stock pick or etf

Stock Pick or ETF: Navigating the Investment Landscape

The world of investing is vast and complex. One of the most fundamental decisions investors face is choosing between stock picks and ETFs (Exchange Traded Funds). This article dives deep into the pros and cons of both strategies, providing a comprehensive guide to help you determine which approach aligns best with your financial goals and risk tolerance. Understanding "stock pick or ETF" is crucial for successful investment strategies.

Understanding Your Investment Objectives: Why "Stock Pick or ETF"?

Before diving into the specifics of stock picking versus ETF investing, it's crucial to define your financial goals. What are you hoping to achieve? Are you seeking aggressive growth or steady, consistent returns? What's your time horizon? Understanding the answer to "stock pick or ETF?" will dictate your decision. This understanding directly informs the approach you take with your investments. "Stock pick or ETF?" isn't a single-answer question, rather, a consideration contingent upon your financial position and your attitude toward investing in the financial markets. This process will help you determine the ideal answer to the central question: "stock pick or ETF?"

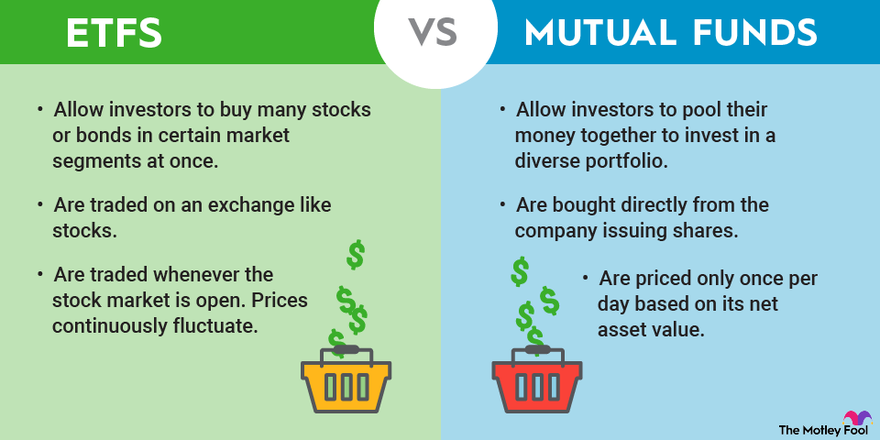

Diversification: Key in "Stock Pick or ETF" Decision

Source: foolcdn.com

One of the key factors when contemplating "stock pick or ETF" involves the concept of diversification. Picking individual stocks can be appealing for those with significant resources and sophisticated investing strategies. However, the potential for significant risk comes into play quickly. A carefully considered ETF approach will potentially yield far more stable investment growth through diversification. How diversified do you need to be? This question often defines whether you choose "stock pick or ETF". "Stock pick or ETF" selection is crucial when deciding whether you need diversification. A well-rounded portfolio might even incorporate elements of both "stock pick or ETF". "Stock pick or ETF"? This will depend heavily on the situation.

Active Management vs. Passive Investing: Key "Stock Pick or ETF" Distinction

Stock picking demands active management. You'll need to research, analyze, and evaluate companies and assess market trends, then buy, hold, or sell assets to optimize investment yield. This necessitates extensive knowledge and market acumen, leading some to favor "stock pick or ETF". ETFs, on the other hand, offer a more passive investment strategy. They track a particular market index, often providing cost-effective diversification across multiple assets. In the choice of "stock pick or ETF," the approach to investing becomes critical. Which method, "stock pick or ETF," provides the greatest opportunity to minimize financial risk? Active versus passive investment choices influence which strategy suits you better regarding the "stock pick or ETF" matter.

.png?width=1600&height=900&name=Difference Between ETF and Mutual Fund A Comprehensive Guide (1).png)

Source: winvesta.in

Cost Considerations: A Critical Factor in "Stock Pick or ETF"

"Stock pick or ETF" decisions frequently hinge on the costs associated with each investment approach. Actively managing stock portfolios requires brokerage commissions, research expenses, and potentially additional fees, adding significantly to overall costs. ETFs are more cost-effective with potentially significantly lower expense ratios. Weigh the "stock pick or ETF" strategies concerning costs and possible returns on investment before reaching a decision. How will costs affect your ability to maintain capital for longer periods? The cost component of "stock pick or ETF" decisions significantly alters overall growth and stability in your investments.

Risk Tolerance: A Key Determinant for "Stock Pick or ETF" Decisions

Source: retirebeforedad.com

Risk tolerance plays a major role in the choice between "stock pick or ETF." Stock picking, often characterized by concentrated positions in individual assets, can have higher levels of associated risks, compared to ETFs' more diversified approach. Before jumping to "stock pick or ETF," acknowledge how risk factors and potential loss might affect the overall return on your investment, because that choice ultimately dictates your risk tolerance when dealing with "stock pick or ETF"

How to Choose Stocks: The Stock-Picker's Guide

For those inclined to take on the challenge of stock picking, meticulous research is key. Consider these steps when determining if "stock pick or ETF" is your best strategy:

- Define your investment criteria: Determine the criteria (e.g., industry, company size, financials, market trends).

- Analyze potential companies: Conduct due diligence, studying financial statements, news reports, and industry analyses.

- Build your stock portfolio: Gradually incorporate companies aligned with your strategy into a diverse investment portfolio.

- Regularly assess your stock portfolio: Ensure your holdings align with your goals. Monitor your stocks actively to reassess and adjust your positions on a frequent schedule. Incorporating these points and adjusting when you consider switching from a stock pick to an ETF are integral to the selection process and your successful approach to your investing strategies when asking the question, "stock pick or ETF".

How to Invest in ETFs: A Simple Guide

Choosing the right ETFs depends upon your specific investment goals, taking into account your choices within "stock pick or ETF."

- Identify your asset allocation needs: Establish clear financial goals for achieving success.

- Select appropriate ETFs: Carefully examine potential ETFs to ensure the underlying index aligns with your strategic approach for choosing your financial instruments within "stock pick or ETF".

- Execute your ETF investment: Buy shares of ETFs via your brokerage account.

- Regularly evaluate your ETF holdings: Rebalance, realign, and re-evaluate investments to stay on track for investment goals when selecting a choice from within the category of "stock pick or ETF" .

:max_bytes(150000):strip_icc()/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Source: thebalancemoney.com

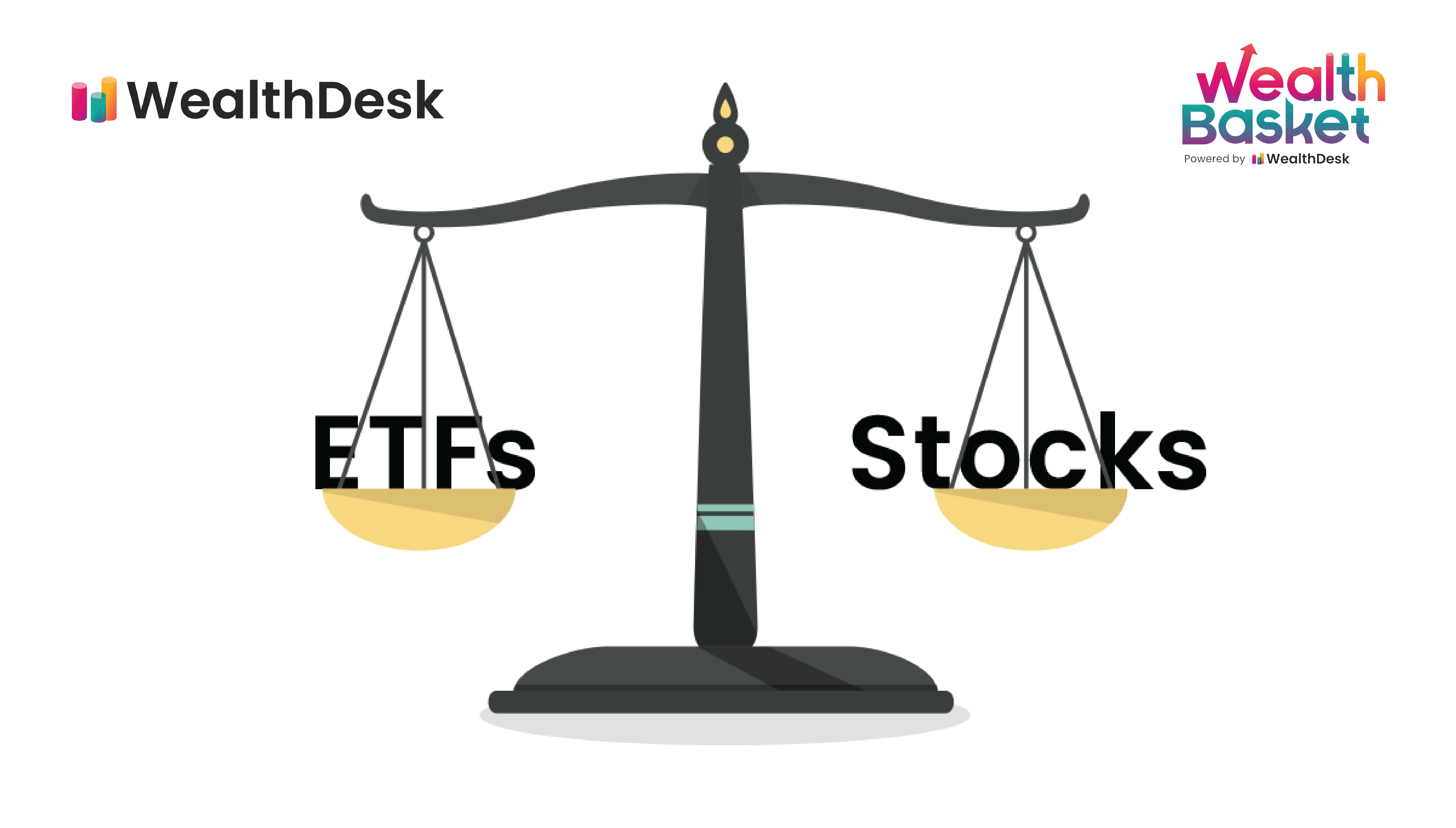

Assessing Investment Horizon: Impact on "Stock Pick or ETF"

Source: wealthdesk.in

The investment timeline is another crucial determinant when you examine "stock pick or ETF". Long-term investors can tolerate potential volatility, thus increasing the opportunity for gains that stock-picking provides over extended periods. Investors with short time horizons might opt for ETF-based strategies to manage risk associated with stock-picking choices. "Stock pick or ETF"? Does this match your overall timeline and projected returns?

Considering Market Conditions and Future Expectations When Evaluating "Stock Pick or ETF"

"Stock pick or ETF" choices vary with broader economic and market conditions. Consider macroeconomic forces impacting each option. A bear market might alter an investment's outlook.

Final Thoughts on "Stock Pick or ETF"

Choosing between stock picking and ETFs isn't a one-size-fits-all solution. Thoroughly analyze your personal financial situation, investment objectives, risk tolerance, and time horizon to arrive at the best choice in considering "stock pick or ETF". Both stock picking and ETFs have the potential for rewards and risks, so conduct due diligence, stay informed about your chosen financial instruments and the markets you are investing in. This will help in your pursuit to select the right approach to investment with the "stock pick or ETF" strategy that's right for you. Ultimately, you should consult with a financial advisor if needed. Remember the importance of "stock pick or ETF" within your investment strategy and the implications it might have.