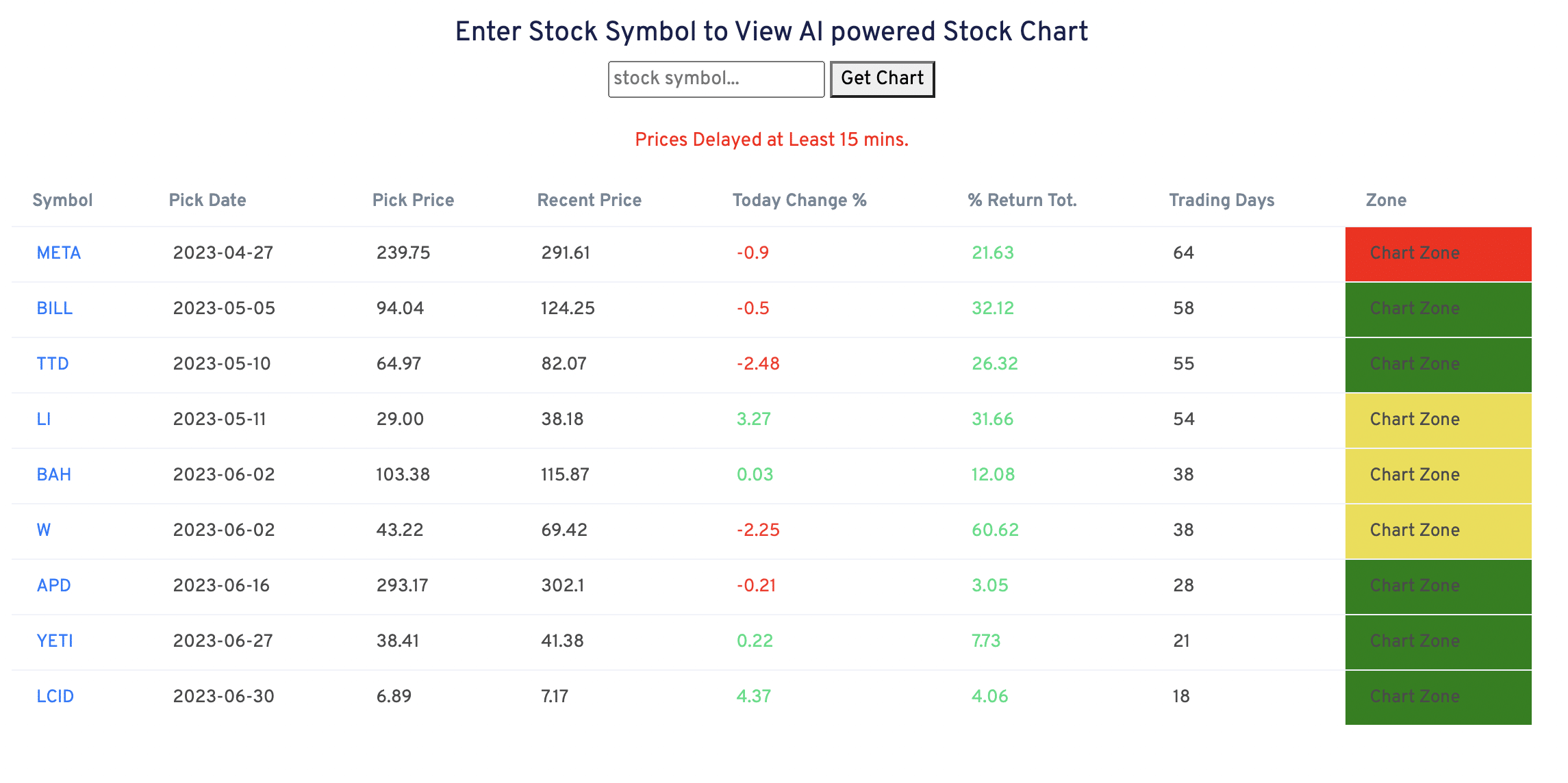

stock picker ai

Stock Picker AI: Revolutionizing Investment Strategies

Introduction

The world of finance is rapidly evolving, and Artificial Intelligence (AI) is playing a pivotal role in reshaping how we approach investment decisions. Stock picker AI, a specialized field leveraging algorithms and machine learning, is emerging as a powerful tool for identifying profitable investment opportunities. This article dives deep into the world of stock picker AI, exploring its capabilities, limitations, and potential applications for investors.

Understanding Stock Picker AI

What is Stock Picker AI?

Stock picker AI refers to the use of AI algorithms, machine learning models, and sophisticated data analysis techniques to identify undervalued stocks, assess market trends, and predict future stock performance. These AI tools sift through massive datasets of historical market data, company financials, news articles, and social media sentiment to inform their investment recommendations. A core component of stock picker AI is the meticulous analysis of financial metrics that provide insight into the health and future potential of a company.

How Stock Picker AI Works

:max_bytes(150000):strip_icc()/GettyImages-683440018-98739d0eea11429faee8c92a17047ebc.jpg)

Source: investopedia.com

Stock picker AI models typically use a combination of statistical analysis, machine learning techniques, and sophisticated financial modeling. They "learn" from historical data, recognizing patterns and correlations that can predict future stock prices. Some models are rule-based, relying on established financial criteria. Other stock picker AI methods employ complex algorithms such as deep learning neural networks. Regardless of approach, a robust stock picker AI system involves multiple layers of data scrubbing and preprocessing to eliminate noise and maximize accuracy. Stock picker AI platforms typically allow users to fine-tune their parameters to fit their individual investment styles and risk tolerance.

How Stock Picker AI Makes Investment Decisions

Data Ingestion and Processing

Central to stock picker AI is the efficient processing of enormous amounts of financial data, from public company filings to news articles. This often involves specific techniques to structure, normalize and clean data, providing consistent inputs for accurate analysis. These intricate data preprocessing stages underpin the robustness and predictive power of stock picker AI tools.

Pattern Recognition and Predictive Modeling

Stock picker AI employs sophisticated algorithms to discover patterns within data, uncovering factors linked to future stock price fluctuations. From trends in earnings reports to social media commentary on corporate announcements, these models synthesize diverse inputs. By carefully tracking indicators and predicting probable future changes in share prices, the stock picker AI system can pinpoint compelling investment strategies. Using statistical analysis techniques is crucial to these algorithms. Accurate stock picker AI performance rests on strong pattern recognition and sound predictive modeling.

Algorithmic Trading and Execution

Stock picker AI often goes beyond just identifying potential investment targets. Advanced applications allow integration with algorithmic trading systems that automatically execute buy and sell orders based on pre-defined strategies. This streamlined automated trading aspect represents the potential to improve efficiency and consistency.

Stock Picker AI and Different Investment Strategies

Value Investing with AI

Source: techopedia.com

AI-powered tools can greatly assist value investors by identifying undervalued companies and determining when and whether stock valuation diverges from fundamental metrics. Stock picker AI models can detect significant discrepancies and assist in predicting possible price movements based on data analyses. Stock picker AI analysis aids in investment decisions, ultimately improving ROI.

Growth Investing with AI

Stock picker AI has the potential to support growth investors by finding promising emerging companies exhibiting high growth potential. Analyzing various company performance and risk factors allows an improved strategy focused on long-term opportunities. These applications could provide value through in-depth investigations on new innovations. Stock picker AI provides an edge, as it scrutinizes vast amounts of market and publicly available information about promising companies.

Limitations and Ethical Considerations

Source: medium.com

Bias in Algorithms

Algorithms, though powerful, are susceptible to biases present within their training data. Historical market bias, like those involving underrepresentation or undervaluing sectors or companies from diverse backgrounds, are inherent issues requiring ongoing oversight and iterative algorithm adjustment to ensure unbiased results. Any deviation from objectivity needs investigation within the context of Stock Picker AI design.

Market Volatility and Uncertainty

Stock picker AI algorithms may struggle to handle unexpected events such as significant market shifts and unforeseen economic issues or other substantial fluctuations. Unexpected trends might deviate from historical performance trends used to train algorithms, leading to limitations and even poor or incorrect outcomes.

Data Privacy Concerns

While stock picker AI uses aggregated data, concerns around the use and privacy of financial data still exist. Regulations on privacy compliance and responsible AI usage must consider these challenges and safeguards to be proactive and to address this in stock picker AI design and execution.

How to Use Stock Picker AI

Setting Investment Goals

Define your investment objectives before selecting a stock picker AI solution to gain clarity. What are your risk tolerance and financial goals, such as growth rate or overall wealth creation over time? These critical factors provide direction for algorithm calibration in a Stock Picker AI system.

Choosing a Stock Picker AI Platform

Extensive research should be carried out on available stock picker AI tools, evaluating features, capabilities, cost, and compatibility with existing financial resources. Do due diligence and consider the support offered for customized strategy adjustments when employing stock picker AI systems.

Implementing a Strategy with Feedback Loops

The key to successfully leveraging stock picker AI is understanding the implementation and feedback processes for ongoing monitoring. Consider utilizing mechanisms to measure results, which would support real-time adjustment and rebalancing, so an effective stock picker AI system becomes dynamically adaptable to the ever-changing financial landscape.

Conclusion

Stock picker AI promises to revolutionize the investment process. By analyzing massive datasets, predicting market trends, and automating decision-making, stock picker AI holds significant potential for optimizing investment strategies and achieving long-term financial goals. However, it is critical to consider the inherent limitations, address any biases within data, and develop feedback loops. Using a stock picker AI system responsibly involves evaluating the strengths and limitations to obtain the greatest possible ROI and effectively leverage its potential for portfolio management success. Stock picker AI solutions can assist you in the best possible way, making them a valuable resource for investors at any experience level and in different financial situations. Stock picker AI has potential for portfolio expansion and future wealth building through intelligent decision-making and accurate identification of future stock prices in comparison with a strategy using human judgement. The future of investing is here—with stock picker AI.

FAQs about Stock Picker AI

Can stock picker AI replace human analysts?

Stock picker AI can assist but cannot completely replace human analysis. Humans retain the role of strategic decision-making, considering external factors and contextual information not typically captured in data sets for AI analysis, while leveraging tools like Stock Picker AI, which help in specific and streamlined tasks. An integrated approach remains critical.

What are the essential qualities of a quality stock picker AI?

Reliable data sourcing, transparent data input management, sound analytical models (i.e., machine learning accuracy and soundness), consistent validation/performance reporting mechanisms, and compatibility with other tools are vital in high-quality Stock Picker AI programs. These robust capabilities improve investment outcomes.

How to stay abreast of the ever-changing field of Stock Picker AI?

Continuously educating oneself about technological advancements, exploring new data insights and exploring the most appropriate investment models are necessary aspects of utilizing Stock Picker AI effectively. Exploring this field via various resources and staying updated is essential in order to effectively apply and learn from evolving stock picker AI models. Stock picker AI innovation often has ongoing impacts to investment strategies and potential investor profits.

How can investors benefit from this evolving stock picker AI innovation?

Source: futurecdn.net

This AI technology can help make investing easier and allow better ROI with more consistency compared to a strategy built solely on human judgement. Ultimately, it allows improved market insight for better outcomes.

Is Stock Picker AI a guaranteed method to always earn profits?

No, any stock picker AI program is not a guaranteed investment method; historical data analyses don’t ensure accurate forecasting of future returns in the financial markets, or guarantee high yields for investments. Markets fluctuate. However, Stock Picker AI can optimize portfolio allocation.