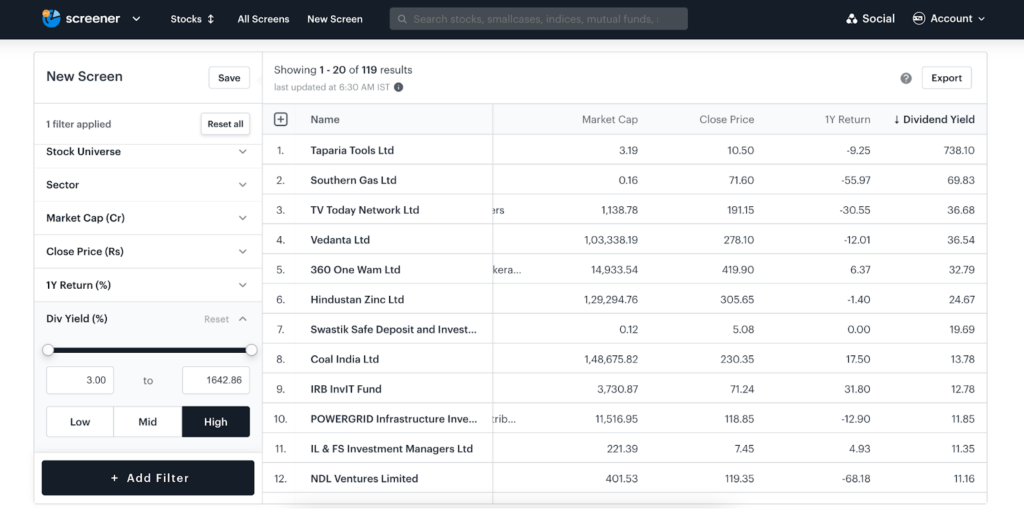

stock screener dividend yield

Uncovering High-Yield Stocks: A Deep Dive into Stock Screener Dividend Yield

Source: europeandgi.com

Finding stocks with attractive dividend yields is a cornerstone of income-oriented investing. This article will guide you through the process of leveraging stock screener dividend yield tools to identify potential income-generating opportunities. We'll explore the nuances of dividend investing, and delve into how to effectively utilize stock screener dividend yield platforms to achieve your financial goals.

1. What is Dividend Yield? Understanding the Basics

Before diving into stock screener dividend yield tools, let's understand the fundamental concept of dividend yield. Dividend yield is the annual dividend payment per share of a stock, expressed as a percentage of the stock's current market price. It reflects the return you receive for owning that stock simply from its dividend payments, regardless of its overall price appreciation or depreciation. A higher dividend yield often indicates a stock paying more for its current market price, but isn't always a guarantee of profitability. Using stock screener dividend yield will help isolate stocks showing the best return based on yield for potential investment. This calculation, when paired with an understanding of company financial strength and overall market health, provides a solid baseline for investigation. A high dividend yield, without analysis, might be deceiving or even risky. Using stock screener dividend yield platforms provides this crucial step.

2. Why Use Stock Screener Dividend Yield Tools?

Source: maynardpaton.com

In today's market, information overload is real. Stock screener dividend yield tools streamline the research process. They allow investors to identify stocks with specified criteria concerning their yield based on fundamental and technical stock data, efficiently filtering the overwhelming number of possible investments down to a manageable portfolio for dividend investing strategies. By narrowing the choices to only promising candidates based on dividend yields you have the opportunity for quicker, and easier filtering. It significantly increases efficiency in identifying potentially lucrative dividend-paying opportunities, while significantly minimizing unproductive research time when leveraging a stock screener dividend yield.

3. How to Choose the Right Stock Screener for Dividend Yield

A plethora of stock screener dividend yield tools are available, each offering different features and capabilities. Key considerations in choosing a tool include user-friendliness, comprehensiveness of data, adjustable filters and parameters to pinpoint stocks matching desired characteristics, and costs of access, as well as accessibility in determining factors that directly impact your search parameters and strategies when looking for the best yield based on dividend payment using your stock screener dividend yield selection criteria. Finding the best stock screener dividend yield tool depends entirely on personal preferences, budget, and research approach to maximize profitability for dividend investments.

4. Setting Up Your Stock Screener Dividend Yield Search

After selecting a tool, set the filters for maximum benefit. Focus on identifying desired parameters, including but not limited to your dividend yield minimum, time period for payment data, financial data specifications for your investment considerations, current price to income data points in your portfolio and desired strategies, the sectors of stocks of your preference, and overall company financials to further investigate into dividend investment strategies based on company background research of potential opportunities. Once you've used the tool to find potentially interesting candidates, you can start conducting independent analysis to get a comprehensive picture of dividend pay and investment returns. You should ensure this is factored into your investment plan through careful stock screener dividend yield use to assess the best possible options to use within your strategy for any particular market.

5. Advanced Features in Stock Screener Dividend Yield Tools

Many advanced stock screener dividend yield tools offer more than just basic filters. Look for features like historical dividend data, payout ratios, and company financial information relevant for dividend safety analysis. Historical dividend payment history within a stock screener dividend yield platform often can point toward a greater understanding of potential performance and dividend security. Examining trends from historical payment patterns allows you to determine which are the dividend yields with consistent payments for sustainable and steady earnings over a certain amount of time in a stock screener dividend yield filtering process.

6. Incorporating Other Financial Metrics

Don't solely rely on dividend yield. Complement your analysis with other financial metrics such as the company's profitability, growth prospects, and debt levels, when making dividend yield choices for your portfolio. Employ a diverse analytical method using additional data found within stock screener dividend yield options when scrutinizing income potential of a company with consideration of these other fundamental aspects of corporate finance for stocks offering sustainable yields within stock market fluctuations using stock screener dividend yield platform research, instead of solely relying on dividend yields.

7. Understanding Dividend Payout Ratios

A company's payout ratio reveals how much of its earnings it distributes as dividends. A healthy and consistent dividend yield within your stock screener dividend yield process typically will have a stable and steady history and reasonable ratios within the company. Analyze a company’s dividend consistency and payouts to assess stability by researching their patterns for better insight when searching for consistent stocks with stable income potential based on dividends, when screening on stock screener dividend yield search tools and analysis.

8. The Importance of Risk Assessment

A higher dividend yield might sometimes correspond with higher risk. Analyze the company's financial position before investing. Using stock screener dividend yield platforms efficiently in combination with assessing risk, you are more capable of prioritizing sound investments by thoroughly examining the companies behind dividend-paying investments that use dividend strategies with stable payout capabilities when screening stock opportunities in an active stock market based on yield considerations and filtering processes of your selected stock screener dividend yield platform.

9. Analyzing the Current Market Environment

Market conditions significantly impact stock prices and dividend yields. Use your stock screener dividend yield tool and analyze the current market conditions as they are very dynamic when screening stock dividends with an understanding of external factors involved that can be observed with appropriate filters through your dividend yield investment tools to get an overall better understanding. Market context often presents factors you might overlook when simply viewing yields. A solid strategy takes into consideration the context within the stock market at the moment based on your investment preferences and considerations.

Source: ytimg.com

10. Diversification and Portfolio Management

Diversifying your investment portfolio and consistently reviewing your holdings will help balance risk, using your stock screener dividend yield tool in a methodic and proactive fashion based on overall goals in your overall stock portfolio holdings. Use different filtering options to match certain sectors within your desired return requirements within each section of your portfolio that incorporates stock screener dividend yield.

11. Ongoing Monitoring of Dividend Stocks

Source: tickertape.in

Investing in dividend stocks doesn't end with the purchase. Consistent monitoring is key. Observe if dividends maintain historical levels, look at the potential for increases, assess factors impacting yield based on your selection in a stock screener dividend yield and be prepared to sell shares when necessary to maintain or achieve desired income and return projections using your stock screener dividend yield insights.

12. Conclusion – Maximizing your Investment Returns with a Focus on Dividend Stocks

By understanding how to utilize the power of stock screener dividend yield tools, you can effectively and confidently create your dividend strategy to maximize return based on consistent returns to benefit your personal financial projections based on dividends through various stock screens and filters of the platform. Utilizing various methods based on factors involved in overall investment gains can streamline finding and identifying suitable choices using stock screener dividend yield research to develop income based opportunities based on dividends and investments. Remember: due diligence and constant vigilance will determine successful stock screener dividend yield selections based on your analysis, considerations and personal strategy to maximizing return potentials through dividends when screening stocks.