stock picking guide

A Comprehensive Stock Picking Guide for Investors

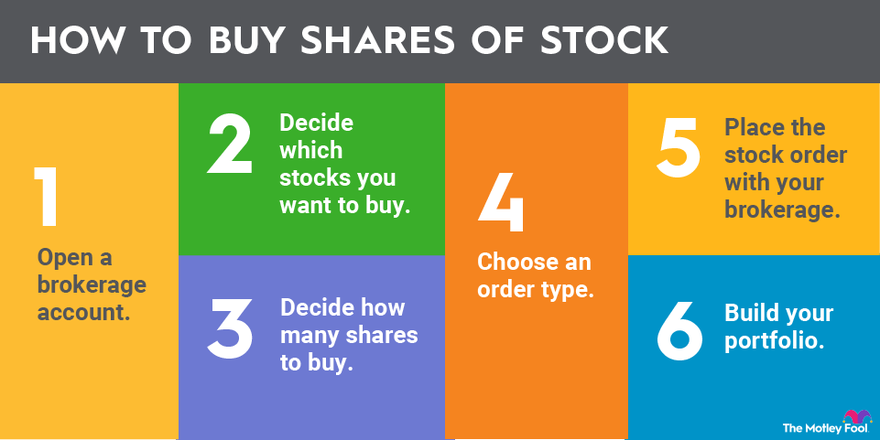

Source: foolcdn.com

This stock picking guide provides a detailed roadmap for identifying and selecting potentially profitable stocks. Navigating the stock market requires careful analysis and understanding of market trends, and this comprehensive stock picking guide aims to empower investors with the tools and knowledge to make informed decisions. We'll delve into crucial aspects of the stock picking process, equipping you with strategies that extend beyond the typical stock picking guide.

1. Defining Your Investment Goals and Risk Tolerance – The Foundation of Your Stock Picking Guide

Source: or.id

Before diving into the intricacies of stock picking, establishing clear investment goals and risk tolerance is paramount. What are you hoping to achieve? Long-term growth, consistent income, or a mix of both? Your timeline for reaching these objectives directly influences the risk tolerance aspect of your stock picking guide approach. Are you comfortable with volatile fluctuations in stock prices? This stock picking guide stresses the significance of matching your investment approach to your personal financial circumstances. Understanding these facets of your investment strategy within the framework of your stock picking guide is critical.

2. Researching the Stock Market – Stock Picking Fundamentals

Thorough research is the cornerstone of any successful stock picking guide strategy. Start by researching specific companies. The focus of your stock picking guide research should include examining the company's financial statements, past performance, management quality, competitive landscape, industry trends, and the broader economic climate. Analyzing company history offers insights relevant to a proper stock picking guide method.

How to research a company:

- Read Annual Reports and SEC Filings: Scrutinize documents to grasp the company's financial performance, growth prospects, and overall health – vital for any proper stock picking guide strategy.

- Examine Financial Statements: Understand profitability, cash flow, debt levels, and return on investment to gauge its underlying strengths. Use your stock picking guide tools appropriately!

3. Assessing Financial Health – Critical Metrics for the Stock Picking Guide

Source: pinimg.com

A strong financial foundation is crucial for the long-term viability of a company, a key takeaway in any reputable stock picking guide. Evaluating factors such as profitability, revenue growth, debt levels, and cash flow helps you understand the financial strength and health of the target company. These metrics are critical to assessing if the company warrants the position within a well-structured stock picking guide.

4. Evaluating Market Trends – Macro Factors and Stock Picking Guides

No comprehensive stock picking guide can neglect broader market dynamics and how they affect particular company fortunes. Understand prevailing macroeconomic trends – interest rates, inflation, economic growth – to see how they might impact your target company within a comprehensive stock picking guide strategy. This is often overlooked but remains critical to good stock picking guide techniques. Consider international markets to see how different markets' fluctuations can influence company fortunes, in your stock picking guide research.

How to Assess Market Trends:

- Review Economic Reports: Follow news regarding GDP, unemployment, inflation and other critical market reports in any useful stock picking guide.

5. Stock Picking Strategies – Beyond the Basics in a Stock Picking Guide

Various approaches exist. Some stock picking guides might suggest fundamental analysis focusing on company financials. Technical analysis using charts can provide insight from trading activity in your stock picking guide. Also understand what stock screens to implement as an important strategy of a strong stock picking guide.

Technical Analysis (For your Stock Picking Guide) : use tools, chart patterns to see trends. Employ fundamental indicators as well as your comprehensive stock picking guide.

6. Building a Portfolio – A Systematic Approach Within a Stock Picking Guide

Building a robust portfolio using a comprehensive stock picking guide framework involves diversification and balancing your risk-return strategy for any investor. Determine your asset allocation to maintain proper stock weight.

7. Considering Risks – Mitigation Techniques Within Your Stock Picking Guide

Risk management is a cornerstone of any stock picking guide, preventing you from being overwhelmed with loss in a poorly structured or inadequate investment portfolio and financial plans. Identify potential risks specific to your target investment. Use strategies such as stop-loss orders to mitigate the risk factor of investment in the context of your stock picking guide plan.

8. The Role of Experienced Advisors – Enriching Your Stock Picking Guide Knowledge

An advisor can offer diverse perspectives that benefit any effective stock picking guide approach. Seek knowledgeable professional advice and understand whether to seek this help is a strategic asset. Leverage your own research and investment experience within any well-organized stock picking guide strategy!

Source: media-amazon.com

9. Keeping Up with Updates – Staying on Top with the Market – A Stock Picking Guide Update

Stock markets, businesses, and their trends can fluctuate dramatically, and the use of stock picking guides to track market events and information must account for market dynamics, company changes, economic forecasts, and industry updates for optimal investment success and consistent return. The proper and thorough implementation of any effective stock picking guide framework requires careful tracking of all available updates in real time.

10. Using Tools & Software – Enhanced Analysis within a Stock Picking Guide Process

Leverage suitable investment research tools and platforms for quick, easy analysis in any detailed stock picking guide framework. Software aids your investment strategy using proper analysis methods.

11. Regular Portfolio Reviews – Optimizing Your Stock Picking Guide Performance

Ongoing portfolio assessment in alignment with your defined stock picking guide strategy is essential to stay informed, make any needed adjustments, and address any shifting needs for portfolio balance, a critical part of any robust stock picking guide and overall strategy. Review regularly to maintain optimal investment performance using a proper stock picking guide methodology.

12. Staying Disciplined & Patient – Important Factors within a Successful Stock Picking Guide

Success in any well-organized stock picking guide framework also hinges on the investor remaining focused and dedicated. Patience, diligent application, understanding the importance of time frames in market valuations, and consistent effort over time (within the bounds of an ethical stock picking guide strategy!) are essential characteristics. Avoid rash decision making. These are key aspects of any sound investment strategy based on a detailed stock picking guide methodology and proven approach to long-term investment principles.