stock picking or index funds

Stock Picking or Index Funds: A Deep Dive into Investment Strategies

Source: retirebeforedad.com

The age-old debate: stock picking or index funds? Choosing the right investment strategy can be daunting, especially in the turbulent world of finance. This article will explore the complexities of both approaches, helping you determine which might be the best fit for your financial goals and risk tolerance. Ultimately, the answer will inevitably come down to whether stock picking or index funds align best with your circumstances.

1. Understanding the Fundamentals: Stock Picking vs. Index Funds

Stock picking and index funds represent two fundamentally different approaches to investing in the stock market. Stock picking involves actively selecting individual stocks that you believe will outperform the market. Index funds, conversely, track a specific market index, such as the S&P 500, providing broad market exposure. Both approaches have potential advantages and disadvantages that impact your potential investment outcome. The heart of the choice – stock picking or index funds – boils down to personal preferences.

2. The Intricacies of Stock Picking: Why Some Succeed and Why Most Don't

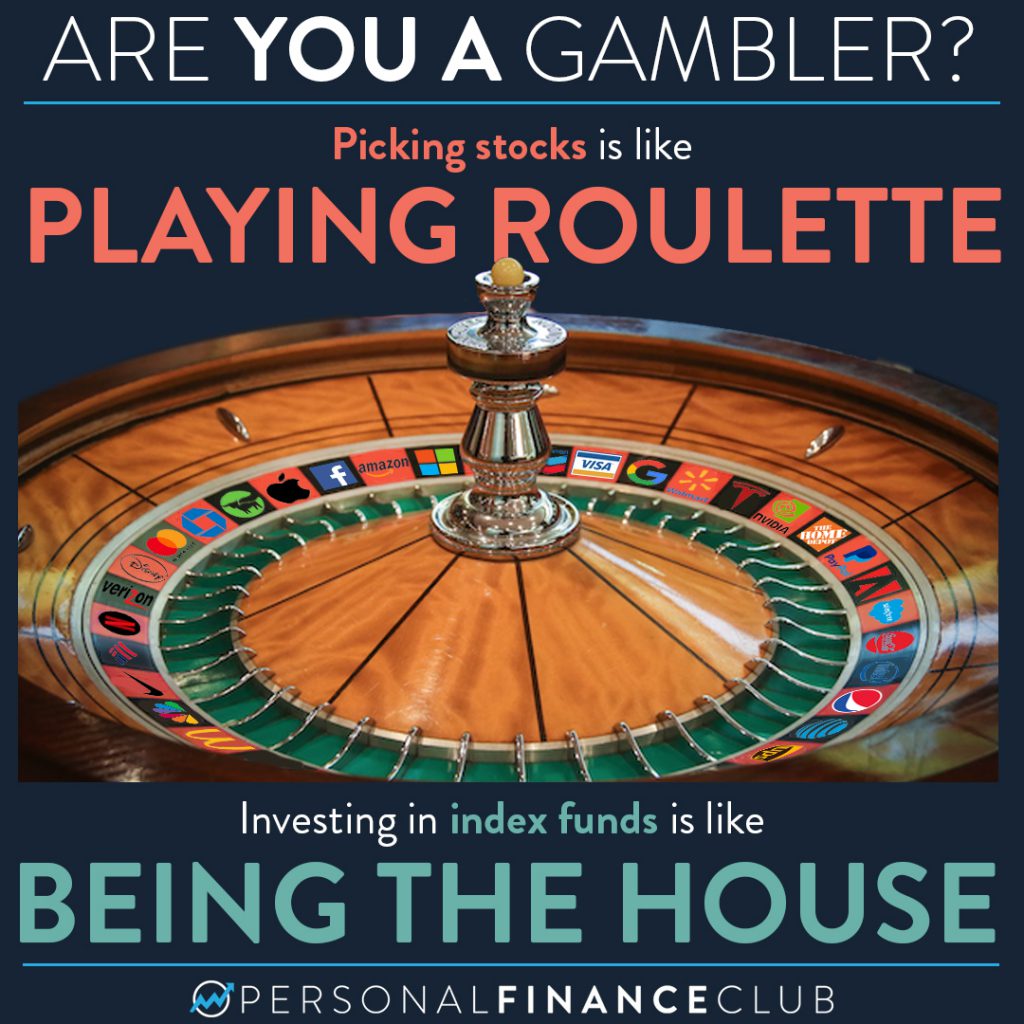

Stock picking, while potentially rewarding for those who succeed, presents substantial challenges. Identifying truly undervalued assets amidst market volatility is an uphill battle for all but the most seasoned investors. Stock picking or index funds: which path are you prepared to embark on? A major element in successful stock picking rests on impeccable research and analytical skills. Often overlooked is a deep understanding of your own capabilities and the willingness to dedicate the necessary resources to diligent stock research – something you might lack in a typical index fund scenario. Can you genuinely dedicate time and effort into comprehending stocks and picking them wisely?

Source: personalfinanceclub.com

How to Approach Stock Picking Effectively

- Thorough Research: Deep dive into financial statements, industry trends, and competitor analyses.

- Identifying Undervalued Assets: Focus on companies whose current price is significantly lower than their perceived intrinsic value.

- Risk Management: Diversify your portfolio and adopt stop-loss strategies. Stock picking or index funds: it's all about evaluating risk, no matter which side of this investment argument you take.

- Consistency: Evaluate investment performance regularly to ensure alignment with long-term goals.

3. The Power of Index Funds: Passivity vs. Performance

Index funds offer a passive approach to investing, effectively diversifying your portfolio across many companies in a specific market segment. Passive investors who prefer not to personally undertake individual stock analysis might prefer the automatic and steady nature of an index fund, whether for stock picking or index funds. With index funds, your investment gains and losses often correlate with market trends. This seemingly easy route often generates impressive results through time, an important distinction from more intensive approaches like stock picking or index funds for novices. In contrast to the intensive analysis inherent in the stock picking strategy, passive approaches like those with index funds can prove easier for individuals without deep market knowledge and understanding.

How to Invest in Index Funds Effectively

- Choose a reputable provider: Evaluate historical performance and management fees.

- Select the right index: Consider factors such as your risk tolerance and investment horizon. Stock picking or index funds – these are your initial considerations as an investor.

- Rebalance your portfolio regularly: This strategy maintains the fund's intended portfolio allocation.

Source: kuvera.in

4. Risk Tolerance and Your Investment Horizon: A Critical Evaluation of Stock Picking vs. Index Funds

Your risk tolerance plays a pivotal role in your stock-picking-versus-index-funds choice. High-risk, high-reward investments often come with the potential for more significant losses; these stock-picking opportunities often entice many investors for their return, making stock picking a tempting option. Conversely, index funds usually fall within a lower-risk category and present more stability, something particularly attractive when risk mitigation matters. Stock picking or index funds is ultimately a very personal financial question. Consider what impact this could have on your day to day life!

5. Understanding the Impact of Taxes

Tax implications are another vital consideration when deciding between stock picking and index funds, which have often become a preferred solution for risk aversion. Tax advantages can make or break certain stock-picking and index-fund scenarios, further reinforcing the decision about stock picking or index funds.

6. Active vs. Passive Investing Styles and the Relevance to Stock Picking or Index Funds

How you define success and which model matches your style – active stock picking or passive index funds—should play a key role. This article examines these styles, considering their distinct implications when assessing stock picking or index funds.

7. Diversification in Both Approaches

Proper diversification is critical in any investment strategy, whether stock picking or index funds. It mitigates risk and improves overall investment performance. How to diversify within these approaches warrants careful consideration for evaluating stock picking or index funds for your specific goals.

Source: ytimg.com

8. Fees and Expenses: Unveiling Hidden Costs in Stock Picking and Index Funds

Scrutinize management fees and expenses when comparing stock picking or index funds. These costs can significantly eat into investment returns over the long term. Understanding your fee structure when examining stock picking versus index funds is crucial.

9. The Importance of Emotional Control in Stock Picking or Index Funds

Impulsivity can derail investment success, both with active stock picking and passive index funds. Learn to maintain discipline, stick to your financial plans, and invest accordingly in both approaches of stock picking or index funds.

10. The Role of Professional Guidance in Selecting the Right Investment: Stock Picking or Index Funds?

Financial advisors can help you align investment strategies, such as the choices between stock picking or index funds, with your individual goals and circumstances. Professional guidance should be considered when evaluating the potential results of stock picking or index funds for long-term success.

11. Evaluating Historical Performance & Trends in Stock Picking or Index Funds

Studying past performance of investment models for stock picking or index funds is insightful for future forecasting; be aware of potential pitfalls.

12. The Long-Term Vision of Stock Picking vs. Index Funds and Making the Best Choice: What Is Right For You?

Choosing between stock picking and index funds is highly personal. Carefully weigh your individual circumstances—risk tolerance, time commitment, investment knowledge, and more. Consider all the options to ultimately choose stock picking or index funds that best align with your financial future. The final decision for stock picking or index funds is deeply rooted in personal investment decisions, with profound long-term effects!