stock picking machine learning

Stock Picking Machine Learning: A Deep Dive

Source: slideplayer.com

Stock picking is a notoriously challenging endeavor, requiring an in-depth understanding of market dynamics, company financials, and economic trends. However, advancements in machine learning (ML) are providing powerful tools to potentially enhance stock selection processes. This article explores the intricate world of stock picking machine learning, detailing its applications, benefits, and pitfalls.

1. Introduction to Stock Picking Machine Learning

Stock picking machine learning utilizes algorithms and models trained on historical financial data to identify potential investment opportunities. These algorithms learn patterns and relationships within the data, potentially forecasting future stock performance and assisting in selecting promising stocks. The core concept behind stock picking machine learning revolves around using algorithms to objectively evaluate factors impacting stock prices beyond traditional human intuition. This form of stock picking machine learning strives to uncover patterns that might be missed by even the most astute analysts.

2. Understanding the Data Landscape

A robust stock picking machine learning system demands high-quality data. This encompasses historical stock prices, fundamental financial data (e.g., revenue, earnings, balance sheet), news sentiment, macroeconomic indicators, and more. The challenge lies in aggregating this data effectively, managing inconsistencies, and ensuring the dataset accurately represents the investment universe you're considering for stock picking machine learning. Gathering relevant data for stock picking machine learning can often be an arduous process, necessitating extensive data cleaning and feature engineering techniques.

3. Feature Engineering for Stock Picking Machine Learning Models

Feature engineering is the process of creating new variables from existing data to enhance model performance in stock picking machine learning. This stage crucially involves transforming raw data into meaningful inputs for machine learning algorithms. For instance, extracting moving averages or calculating volatility indicators transforms data that the algorithms may easily interpret. A successful stock picking machine learning system often hinges on these engineered features capturing essential aspects that humans would have to diligently evaluate otherwise.

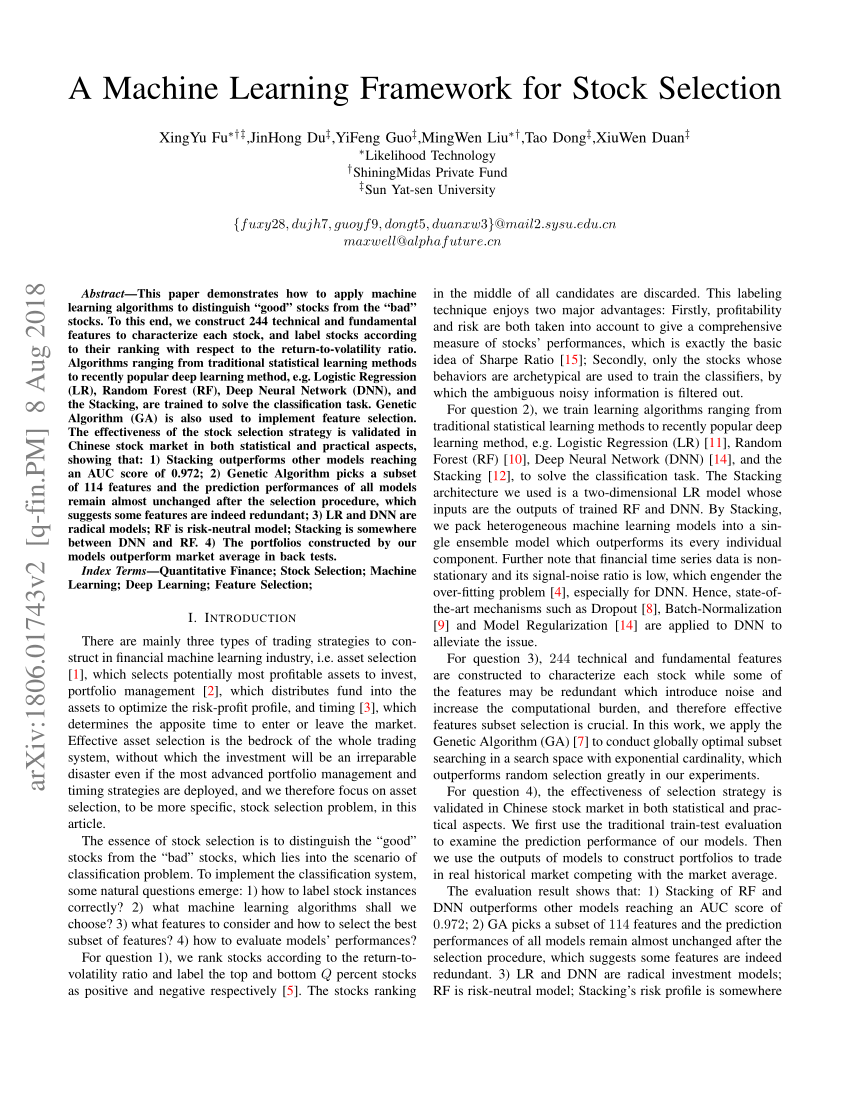

4. Different Machine Learning Models in Stock Picking Machine Learning

Various machine learning models, like Support Vector Machines (SVMs), Random Forests, and Recurrent Neural Networks (RNNs), are applicable to stock picking machine learning. Each model has unique strengths and weaknesses regarding different types of investment strategies for stock picking machine learning. For instance, SVMs might be well-suited to identify distinct classes or clusters of stocks, while RNNs could excel at learning temporal dependencies from time series data essential to stock picking machine learning. Different methodologies and their respective strengths in stock picking machine learning should be carefully considered when selecting the optimal approach.

Source: researchgate.net

5. How to Develop a Stock Picking Machine Learning Strategy

A robust stock picking machine learning approach necessitates meticulous planning. Define your investment objectives and risk tolerance and design a machine learning algorithm reflecting these criteria for your stock picking machine learning efforts. Choose relevant features and employ appropriate machine learning models suited to your strategy. Consider backtesting performance against a robust set of historical data, focusing on accuracy, return, and risk evaluation to refine and tune your model before application. The ultimate effectiveness of any stock picking machine learning system rests heavily on a well-developed methodology.

6. Assessing Model Accuracy for Stock Picking Machine Learning

Source: rgstatic.net

Validation is key for assessing a stock picking machine learning system. Divide your data into training, testing, and validation sets to ensure that model predictions accurately reflect unseen data and the stock market conditions. Measuring accuracy via precision and recall will allow the analysis of its potential for consistent stock selection. Backtesting is critical for stock picking machine learning – validating how well your algorithms perform using historical data in real-market scenarios. Evaluating different models across diverse backtests for stock picking machine learning is imperative.

Source: website-files.com

7. How to Implement a Stock Picking Machine Learning System

Implementation steps include deploying the chosen model to a production environment. This means choosing the appropriate infrastructure (cloud services like AWS, Azure, etc., and cloud-based solutions for deploying these machine learning models). This should also incorporate mechanisms to periodically retrain and refine the model.

8. Ethical Considerations in Stock Picking Machine Learning

Any use of stock picking machine learning involves potential biases present within the training data, a consideration not present in the past era of traditional stock picking techniques. Therefore, careful selection of diverse features from comprehensive and varied datasets helps. Transparency and clear accountability are essential as an organization relies more heavily on machine-derived insights for making important financial decisions about stock selection. It is imperative that one understands how stock picking machine learning works and acknowledges potential pitfalls related to its deployment.

Source: website-files.com

9. Risks of Relying on Stock Picking Machine Learning

Stock picking machine learning solutions are not a guaranteed recipe for financial success. ML algorithms rely on historical patterns, which may not accurately predict future stock market fluctuations, for stock selection strategies. It's essential to understand that stock market trends and volatility can shift considerably and cause previously identified stock patterns for stock picking machine learning strategies to no longer hold true. Diversification and a well-balanced portfolio are fundamental risk mitigation strategies in conjunction with machine-learning driven analysis.

10. How to Mitigate Risks

Thorough testing and validation with extensive and robust datasets form the foundation of mitigation for inherent risks related to any machine learning method. Stock picking machine learning is not a replacement for experienced investment analysis and understanding market conditions. Stock picking machine learning algorithms require appropriate safeguards, including clear performance metrics and a fallback strategy for managing deviations from anticipated returns and stock valuation metrics.

11. Staying Updated and Adapting

The field of stock picking machine learning evolves continually. Staying updated with the latest research, algorithms, and best practices is critical. The market and its features can shift with unforeseen circumstances. Adaptability is key for maximizing a stock picking machine learning methodology’s predictive abilities. Constant monitoring of changes in market conditions can provide an understanding for adjustments needed in the algorithms or data selection processes. Stock picking machine learning should remain dynamic and responsive to change.

12. Conclusion

Stock picking machine learning is a fascinating and powerful tool that offers substantial advantages in the investment space, especially for uncovering previously obscured trends. But it's equally important to understand its limitations and integrate machine learning into a broader investment strategy incorporating sound risk management practices. Continuous research and a focus on refining techniques for data extraction and integration remain central to ensuring sustained effectiveness in a ever-changing financial landscape, applying stock picking machine learning methodologies to ensure predictive capabilities are effective, valid and insightful for financial outcomes.