stock picking criteria

Mastering Stock Picking Criteria: A Comprehensive Guide

Introduction

Stock picking criteria are the bedrock of successful investing. Understanding and meticulously applying these criteria can significantly impact your portfolio's performance. This comprehensive guide dives deep into various aspects of stock picking criteria, providing practical insights and actionable strategies.

Defining Your Stock Picking Criteria: A Personalized Approach

The first crucial step in stock picking success involves defining your unique stock picking criteria. These criteria are tailored to your individual investment goals, risk tolerance, and time horizon. What are your ideal return targets? How much risk are you comfortable taking?

Defining Your Risk Tolerance and Time Horizon

Understanding your risk tolerance and investment time horizon is critical to establishing effective stock picking criteria. An aggressive investor with a long time horizon may have different criteria than a cautious investor with a shorter-term goal. These individual assessments form the very core of your unique stock picking criteria.

Setting Realistic Investment Goals

Source: wisdomhatch.com

Clear financial goals are fundamental for the creation of solid stock picking criteria. Whether you're aiming to achieve retirement, fund education, or build wealth, aligning your stock picking criteria with your goals is key.

Key Elements of Robust Stock Picking Criteria

Strong stock picking criteria incorporate multiple factors.

Assessing Financial Health through Key Metrics

Solid financial health analysis is crucial. Examining factors like debt levels, profitability margins, cash flow, and revenue growth form a major part of well-defined stock picking criteria. Detailed financial analysis with key metrics is central to discerning successful stock picking criteria.

Analyzing Industry Trends and Competitive Landscape

Analyzing industry trends, competitive landscapes, and regulatory changes are important aspects of robust stock picking criteria. Understanding the evolving needs and pressures within specific industries ensures your investment aligns with current circumstances. This analysis directly informs effective stock picking criteria.

Evaluating Management Team Capabilities and Reputation

Source: moneywise.com

Experienced and reputable management teams are essential for a successful investment, adding considerable strength to your stock picking criteria. Assessing their past performance and long-term strategic vision are important aspects in robust stock picking criteria.

Fundamental Analysis Tools for Stock Picking Criteria

Fundamental analysis underpins many successful stock picking criteria.

Evaluating Earnings Growth and Consistency

Sustainable earnings growth, over a specific time period, is pivotal to strong stock picking criteria. The consistency of these growth patterns also strongly contributes to an informed and thorough assessment using stock picking criteria.

Evaluating Dividend Policies and Yield Potential

Many investors include dividend policies and potential yields as essential factors in their stock picking criteria. Consistent dividends and attractive yields significantly contribute to the effective deployment of stock picking criteria. The consistency in payment further underscores effective use of stock picking criteria in your stock selection methodology.

How To Use Valuation Metrics for Stock Picking Criteria

Comparing Valuation Ratios Across Companies

Comparing valuation ratios, such as price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) across companies in the same industry assists in effective stock picking criteria and informed investment decisions. Using a wide range of such valuation ratios across companies in the same industry bolsters your use of stock picking criteria for a more sophisticated approach.

Assessing Historical Valuation Trends for Consistency

Understanding how valuations have evolved historically aids in assessing long-term value. This consistent assessment provides another strong framework for developing effective stock picking criteria and making informed choices. Consistent assessment helps reinforce well-developed stock picking criteria.

How To Incorporate Technical Analysis into Stock Picking Criteria

Source: getmoneyrich.com

Charting and Pattern Recognition

Effective use of stock picking criteria often involves incorporating chart analysis methods and patterns to understand market sentiment. Proper use of stock picking criteria allows you to adapt to evolving conditions using such technical analyses. The effectiveness of your stock picking criteria also relies on your understanding of how this market reaction helps shape future price trends.

Identifying Support and Resistance Levels

Source: slidesharecdn.com

Key support and resistance levels provide important data for refined stock picking criteria and strategic market assessments. Developing a methodology for the identification of important support and resistance levels for optimal effectiveness using stock picking criteria.

Employing Quantitative Strategies in Stock Picking Criteria

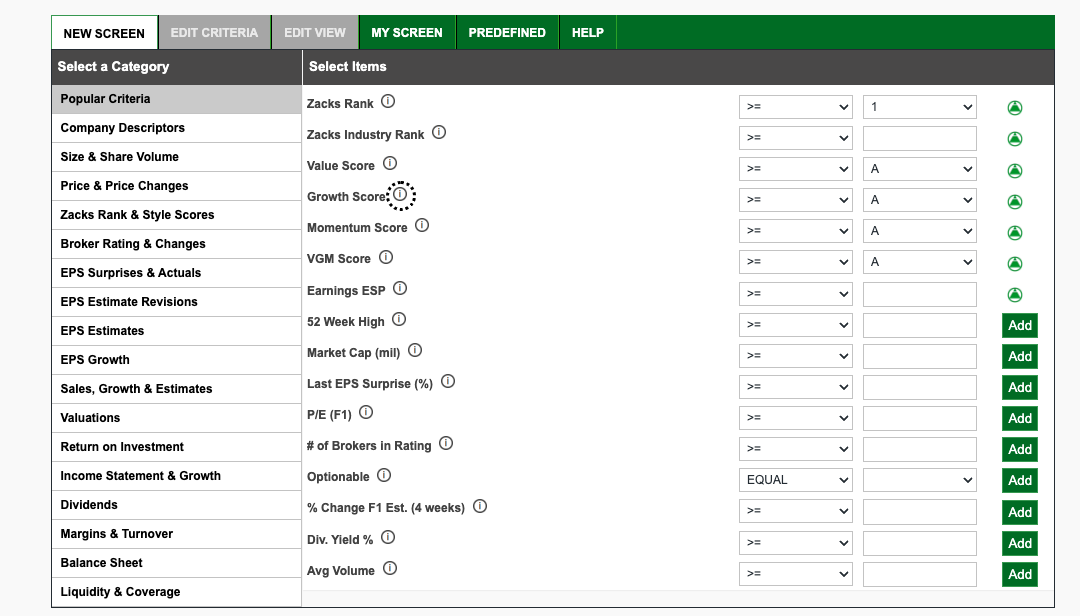

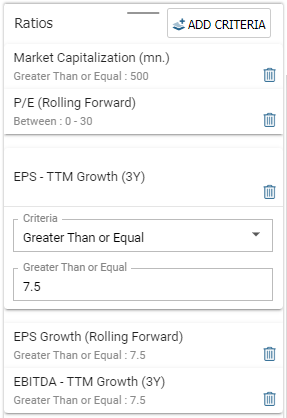

Filtering Stock Pools for Key Metrics

Source: equityrt.com

The judicious selection of key quantitative metrics plays an integral role in forming and enforcing effective stock picking criteria. Selecting and deploying appropriate quantitative stock picking criteria for the optimal portfolio design strengthens and reinforces the accuracy and robustness of the selected stock picking criteria.

Using Machine Learning to Predict Stock Performance

Employing machine learning approaches is becoming increasingly integrated into well-designed stock picking criteria. Machine learning and stock picking criteria support a stronger decision-making framework for predictive modelling to aid portfolio optimization. This integration, supported by informed stock picking criteria, potentially boosts return projections for effective long-term growth.

Diversification in Stock Picking Criteria

Risk Management through Portfolio Diversification

Diversification of a stock portfolio across diverse market segments, industries, and geographies ensures long-term robustness. Well-defined and robust stock picking criteria will have to incorporate the vital aspects of portfolio diversification.

The Importance of Asset Allocation in Stock Picking Criteria

Asset allocation provides balance for long-term strategies for a balanced investment plan, aligning closely with overall stock picking criteria. Robust stock picking criteria acknowledge the benefits of balanced and strategic asset allocation strategies.

Beyond the Basics of Stock Picking Criteria

Staying Updated with Economic Conditions and Market Sentiment

Keeping a keen eye on macroeconomic conditions and the shifting sentiments of the market is crucial for successful use of stock picking criteria. Stock picking criteria will benefit significantly by staying up-to-date on relevant changes and their overall implications. Real-time tracking ensures consistent refinement and effectiveness.

Monitoring and Re-evaluating Your Stock Picking Criteria

Maintaining regular monitoring and revisiting stock picking criteria for potential adjustments based on observed market trends and results from investments ensures effective portfolio alignment for maximizing ROI and risk management.