stock screener api

Unlocking Investment Opportunities with a Stock Screener API

A stock screener API is a powerful tool for investors, traders, and financial analysts seeking to navigate the vast landscape of financial markets. This detailed guide will explore the intricacies of stock screener APIs, their benefits, and how they can elevate your investment strategies.

Understanding Stock Screener APIs

Source: pressablecdn.com

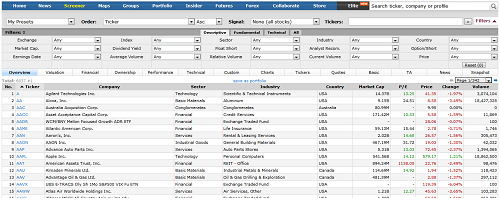

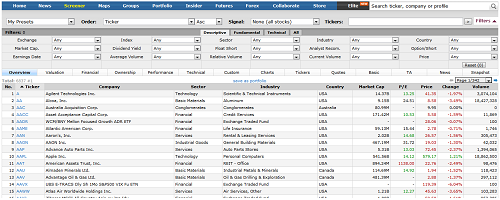

What is a Stock Screener API?

Source: fidelity.com

A stock screener API (Application Programming Interface) acts as a bridge between your investment software or platform and vast databases of financial data. Essentially, it provides programmatic access to stock data, enabling automated filtering, sorting, and analysis. Instead of manually searching through endless listings, you can leverage the stock screener API to refine your search. This accelerates the process, allowing you to find potentially lucrative opportunities based on precise criteria. This data often includes historical prices, fundamental financial information, and more. This level of integration empowers you to develop powerful, automated stock screening workflows and dramatically increase investment speed and accuracy. Stock screener APIs provide direct access to these extensive repositories of stock data, which are critical components for sophisticated stock screening tools. Using a stock screener API unlocks unprecedented automation possibilities.

Key Features of a Robust Stock Screener API

A high-quality stock screener API offers more than just access to stock data. Features often include customizable search criteria (which makes the stock screener API particularly effective) like profitability ratios, growth rates, industry segments, market capitalization, and even geographical location. Sophisticated algorithms make searching easier; this is an immense benefit of the stock screener API. This allows for precision screening and identifies assets aligning with specific investment philosophies and financial goals. A strong stock screener API streamlines the filtering process. The speed with which these searches can be carried out, when implemented via stock screener API, is an invaluable benefit to modern finance.

How a Stock Screener API Works

Data Extraction and Processing

A stock screener API connects directly to financial databases. This process enables real-time data fetching or allows historical data downloading for different stock markets and securities. These stock screener APIs can retrieve real-time and historical stock market data to allow more accurate analysis. Accessing this information via a stock screener API eliminates the need for tedious manual data entry. This aspect of stock screener API makes them invaluable. A robust API efficiently organizes the gathered data allowing analysts to filter and study this data efficiently and swiftly, maximizing the investment process' effectiveness through the use of a stock screener API.

Defining Screening Criteria

Using the stock screener API, users establish clear and concise selection parameters that align with their unique investment needs and strategies. With these stock screener APIs you are defining precisely what your goals and filters are. These parameters shape the results generated and pinpoint stocks meeting predefined conditions in an efficient and accurate manner through a powerful stock screener API. This functionality is key to using the stock screener API to find the right opportunity.

Generating Reports

The power of a stock screener API extends beyond screening; these powerful platforms often facilitate the generation of customized investment reports that contain useful data relevant to the analyst's stock analysis criteria. This integration often makes the investment decision more organized, transparent and more effective. Many stock screener API integrations help organize a well thought out approach to research, saving substantial time. Using the stock screener API allows your reports to automatically track investment outcomes against user expectations.

Benefits of Using a Stock Screener API

Enhanced Speed and Efficiency

Manually reviewing thousands of stocks is incredibly time-consuming. A stock screener API drastically reduces this time investment. This crucial component empowers faster investment decisions with automated and efficient investment strategy research. Automation delivered through stock screener API integrations brings immense value.

Increased Accuracy

Reducing human error associated with data entry, analysis, or interpretation is a substantial benefit to stock screener API tools. The precision this API offers in stock selection and identification elevates your investment accuracy. The improved accuracy of the stock screener API will make the investment more efficient and profitable.

Customizable Analysis

Creating bespoke strategies involves refining criteria. Stock screener APIs let you customize precisely these criteria. Using the API tools empowers detailed research to produce specific results based on an investment's expected profitability through a highly intuitive process. Having highly detailed control over parameters in this fashion is another critical use of the stock screener API.

Scalability for High-Volume Trading

Stock screener APIs are particularly vital for investors dealing with high-volume transactions and automated trading. In this context the power of a stock screener API comes into play when automating the process.

How to Integrate a Stock Screener API

Choosing the Right API

Understanding what functionality you need determines the most fitting stock screener API. Different options cater to various preferences.

Obtaining API Keys

Each stock screener API service provides these necessary keys for authorized data access and use within your platform's investment strategies. The security and robustness of these APIs make for better investment security and decision making through their integration in a user's process.

API Implementation

Various programming languages (e.g., Python, Java, JavaScript) support API integrations. Each stock screener API often has documentation describing this process with comprehensive instructions tailored to various needs and approaches in stock picking strategy.

Data Manipulation and Reporting

Within the automated process you choose data manipulation functions and generate the reports within the selected data environment according to criteria within the stock screener API and how you want the data returned. Understanding the data return and how this will be handled and integrated will shape your stock screener api.

Evaluating a Stock Screener API

Reliability and Performance

Essential components in evaluating the effectiveness of a stock screener API include its speed of access and availability. Factors such as accuracy of information, response time of APIs are essential. Look for consistent data integrity and stable platform availability.

Source: eodhd.com

Cost-Effectiveness

A detailed understanding of costs associated with a stock screener API, both the cost-to-implementation, as well as ongoing access and update fees associated, are essential in determining which options best fit your requirements. These APIs also can dramatically reduce costs as your operations grow as a business. The ongoing costs may outweigh other possible strategies when selecting a stock screener API, but the overall accuracy in evaluating financial data via these APIs is worth the investment.

Source: blackbull.com

Customer Support and Documentation

Good API documentation simplifies the onboarding process significantly. API providers should offer assistance if any problems occur. The responsiveness of the customer service helps identify if their products and stock screener APIs support your goals. Understanding all this data will allow better use and return via a stock screener API.

Real-World Applications

Stock screener APIs have transformed portfolio management by giving investors powerful tools, thereby dramatically impacting portfolios through automated stock-screening practices in diverse portfolio-management contexts, using the available features.

Future Trends in Stock Screener APIs

The stock screener API field is continuously evolving. Look for real-time integration, advanced analytics, and integration with artificial intelligence to gain a competitive advantage via your stock screening API use and operations. AI and machine learning integrations via these APIs are also important considerations as these can help refine investment selection strategies over time, significantly impacting your approach to trading and investment selection and strategy via these tools and stock screener APIs.

Conclusion

A stock screener API is more than just a tool; it's a catalyst for improved investment decisions. It empowers investors with enhanced efficiency, precision, and control. This is only further heightened by a robust API with real-time data integration and customizable filters; critical elements of selecting the right tools and products via a robust stock screener API.