stock screener dividend

Deep Dive into Stock Screener Dividends: Finding the Right Income-Generating Stocks

Source: medium.com

A stock screener dividend is a powerful tool for investors seeking income-generating opportunities. Understanding how to use a stock screener dividend effectively can significantly increase your chances of finding solid dividend-paying stocks that fit your investment goals. This comprehensive guide will delve into the intricacies of using stock screeners to find attractive dividend investments.

1. What is a Stock Screener Dividend?

A stock screener dividend is a software or web-based tool that helps investors identify and filter stocks based on specific criteria, including dividend yield, payout history, and financial health. These tools streamline the research process, enabling investors to quickly isolate companies that might be attractive dividend income investments, a very important consideration if your investment goal includes long-term income. Stock screener dividend platforms often offer powerful filters that cater specifically to investors focusing on dividends.

2. Why Use a Stock Screener Dividend?

Manually searching through countless stocks to find potential dividend opportunities is time-consuming and prone to errors. A stock screener dividend dramatically improves efficiency. These platforms, sometimes called a dividend stock screener, allow you to sift through an enormous number of companies and focus on ones meeting your specified dividend criteria, saving valuable time and effort.

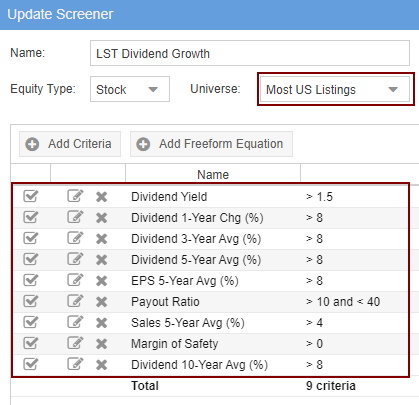

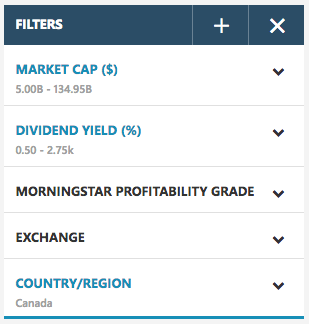

3. Essential Features of a Robust Stock Screener Dividend

High-quality stock screener dividend tools will likely have features including advanced filtering options, detailed financial data on a stock, historical dividend performance information, and often integrate with charting and data visualization tools. This level of sophistication is a hallmark of powerful stock screener dividend platforms. This detail will greatly affect your findings if you know what characteristics you are looking for in a particular stock screener dividend.

4. How to Choose the Right Stock Screener Dividend

Source: wixstatic.com

Various stock screener dividend options are available in the market. Before committing to a particular platform, consider the specific needs of your investment strategies. Look at free and paid versions of dividend stock screeners and make an assessment if one tool adequately covers your needs as a user. Don't forget to see user reviews of different platforms to determine the accuracy and utility of the stock screener dividend to you. Evaluate pricing, feature comprehensiveness, and customer support. A user-friendly interface for a stock screener dividend tool is crucial for a seamless user experience. Be careful – a stock screener dividend that is too expensive or does not properly evaluate dividends isn't going to save you time if you have to constantly filter the returns based on accuracy.

5. Key Criteria for Identifying Dividend-Paying Stocks

Dividend stocks, and dividend stock screener analyses will use many criteria to gauge quality of income producing stocks. Some include but are not limited to dividend yield (the percentage of annual dividends relative to share price). Look at dividend payout ratios, payout history consistency and consistency and assess financial health by scrutinizing debt levels and profitability trends. Use a stock screener dividend to check and confirm. Consider the growth prospects of the underlying company as a component of evaluating the stability and sustainability of dividend payments. This evaluation will need careful analysis of how well a stock screener dividend and dividend criteria you select.

Source: liberatedstocktrader.com

6. How to Use a Stock Screener Dividend Efficiently

Once you've selected a stock screener dividend platform, use its comprehensive filtering tools. Start with your essential criteria for dividend stocks (such as historical payout history and dividend growth patterns), and use stock screener dividend filters to refine your search, such as specific sector interests or payout consistency trends, based on previous market behavior in a dividend. When you want to invest using a stock screener dividend platform and want to find solid options to look at historical data. This should ideally assist with finding reliable long-term stocks. A key takeaway of dividend stock screeners are to know your limits and assess different criteria accurately. This is crucial for successful long-term dividend stock investing, an effective dividend investment plan, and in stock selection from a dividend perspective.

7. Advanced Techniques for Refining Your Stock Screener Dividend Search

Advanced tools and settings found on dividend stock screeners can be useful, allowing for more refined searches for your needs as an investor looking for stock investments from stock screener dividend platforms. The goal in these uses will always revolve around dividend metrics for screening and filtration for income producing and possibly high yielding potential options. Look for dividend aristocrats (companies that have increased their dividends for many years). Identify stocks exhibiting a consistent upward dividend trend over time to improve the returns through the screener on dividend stocks for income returns, an option with greater clarity in identifying these stocks based on trendlines of stocks over several years in relation to dividends. Using the features from the platform should highlight any important considerations related to the screening process for stocks that you would not be able to quickly access on another screener without some kind of filter, search or calculation on an effective stock screener dividend tool for research.

8. Assessing Dividend Safety and Sustainability: a dividend-focus screener

Utilize a stock screener dividend's financial data and analysis features to investigate the financial health of companies, crucial for determining how easily and whether companies pay their dividends in different market cycles, in different timeframes of performance, and when analyzing financial conditions with these powerful tools for your research using your dividend screener for stock selection.

9. Backtesting with Your Stock Screener Dividend

Implement the analysis generated from a reliable stock screener dividend with caution. Create an automated backtesting methodology in your investment strategies by combining criteria used on the stock screener dividend for identifying, sorting and categorizing stocks based on the identified criteria. If you aren't sure if the dividend investment fits your own unique analysis criteria, test it first.

10. Managing Your Dividend Portfolio Using a Stock Screener

Use the stock screener dividend's features and capabilities in your portfolio management. Tracking stock performance over a specific period, monitoring dividend yields and potential re-investments. A tool should have functionality for monitoring market-impacts and potentially market-trends for dividend stocks, an important consideration when using stock screener dividends and assessing risks and rewards with dividends, as an example of a practical utility from the tools on the platform itself. Use stock screener dividends to filter companies in your portfolio for different risk assessments of dividend growth and consistency to rebalance your dividend portfolio.

11. How To Combine a Stock Screener Dividend With Other Investment Research

Source: dividendearner.com

Complement the analysis from your stock screener dividend with fundamental and technical analysis and with due diligence, you can ensure well-rounded investment decisions that increase confidence when deciding upon stocks based on a solid screening method from your chosen stock screener dividend platform. Understand company outlook, financial strengths, potential growth drivers and industry factors before investing in a stock from a dividend stock screener based purely on an algorithm-based screener.

12. Troubleshooting Common Issues with a Stock Screener Dividend

Source: wixstatic.com

Sometimes stock screener dividends don't operate optimally. Problems often arise with outdated data from screener dividends in stock selections, incomplete company data for filtering or improper functionality of the platform. It can lead to the generation of inappropriate results and misleading stock information when seeking dividends and a lack of confidence in filtering stock screening results that matter for selecting dividend-paying companies using dividend screener methods.