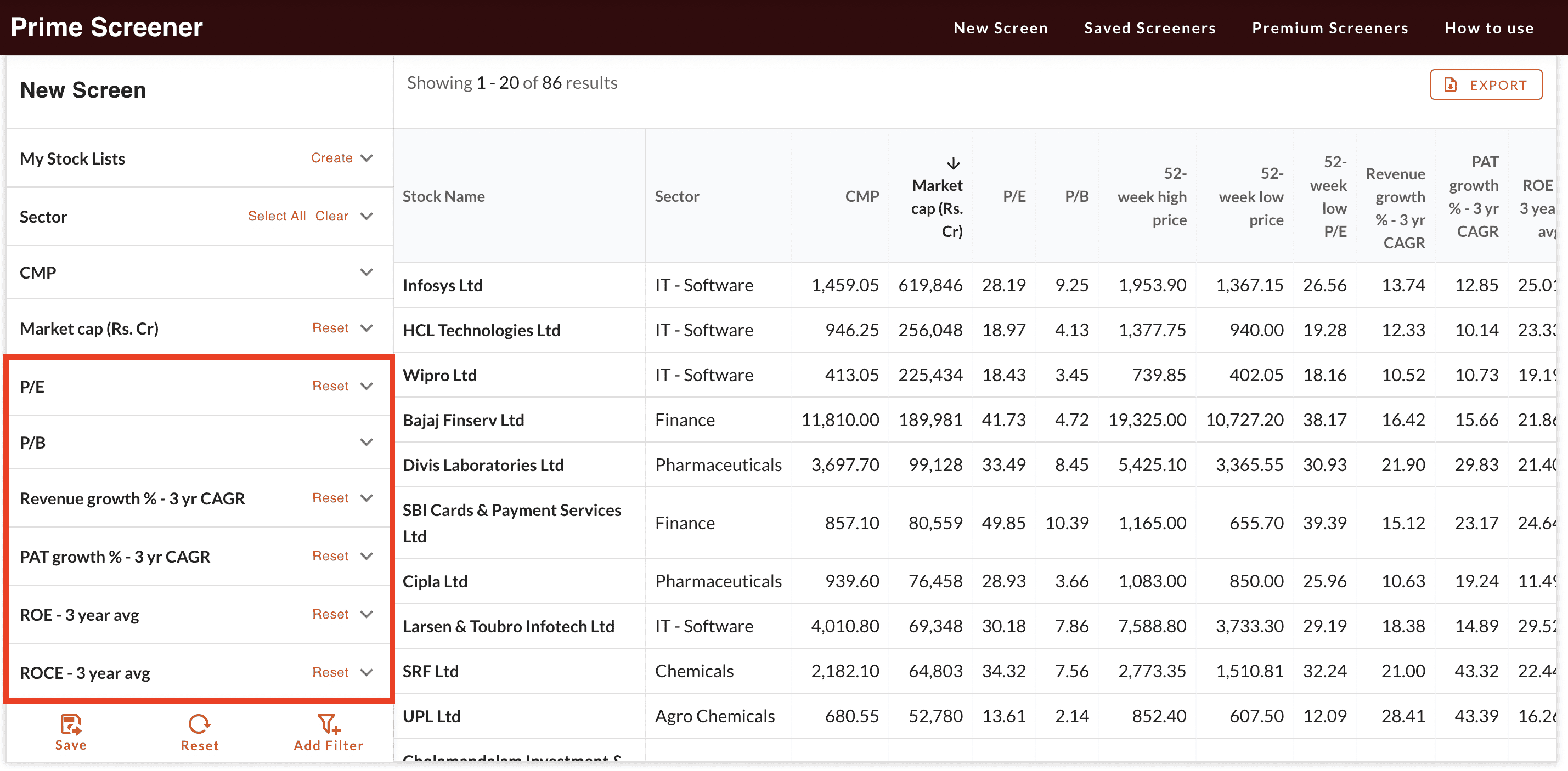

Source: primeinvestor.in

Earnings per share (EPS) represent the portion of a company's profit allocated to each outstanding share. EPS growth measures the percentage change in earnings per share over a specific period, typically a quarter or a year. This fundamental metric provides valuable insight into a company's profitability trend. Positive EPS growth signals a healthy and growing business. A stock screener with advanced filters based on EPS growth allows investors to identify promising companies in any market environment.

How to Use a Stock Screener for EPS Growth Analysis

Stock screeners are invaluable tools for analyzing EPS growth. Most reputable stock screeners have built-in functions to filter companies by historical and projected EPS growth rates. This makes identifying companies with robust EPS growth profiles very convenient and easily accessible. This simplifies your search, helping you unearth hidden gems, using your stock screener EPS growth tool to uncover growth opportunities. Understanding how to utilize your stock screener EPS growth tools effectively is paramount for investment success.

How to Choose the Right Stock Screener for EPS Growth

Several stock screener platforms cater to various user needs. Some are simpler to use, great for basic analyses; others have comprehensive features, including detailed financial statements, essential when exploring the nitty-gritty of stock screener EPS growth analysis. A quality stock screener platform focused on EPS growth can save significant time and energy when evaluating companies.

Setting up Your Stock Screener EPS Growth Filters: Essential Criteria

Different investors prioritize different criteria when searching for stock screener EPS growth potential. Factors such as target growth rate, industry sector, market capitalization, and company revenue all play significant roles. Your stock screener EPS growth platform should allow you to refine these filters to pinpoint investments aligning with your investment strategy. Properly setting your stock screener EPS growth filters will enable you to focus your analysis on potential candidates meeting the predefined investment strategy, tailored precisely for those interested in strong earnings per share (EPS) growth characteristics.

Identifying High EPS Growth Potential Companies

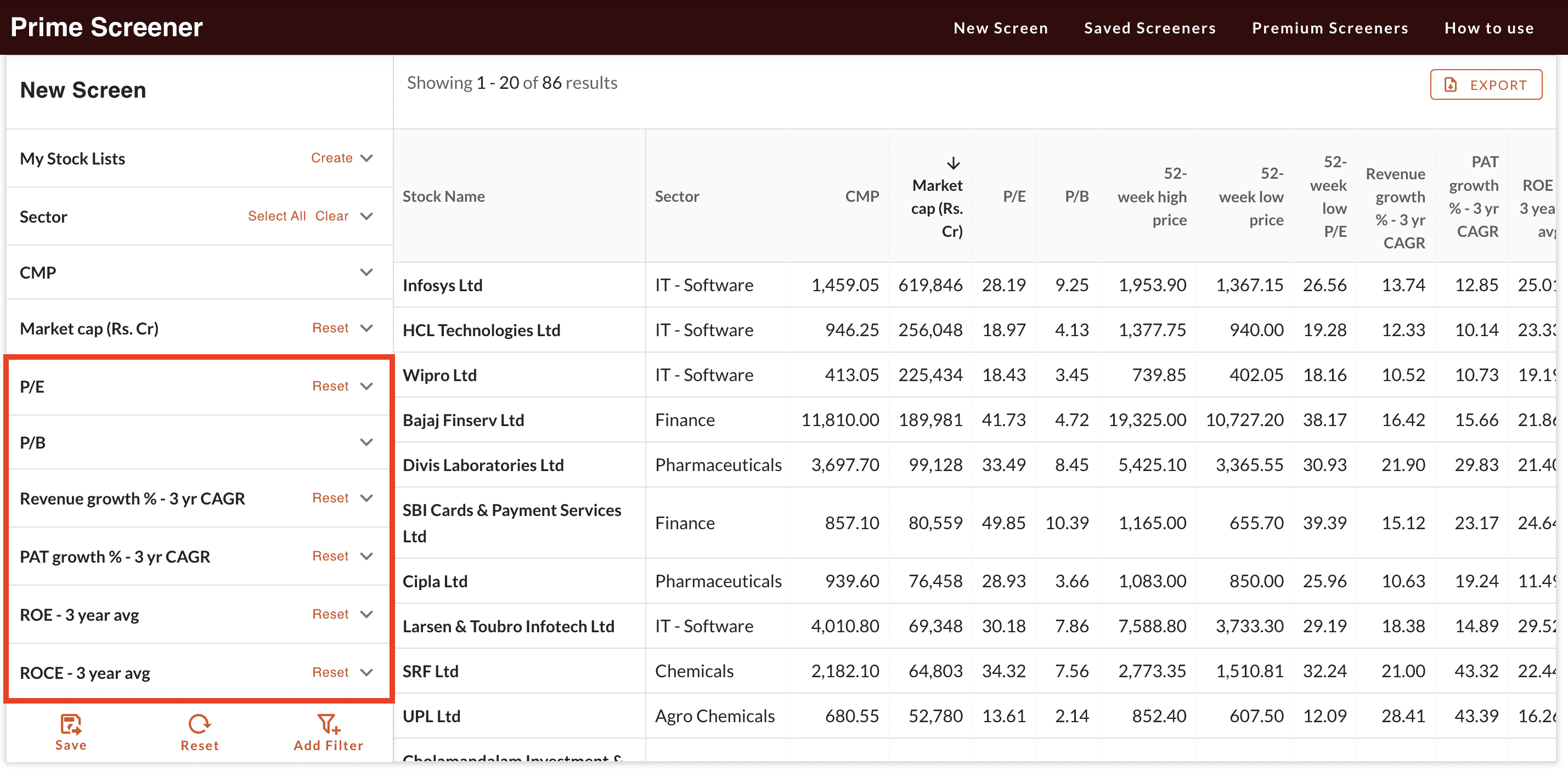

Source: investing.com

This is the heart of the stock screener EPS growth journey. Learning to discern companies with substantial EPS growth potential is critical for success. Historical EPS growth data, combined with anticipated EPS growth projections provided by the company and reputable research organizations, gives investors insight. You can identify growth and consistent profitable growth with an advanced stock screener focused on EPS growth characteristics. A comprehensive stock screener EPS growth tool streamlines this process dramatically, ensuring efficiency.

Understanding Historical vs. Projected EPS Growth: Why it Matters for Stock Screener EPS Growth

A key step in evaluating stock screener EPS growth is recognizing the distinction between historical and projected EPS growth. Analyzing historical trends reveals consistent growth patterns. Projecting EPS growth, on the other hand, allows assessment of anticipated future profitability and aids in discerning long-term potential based on financial modeling by management, as well as professional sources. It's vital for potential investors to utilize stock screeners effectively and identify those companies showcasing the desired historical trend while projected figures showcase strong and potentially promising growth trajectory within a company analysis stock screener. Your stock screener EPS growth search can encompass these parameters for the most in-depth exploration possible.

Analyzing Other Financial Metrics Alongside Stock Screener EPS Growth

EPS growth alone isn't enough to guarantee an investment's success. An effective investment strategy involves scrutinizing other vital metrics—such as revenue growth, debt-to-equity ratios, and profit margins—using stock screener EPS growth in conjunction with other key data. This all-encompassing evaluation strengthens your insight gained via the stock screener EPS growth features available. This rigorous approach helps unearth strong long-term growth, allowing you to accurately filter out unreliable companies with their less significant EPS growth trends that the company stock screener EPS growth displays.

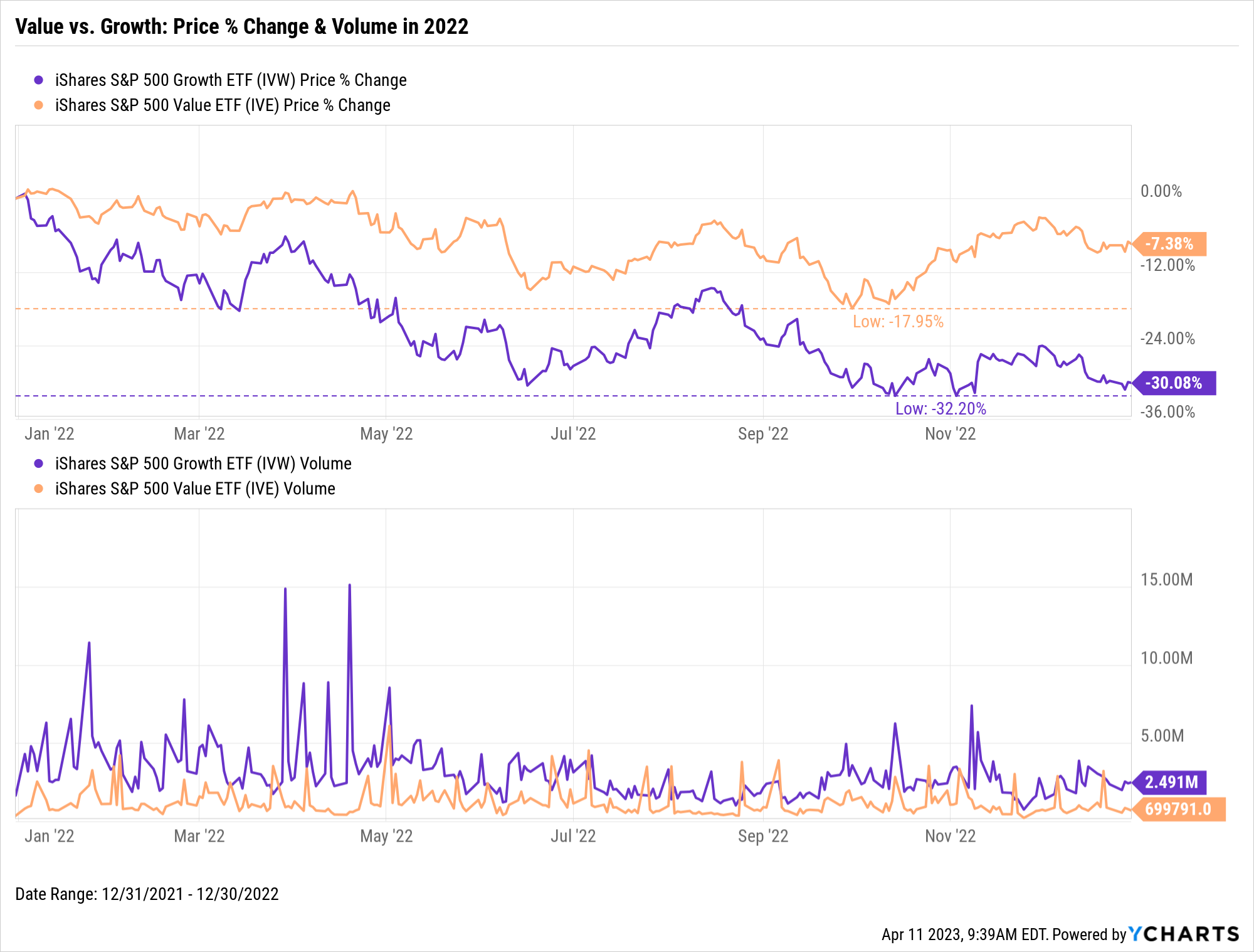

Source: dividendstocks.cash

Minimizing Risk with Stock Screener EPS Growth Evaluation

Recognizing potential risks when evaluating EPS growth within a stock screener is an equally crucial element. External factors such as industry downturns and macroeconomic conditions can influence a company's ability to generate profits. Your stock screener EPS growth screening approach must integrate consideration for such uncertainties and mitigate the potential for losses within your overall portfolio stock screener EPS growth screening. Consider using a combination of metrics to accurately gauge risk while simultaneously evaluating stock screener EPS growth attributes to filter companies accurately based on individual risk appetites.

Source: ycharts.com

Combining Your Stock Screener EPS Growth Analysis with Fundamental Analysis

Utilizing your stock screener EPS growth tool effectively and complementing it with more comprehensive fundamental analysis is indispensable. By looking deeper into company management, competitive landscape, and revenue sources, the insight provided will augment your EPS growth analysis through the stock screener. Use stock screener EPS growth capabilities combined with this deeper fundamental analysis to fully explore potential opportunities within the current stock market landscape.

Further Enhance Your EPS Growth Filtering Using Stock Screener Technology

Further refining your stock screener EPS growth selections and finding promising, growing companies is essential. Exploring options on different platforms can unearth potential investment opportunities through tailored, enhanced, EPS growth filtering in stock screeners. With several reputable stock screener platforms boasting a variety of features designed specifically for stock screener EPS growth analysis, ensuring a streamlined search is easily achieved. Leveraging the most refined tools and technology through stock screeners based on your chosen strategy, helps pinpoint hidden EPS growth opportunities. Stock screener EPS growth is a powerful resource that, when effectively applied, can improve the probability of identifying potential long-term successes and avoiding any potentially dangerous investments.

This comprehensive guide equips you to harness the power of stock screener EPS growth, empowering you to uncover companies with significant earning potential, allowing for a clearer evaluation and investment strategy based upon analysis utilizing various criteria filtered through the powerful search abilities of the best stock screeners available focused specifically on identifying promising companies showcasing consistent and potentially strong earnings growth, the key driving force that stock screeners offer based on the user's need to identify those potential candidates of companies for EPS growth with accuracy and the potential to build a comprehensive strategy toward a successful long-term stock selection through use of powerful stock screeners available on various platforms in the market.