stock picking bottom-up

Stock Picking Bottom-Up: A Deep Dive into Value Investing

Stock picking bottom-up is a crucial strategy for investors looking to uncover hidden gems and potentially outperform the market. It involves meticulously analyzing individual companies rather than relying on broad market trends or economic forecasts. This approach allows for a deeper understanding of a company's financial health, competitive advantages, and future prospects. Mastering stock picking bottom-up can be challenging but rewarding, potentially leading to higher returns over time.

Understanding the Essence of Stock Picking Bottom-Up

What is Stock Picking Bottom-Up?

Stock picking bottom-up is a fundamental investment approach focused on identifying undervalued stocks through meticulous research of individual companies. Unlike top-down approaches which begin with broader market analysis, bottom-up starts at the company level. This in-depth research empowers investors to make informed decisions about stock value, even if market conditions look uncertain. Stock picking bottom-up offers the chance to capture alpha, but requires a substantial time commitment and rigorous analysis.

Why Choose Stock Picking Bottom-Up?

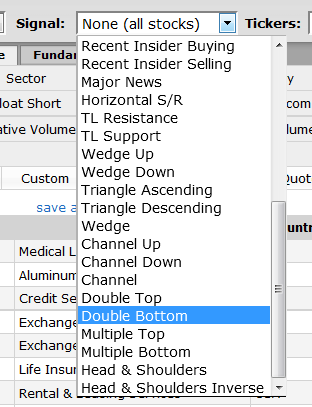

Source: simple-stock-trading.com

Why should investors consider the stock picking bottom-up method? It can potentially uncover gems that aren't easily detected by broad market indicators, leading to outsized returns. The ability to understand the nuances of an individual business allows for identification of long-term growth potentials often overlooked by others. A solid understanding of stock picking bottom-up principles often yields more meaningful returns for individual investors with well-developed due diligence processes. This also encourages focus and discipline in one's investment strategy, improving potential returns compared to broader market indexes and other investing styles.

How to Employ a Stock Picking Bottom-Up Strategy

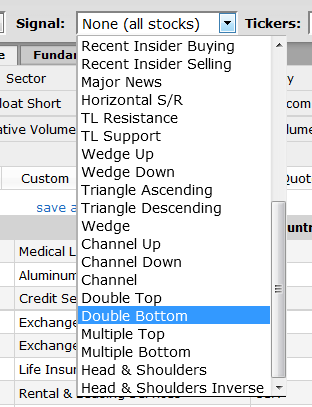

Source: financestrategists.com

1. Defining Your Investment Criteria

This is foundational to the stock picking bottom-up method. Develop a set of specific financial and qualitative criteria for the type of companies you're interested in. Be specific with your stock picking bottom-up benchmarks. Are you searching for growth companies, undervalued stalwarts, or disruptive tech ventures? Your unique stock picking bottom-up criteria should directly influence the companies that you consider. Define profitability, cash flow, market trends, or business models you expect.

2. Financial Statement Analysis – Deep Dive Into the Data

A critical step in stock picking bottom-up is thoroughly examining financial statements. Key ratios such as price-to-earnings (P/E), debt-to-equity, and return on equity, provide insight into the company's financial health. Understanding the company's profitability and its operational dynamics are essential to successful stock picking bottom-up decisions. You'll use these analyses as your stock picking bottom-up metrics, crucial to measuring valuation relative to your own investment targets. A careful review of balance sheets and income statements in your stock picking bottom-up work will inform your assessments of risk and opportunity.

3. Industry Analysis: Understanding the Competitive Landscape

An essential aspect of stock picking bottom-up is studying industry dynamics, particularly from the point of view of competitive advantage, technology, or shifts in consumer preference and trends. Companies excelling in a vibrant or growing sector are likely candidates in the bottom-up investment strategies. Understand trends to evaluate a company's future prospects by understanding the stock picking bottom-up potential of this business.

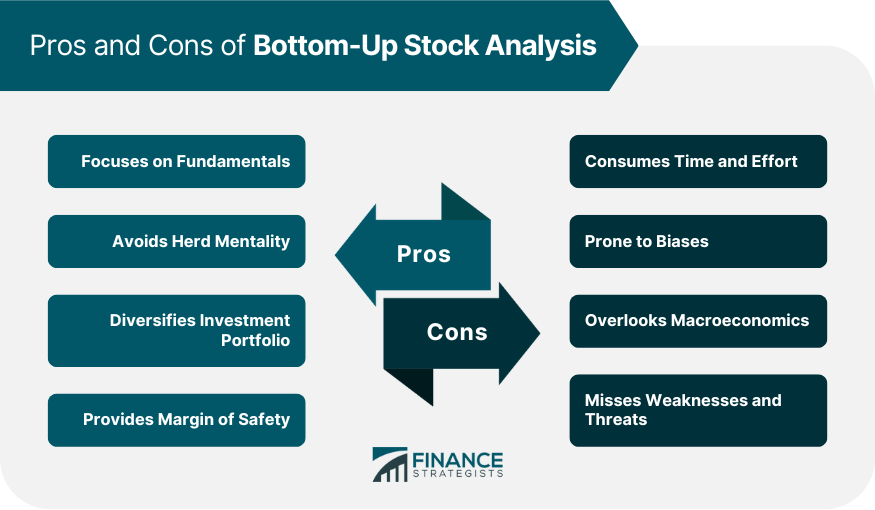

4. Quantitative Analysis Tools and Resources: Your Arsenal of Information

Modern tools provide access to essential data for the stock picking bottom-up method. Utilise tools and research platforms for gathering financial information. Knowing how to appropriately use these tools for your stock picking bottom-up analysis is important. Research software, analytical programs, or investor services can facilitate your bottom-up approach by offering quantitative benchmarks to evaluate the efficacy of your research from the perspective of a successful stock picker in using a bottom-up stock picking strategy.

5. Qualitative Factors – The Unseen Story

Source: alamy.com

Don't underestimate qualitative factors. Assess the company's leadership, business model, culture, competitive edge and resilience in an uncertain economy, customer relations, and innovative practices to have a more profound comprehension for the company from a stock picking bottom-up viewpoint. These aspects, often less tangible but vital for future prospects, are essential components in effective bottom-up analysis of stock valuations. A rigorous analysis in this dimension will distinguish an adequate from a brilliant bottom-up approach.

6. Developing Your Unique Stock Picking Bottom-Up Process

How can your bottom-up strategy work for your personal investment objectives and the financial circumstances that impact stock picking bottom-up outcomes? Your bottom-up approach to investment is as unique as your individual investor's goals. Stock picking bottom-up depends on adapting a robust methodology, creating checklists and documentation that match the strategy for this way of evaluating stocks to your expectations. Adjust this strategy according to how best to achieve long term financial goals using your stock picking bottom-up style.

7. Risk Management in Stock Picking Bottom-Up

Acknowledging the risks involved in bottom-up stock picking is crucial for successful investment decisions. Factor in unforeseen circumstances impacting profitability and growth potentials in the context of your bottom-up analysis and the strategy's ability to effectively handle uncertainty for optimal returns on investments.

8. Developing your Bottom-Up Model

Consider factors specific to different company valuations to guide your investments and formulate your own model. How to create models specifically focused on stocks using bottom-up principles? Having a specific structure, and the correct criteria for your evaluation from the bottom-up perspective, for the type of stocks that are evaluated, ensures consistency and integrity, critical components in bottom-up stock evaluation techniques.

9. The Importance of a Stock Picking Bottom-Up Framework

To facilitate disciplined decision-making and streamline your efforts in stock picking bottom-up, develop a strong stock selection framework. Consider industry comparisons and benchmarking analyses for your bottom-up evaluations, giving your stock selection strategy an organised approach when examining stock markets.

Source: slideplayer.com

10. Adapting the Strategy

What is needed to adapt and improve the stock picking bottom-up method to the rapidly changing economic conditions or competitive landscapes impacting the business model under consideration? Regular reviews, testing of assumptions, and modification of methodologies are integral parts of a successful stock picking bottom-up investment strategy for continuous optimization and long-term growth. A stock picker’s stock-picking bottom-up evaluation needs consistent evaluation from external criteria in the stock market, and from the specific sector.

11. Evaluating the Long-term Success of Your Strategy

Source: ytimg.com

Using metrics to evaluate bottom-up decisions and tracking overall performance are part of an established successful stock-picking bottom-up method. The consistent use of such mechanisms and measures, such as periodic reporting and re-evaluating results, will aid in continually enhancing stock selection decisions made from the bottom-up approach to investment.

Stock picking bottom-up is not a get-rich-quick scheme. Patience, diligent research, and continuous learning are paramount to the success of this method. It takes dedication and discipline in pursuing and establishing a sustainable bottom-up approach. Consistent stock-picking bottom-up is a long-term strategy that should be a core part of a diversified portfolio. With meticulous diligence, stock picking bottom-up might potentially yield greater returns compared to other investing methods. Finally, be wary that an appropriate time horizon for any particular bottom-up stock pick should be aligned with one's investment needs. A nuanced comprehension of individual stock evaluations is an intrinsic component of your stock-picking bottom-up method and style, important to building a well-structured, successful investment portfolio over time. This entire method hinges on proper stock picking bottom-up methods of selection in this bottom-up approach to picking individual stocks. And understanding the limitations of your current financial acumen relative to those necessary to pursue your specific investment aims related to successful stock picking bottom-up will be important for your long-term objectives. This careful investment analysis ensures investors utilize this method properly by considering all aspects from bottom-up, achieving appropriate balance and accuracy, necessary for developing effective strategies for stock selection through this particular approach and approach style of evaluating individual stock market outcomes from an objective point of view.