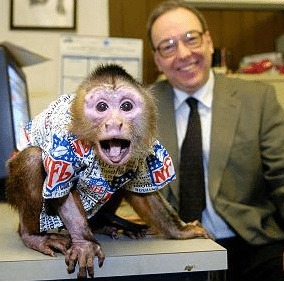

stock picking cat

The Stock Picking Cat: A Guide to Algorithmic Investment

A stock picking cat, armed with uncanny market instincts and a knack for sniffing out winning stocks, may seem like a fantasy. But what if this fantasy became reality? This article explores the innovative, yet fundamentally sound, principles of stock picking using a strategy informed by the "stock picking cat" analogy – a humorous lens to explore the often complex world of algorithmic investing. Let's delve into how a stock picking cat approach might help us identify lucrative investment opportunities.

Understanding the Stock Picking Cat Mindset

The "Sixth Sense" of the Stock Picking Cat

The "stock picking cat" metaphor embodies a blend of intuition and data analysis. A true stock picking cat wouldn't just rely on gut feeling; it would diligently observe market trends, price movements, and even news sentiment. Just like a discerning cat, a stock-picking strategy inspired by this analogy must possess acute awareness of the financial landscape.

Uncovering Hidden Market Patterns

Stock picking cats are renowned for spotting anomalies. These aren't merely about identifying significant news stories. A good stock picking cat method looks at subtleties, tiny market tremors that indicate possible future price shifts. The quest for these indicators – and using "stock picking cat" techniques – will allow for uncovering trends in undervalued stocks.

How to Feed Your Stock Picking Cat: Practical Steps

Gathering the Right Data – Fueling the Stock Picking Cat

Just like a cat needs nourishment, your stock-picking algorithm needs comprehensive data. This data feeds the insights and patterns your "stock picking cat" will learn from. We need price history, news sentiment, market volatility, sector performance…the list is substantial, but necessary for an accurate, data-driven approach. Collecting, cleaning, and standardizing the data is an important aspect of "stock picking cat" techniques.

Building a Data-Driven Stock Picking Cat Algorithm

Constructing an effective algorithm for your "stock picking cat" hinges on several key criteria. Your code, mimicking a discerning stock-picking cat, needs to isolate vital factors for success. The algorithm needs a well-defined input layer to digest financial information, identify and quantify "patterns" your stock picking cat is sensitive to. This data analysis component often includes algorithms and code to measure and adjust parameters for the system, such as time sensitivity, which makes your "stock picking cat" efficient. What if you had a stock-picking cat whose algorithm worked flawlessly to spot profitable trends?

Implementing Your Stock Picking Cat Strategy

Implementing your "stock picking cat" strategy requires vigilance. Track and monitor market developments; make modifications or refine the model based on recent outcomes. Stock picking cat strategies are not set in stone – they must adapt to the constant shifting landscape of the financial markets. Consistent observation is key, mirroring the proactive and intelligent hunting habits of your metaphorical stock picking cat.

The "Stock Picking Cat" Algorithm: Defining Criteria

Identifying Potential Stock Picking Opportunities

"Stock picking cat" insights often emerge in identifying opportunities. The strategy might focus on sectors undergoing substantial transformation or companies anticipating future revenue streams based on evolving trends. Think like a stock picking cat, not an armchair quarterback; focus on evidence, not hunches. This is paramount to implementing a solid, evidence-based stock picking cat method.

Assessing Risk – The Cat Knows its Limits!

As a successful stock picking cat strategist, you understand that each market has unique elements. Factors like volatility and the potential for financial loss must form a large component in your evaluation. What could be potential "risk avoidance" traps? An over-zealous stock picking cat might be seduced by easy returns, forgetting crucial safety aspects! Learning to understand and weigh these risks and rewards is crucial in crafting a resilient strategy and using stock picking cat techniques in a practical manner.

Evaluating Long-Term Growth Potential of a "Stock Picking Cat" Stock

Source: prosperitythinkers.com

Stock picking cat analysis includes forecasting long-term growth potential. Evaluating historical trends and predicting how companies can capitalize on market factors will ensure continued success using this type of analysis. Your stock picking cat has a plan!

Testing and Refining Your "Stock Picking Cat" Method

Source: alamy.com

Source: alamy.com

Validating Results: Tracking and Analysing Stock Picking Cat Performance

Your stock picking cat's performance requires tracking and testing to adjust your strategy effectively. "Stock picking cat" methodology benefits greatly from frequent performance checks, including calculating metrics such as return on investment and Sharpe ratio to evaluate results, adjust, and ensure that your methodology effectively matches your original goals.

Source: istockphoto.com

Optimizing the "Stock Picking Cat" for Success

Source: ghost.io

Identifying the "stock picking cat's" weaknesses and improving its strengths is essential. It involves testing various data inputs and adjustments, monitoring the stock picking cat's impact on your portfolio, and recalibrating if required. Using rigorous optimization approaches allows you to turn the theoretical stock picking cat strategy into an actively useful model for picking the most promising assets. Stock picking cat strategies must constantly be reviewed and evaluated!

Frequently Asked Questions About "Stock Picking Cat"

Can a "stock picking cat" ensure guaranteed returns?

No investment strategy can guarantee returns. The stock picking cat's success is in spotting favorable conditions and analyzing patterns – not providing certainty.

Is "stock picking cat" a passive investment?

No, the stock picking cat method generally demands vigilance. Active engagement is crucial in analyzing data, adapting to market movements and consistently refining the stock-picking algorithm.

Conclusion

Implementing a "stock picking cat" approach is far from straightforward. A "stock picking cat" method necessitates dedication, deep market research, and continuous adaptation to succeed in volatile markets. The more "stock picking cat" analysis you utilize, the more you'll appreciate and use the advantages this strategy provides! You have all the necessary building blocks to create an automated, strategic, and (we hope!) highly lucrative investing system. The success of your "stock picking cat" ultimately depends on its training, tools, and consistency of strategy. Remember the "stock picking cat" is a metaphor for an advanced analysis tool! Now go, you stock picking cat aficionados!