stock picks for short term

Stock Picks for Short Term: Navigating the Volatile Market

Introduction

The stock market can be a thrilling rollercoaster, offering the potential for quick gains but also carrying significant risk. This article delves into the world of short-term stock picks, exploring various strategies and offering actionable steps for making informed investment decisions within the context of a fluctuating market landscape. Stock picks for short term often involve evaluating rapid changes in prices and are influenced by the specific day-to-day events. Stock picks for short term traders usually prioritize quick turns over substantial returns over longer durations. Stock picks for short term require thorough research to predict and respond to volatile price movements. Stock picks for short term investments usually include higher-risk trades and shorter holding periods. Stock picks for short term investing often favor speculative stocks rather than solid blue-chips, which generally show more stability.

Understanding Market Dynamics: The Foundation of Short-Term Stock Picks

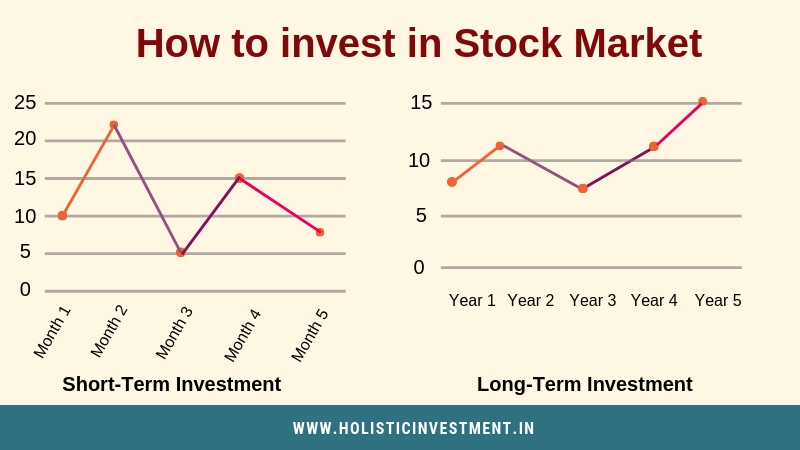

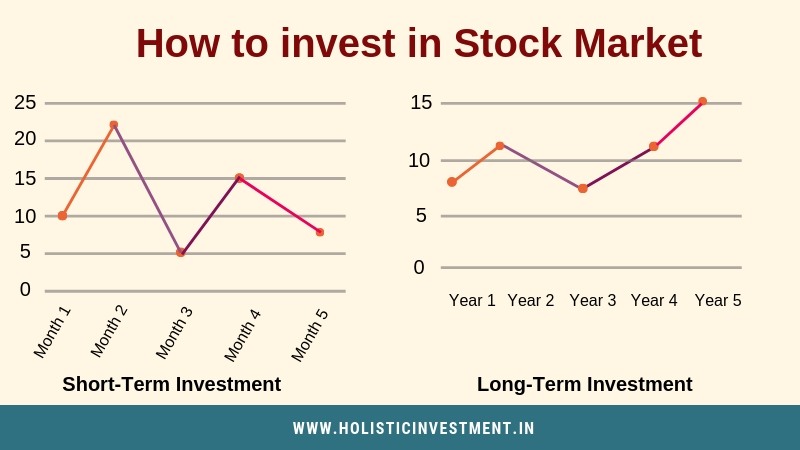

Source: holisticinvestment.in

What Drives Short-Term Stock Movement?

Short-term stock picks thrive on identifying the key factors behind fleeting market swings. This can involve news cycles, investor sentiment, and even economic forecasts. Understanding what factors dictate a particular day-to-day price trend will dictate if the stock pick is suitable for your short-term strategy. Understanding stock picks for short term needs thorough market awareness and vigilance. A major trend affecting short-term stock picks can stem from an industry sector’s volatility, which is highly susceptible to quick change. For those interested in stock picks for short term, studying how different markets behave will enhance potential gains in short term stock picking. Stock picks for short term profit also rely heavily on daily movements which will determine the immediate profitability.

Identifying Potential Short-Term Stock Picks

How to Spot Potential Winners

Recognizing opportunities amongst potential stock picks for short term profit needs a systematic approach. Studying news sentiment, the actions of insiders and trading volume can provide vital clues that guide investors towards viable short term investment candidates. Key factors including earnings reports, corporate announcements, and overall industry performance must also be factored into the equation. This meticulous strategy in selecting stock picks for short term profit will result in well-informed selections. Using quantitative data tools is necessary to pinpoint a potential winning investment among various options available. Stock picks for short term profits require intensive daily analysis; a thorough market study for relevant stock picks for short term traders will be necessary.

Technical Analysis for Short-Term Stock Picks

Unlocking Hidden Market Trends

Technical analysis plays a pivotal role in stock picks for short term investments. Utilizing tools such as chart patterns, moving averages, and indicators, astute short-term investors can potentially predict potential price movement directions. Knowing how to decode these patterns from a visual chart can significantly impact the efficacy of stock picks for short term investors.

Fundamental Analysis: Deep Dive into Company Performance

Understanding Intrinsic Value and Risks

Complementing technical analysis is fundamental analysis, focusing on the inherent strength of a company and its prospects for profit. The approach helps identify company performance and growth trends for better comprehension and strategy design. Identifying reliable companies whose intrinsic value provides greater confidence can make the stock pick for short term successful. Knowing which companies provide solid investment opportunities with less risk plays a huge factor in developing successful short-term stock pick investments. This analysis will enhance your knowledge for stock picks for short term investment and better identify the strengths and weakness that exist amongst a particular stock picks for short term opportunity.

Source: alamy.com

Risk Management Strategies for Short-Term Investments

Protecting Your Capital

The realm of stock picks for short term is inherently risky. Robust risk management strategies are paramount to mitigating potential losses. Determining stop-loss orders, understanding leverage limits, and employing proper position sizing are critical steps towards effective stock picks for short term investments. Identifying any unforeseen circumstances or financial challenges can greatly alter a short-term stock pick’s success. Properly analyzing a potential investment can assist traders seeking a more manageable risk investment.

Psychology of Trading: Mastering Emotions

Controlling the Internal Game

The human factor is vital in stock trading, as it greatly determines your ability to successfully execute any trading strategy. Trading psychology becomes even more critical with stock picks for short term, where rapid price movements and tight timelines can greatly affect emotion-based reactions and potential investment losses. Emotional regulation plays a large role in evaluating the success of short-term investment strategy.

Portfolio Diversification: Balancing Risks

Broadening the Investment Landscape

Investing in multiple companies to avoid over-reliance on a specific stock or company strategy remains essential, especially with stock picks for short term investments. Understanding how and where your resources and funds can be allocated across varying asset classes becomes increasingly more vital to a sustainable portfolio strategy and approach to your stock picks for short term opportunities. A balanced and structured portfolio will support future diversification and profit with any successful stock picks for short term gains.

Short-Term Stock Pick Strategy Selection

Building Your Method

Consider the particular timeframe for your stock picks for short term gains. Selecting a strategy suitable for short-term investing involves tailoring a system that accommodates specific risk tolerance levels, financial standing and future planning. Choosing appropriate strategies based on the individual timeframe will positively contribute to stock picks for short term trading success. Implementing a reliable framework and assessing individual and business conditions are necessary when forming short-term trading strategies.

Entry and Exit Strategies: Precision is Key

Source: cloudfront.net

Capitalizing on Opportunities

Source: wixstatic.com

Knowing the optimal timing for entry and exit, and defining clear triggers to enact either step is vital for profitability for stock picks for short term strategies. Proper entry and exit plans to secure capital gains are necessary when engaging in short-term investing strategies. Properly establishing stop loss values when engaging in trading of stocks that undergo significant short term gains is crucial to successful short term stock picking investment strategies.

Conclusion

Mastering short-term stock picks requires diligent research, a balanced approach to various strategies, robust risk management, and a well-controlled psychological response to market movements. Effective stock picks for short term demand continuous learning and adaptation to shifting market conditions, in which understanding these elements becomes vital for success in stock picks for short term investing and trading.

Important Note: Investing in the stock market carries inherent risks. Past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions. This information is not financial advice.