stock picking effect

The Stock Picking Effect: Navigating the Labyrinth of Market Opportunities

The stock market, a dynamic arena of fluctuating values and unpredictable trends, presents both a fascinating and daunting challenge for investors. Unlocking consistent profitability often hinges on the delicate art of stock picking – selecting those promising companies that hold the potential for significant returns. This in-depth analysis explores the intricacies of stock picking, examining various strategies and approaches within the overarching concept of the stock picking effect. We will delve into understanding the fundamental elements influencing a company's stock price and how investors can harness the stock picking effect to achieve their financial objectives.

Understanding the Stock Picking Effect

Source: cloudfront.net

The stock picking effect is the observed phenomenon where investors, using a variety of strategies and techniques, identify and select stocks that subsequently outperform the broader market. This strategy depends critically on a profound understanding of how market forces, company performance, and investor psychology interplay, generating consistent stock picking effect benefits. However, it’s a double-edged sword. Success hinges on skillful selection, but consistent outperformance remains a significant challenge within the realm of the stock picking effect.

What is the essence of the stock picking effect?

At its core, the stock picking effect boils down to identifying companies poised for substantial growth and appreciation, thereby surpassing the overall market performance. The essence lies in deep analysis, thorough research, and a keen ability to forecast future market movements, which directly relate to the stock picking effect. The effectiveness of the stock picking effect is often closely tied to the quality of this prediction.

Why does the stock picking effect matter?

For those looking to exceed the passive returns provided by index funds, the stock picking effect becomes crucial. If consistently executed, this strategy can lead to greater accumulation of wealth. Mastering the stock picking effect involves rigorous research, in-depth understanding of individual companies, and adeptness at assessing the future prospects of different assets, emphasizing the vital role played by stock picking effect strategies.

Strategies for Stock Picking Success

Fundamental Analysis: Unveiling Intrinsic Value

Fundamental analysis is at the heart of many successful stock picking effect strategies. By examining a company’s financial health (revenue, profit margins, balance sheet strength), management, industry trends, and competitive landscape, investors can gauge its intrinsic value. This process helps one discern the stock picking effect within the realm of each stock.

Technical Analysis: Deciphering Market Patterns

Technical analysis utilizes charts and historical data to identify potential trends and patterns. Observing price movements, volume data, and support and resistance levels is key, understanding the influence that the stock picking effect exerts upon them. Recognizing patterns, although often employed by professionals within stock picking, could yield fruitful stock selection utilizing the stock picking effect.

Quantitative Analysis: Using Data for Enhanced Insights

Utilizing quantitative analysis alongside other strategies allows a thorough examination of the intricate workings of the stock picking effect. With this approach, advanced algorithms and computer-assisted data analysis can reveal previously hidden connections within the stock market and pinpoint the best investment choices through advanced modeling. These numerical inputs, integrated into investment analysis, enhance understanding and help pinpoint investment strategies that generate strong stock picking effect outcomes.

The Practical How-To of Stock Picking

Gathering Data: Sources of Accurate Insights

Accurate data is the bedrock of stock picking strategies that successfully generate the stock picking effect. Investors must rely on reputable financial sources to uncover insightful data points regarding potential investments. This aspect is fundamental within effective stock picking effect strategies. This approach provides strong potential to positively leverage the stock picking effect.

Applying Selection Criteria: Filters for Effective Picking

Source: slidesharecdn.com

Source: slideteam.net

Developing and applying unique selection criteria is essential to make your stock picking endeavors productive, strengthening the effects generated. Consider incorporating multiple factors – valuation ratios, growth prospects, and risk parameters. Understanding how these filters apply to specific investment contexts greatly enhances stock picking effectiveness. Incorporate factors aligned with the stock picking effect for maximized benefit.

Risk Management and Diversification: Maintaining Stock Picking Sustainability

Even with sophisticated strategies to cultivate the stock picking effect, a comprehensive strategy of diversification remains critical. Maintaining risk controls while capitalizing on the stock picking effect through a judicious allocation of capital is essential in building a robust and lasting investment portfolio. Implementing sound risk management approaches plays a crucial role within an efficient stock picking system that effectively applies the stock picking effect.

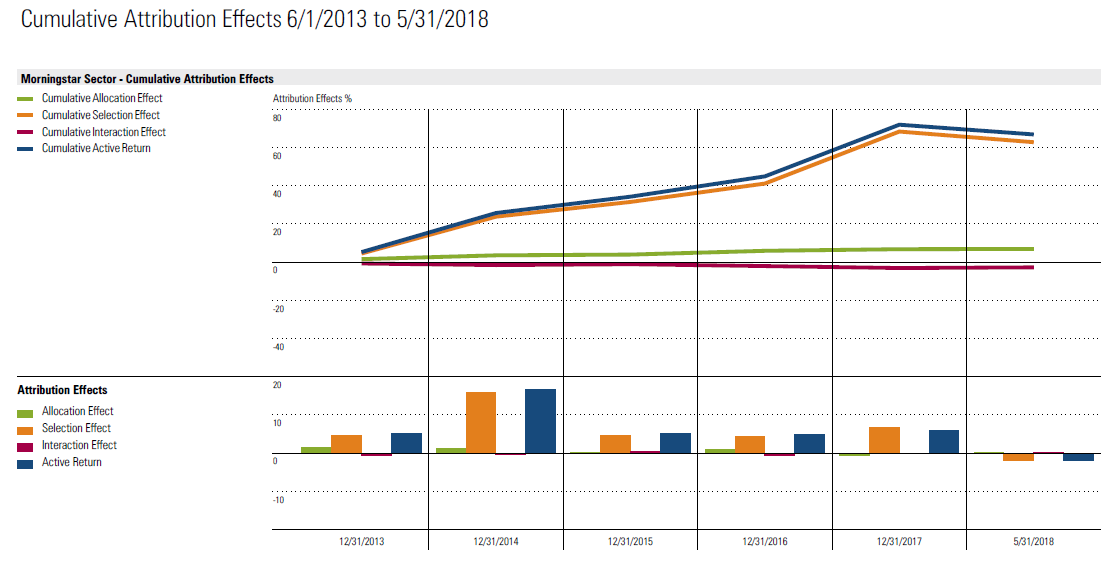

Evaluating Stock Picking Performance

Source: morningstar.in

Metrics for Measurement

Investors should utilize key metrics like return on investment (ROI) and time taken to reach goals to assess stock picking performance related to stock picking effect. These tools help demonstrate whether specific strategies successfully capitalized on market movements. This includes a comprehensive evaluation of metrics relative to the stock picking effect.

Monitoring Stock Movement Patterns

Continuously monitoring a stock’s movement is integral to maintaining the stock picking effect's positive returns and allows a timely reaction to shifting market conditions and signals related to the stock picking effect. This process aids in realizing the full benefits inherent within the stock picking effect.

Pitfalls and Limitations of Stock Picking

Emotional Trading and Behavioral Biases

One frequent cause of failure involves reacting to emotional triggers while applying the stock picking effect rather than calmly sticking to the planned investment strategies. The stock picking effect requires precise data-based decision-making, thereby avoiding emotion-driven stock selections. Avoiding emotion-based investment is critical within the context of stock picking strategies and leveraging the stock picking effect.

Source: twimg.com

Market Volatility and Uncertainty

Predicting market trends accurately can be challenging in times of great market instability and uncertainty. During unpredictable market scenarios, investors should adjust and reassess the stocks included in their portfolios while applying strategies influenced by the stock picking effect, given the challenging nature of predicting market movements within that effect.

The Future of Stock Picking Effect

Technological Advancement: Enhanced Stock Picking Assistance

Stock picking is continuously influenced by advanced technology, creating novel applications for understanding the market. Artificial intelligence, algorithms, and sophisticated analytical platforms allow sophisticated stock selection to strengthen the stock picking effect.

Adapting to Changing Market Conditions

As market dynamics shift, continuous adjustments within your stock picking strategies based on current conditions and the stock picking effect remain essential. Successfully navigating these changes plays a vital role in generating a favorable investment return by considering the impact of these trends on the stock picking effect. This adaptation ensures your strategies effectively harness the stock picking effect and are geared towards continued performance and profitability.

In conclusion, mastering the intricacies of stock picking – or realizing the full potential of the stock picking effect – requires thorough understanding of fundamental and technical aspects. Implementing sophisticated strategies while considering risk management principles can help cultivate effective portfolios by skillfully utilizing the stock picking effect. However, success involves understanding the inherent challenges of volatile markets and emotional investment decisions, reinforcing the complex nature of leveraging the stock picking effect to its full potential. The journey is about diligent research and well-structured methodology within the realm of stock picking to help capitalize upon potential through the stock picking effect.