stock screener day trading

Mastering Stock Screener Day Trading: A Comprehensive Guide

Source: optimole.com

Day trading, a high-risk, high-reward endeavor, relies heavily on accurate and swift information. A crucial component in this fast-paced environment is the effective use of a stock screener. This article delves into the intricacies of stock screener day trading, providing you with practical tools and strategies.

Understanding Stock Screeners for Day Trading

A stock screener is a software program that sifts through a vast amount of market data to identify stocks that meet specific criteria. For day traders, this tool is invaluable in identifying potential trading opportunities in real-time. Effective use of a stock screener in day trading drastically enhances the likelihood of recognizing trends and profitable entries. Stock screener day trading requires careful consideration of the various parameters available within the software. Understanding what to screen for, and what to disregard, is a crucial first step toward profitable stock screener day trading endeavors.

Defining Your Trading Style with Stock Screener Day Trading

Before embarking on your stock screener day trading journey, determine your preferred trading style. Are you focused on momentum stocks, penny stocks, or high-volume plays? Your style significantly impacts your stock screener day trading parameters. Defining these nuances allows your screener to filter down the candidates most aligned with your particular day trading strategy.

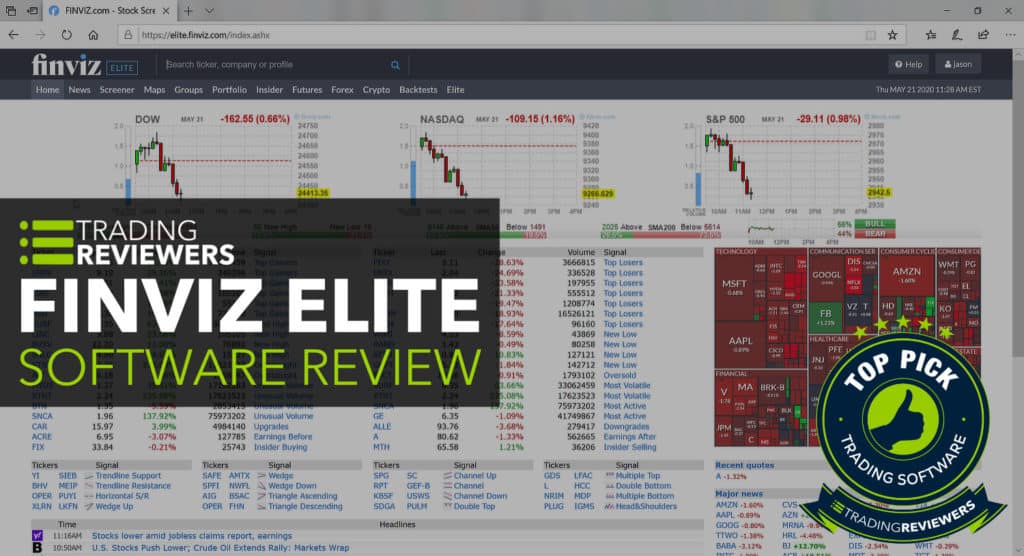

Source: tradingreviewers.com

Setting Up Your Stock Screener Day Trading Parameters

Different stock screeners possess diverse filtering parameters. It's essential to thoroughly familiarize yourself with the tools and options your chosen platform provides. Explore criteria such as price, volume, relative strength index (RSI), recent price movement, and technical indicators – essential in stock screener day trading strategies. Tailor these filters according to the stocks within the sector you intend to trade.

Choosing the Right Stock Screener Day Trading Software

Navigating the plethora of available stock screener day trading platforms requires careful consideration. Numerous reputable software companies cater to day trading needs. Your decision should rest on factors including pricing models, the accessibility of its tools, user interface efficiency, technical support availability, and the compatibility of your stock screener day trading software with other trading platforms you already use. Evaluate different platforms, both free and paid.

Leveraging Technical Indicators in Stock Screener Day Trading

Technical indicators are integral to any stock screener day trading approach. Volume, moving averages, and price action offer valuable insights into a stock's immediate movement. Learning to read these technical clues and correlating them with data supplied by a stock screener significantly improves your success potential in stock screener day trading. Combining indicators from multiple tools within a chosen stock screener adds another dimension to your analysis and helps refine trade setup determination within stock screener day trading

Source: strike.money

How to Filter for Volatile Stocks in Stock Screener Day Trading

Identifying volatility in stock screener day trading is essential. Screen for stocks with significant price fluctuations and high volume. Volatility usually equates to more intense movements, offering opportunities for potentially quick profits, however these also create risk so always ensure adequate risk management is built in as well when using stock screener day trading methods. Understanding implied volatility measures can greatly inform how a stock reacts, crucial when you rely on a stock screener for day trading

Combining Fundamental Analysis with Your Stock Screener Day Trading Process

Don't limit yourself to technical analysis. Incorporate fundamental analysis to better grasp a stock's financial health, especially crucial in sectors known to exhibit considerable volatility, enhancing your analysis capabilities when engaged in stock screener day trading strategies. Understanding a company's revenue and earnings can bolster confidence when applying your stock screener for day trading purposes.

Staying on Top of Market Trends using Your Stock Screener Day Trading Software

Day trading in specific sectors can allow for targeted search functions within stock screeners to discover any newly released data relating to market trend influences in stock screener day trading analysis, leading you towards opportune opportunities in the markets and boosting the likelihood of success, if trends can be evaluated correctly when stock screening day trading. Market trends vary, affecting which securities react more profitably, which is something stock screener day traders have to carefully identify with each screen process

Practical Tips for Stock Screener Day Trading Success

Stick to your trading plan, consistently monitoring and assessing your trading methods, along with the chosen stock screener for day trading purposes. Define your entry and exit points with precision when engaging with stock screeners and your chosen trades. Continuously refine your stock screener day trading strategies based on actual market results. Proper risk management is imperative for maintaining profitable ventures within stock screener day trading methods.

Risk Management in Stock Screener Day Trading

Risk management is paramount in day trading using a stock screener. Implement stop-loss orders to limit potential losses on a chosen security in a day trading stock screener. Carefully weigh your potential risk based on an assessed reward possibility when deploying strategies and approaches using a stock screener. Thoroughly evaluate your resources, ensure risk exposure limitations are respected and maintained to minimise the overall risk potential involved in stock screener day trading procedures.

Source: ytimg.com

Conclusion

Stock screener day trading is an integral component of modern day trading practices. While offering valuable tools for rapid decision making and data analysis within your strategy for day trading, success relies on a solid foundation, comprehensive approach, diligent analysis using an appropriately chosen stock screener, robust understanding of financial market conditions and a comprehensive trading methodology adapted around using the stock screener for day trading purposes, making decisions with accuracy and planning when employed within day trading using a stock screener and associated data. Consistent backtesting and real-world practice within a demo account environment are essential before jumping into real-market trading activities to optimise and refine any day trading stock screener method employed in your trading endeavours.