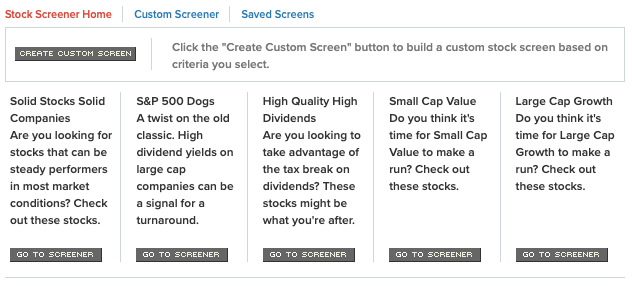

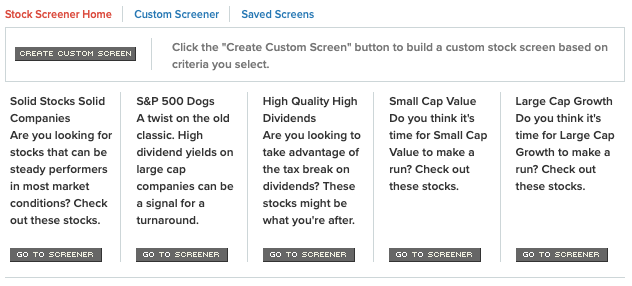

stock screener list

Uncovering Investment Opportunities: A Deep Dive into Stock Screener Lists

Finding the perfect investment opportunity can feel like searching for a needle in a haystack. With thousands of publicly traded companies, it's crucial to narrow your focus. This is where stock screener lists become invaluable tools. This comprehensive guide delves into the world of stock screener lists, providing actionable strategies to navigate the vast landscape of investment choices and build a winning portfolio.

What is a Stock Screener List?

Source: valuespreadsheet.com

A stock screener list is a curated selection of companies based on specific criteria defined by an individual investor or a financial platform. This targeted selection helps identify stocks that align with an investor's preferences and financial goals, effectively reducing the pool of options to explore further. The usefulness of stock screener lists is readily apparent for anyone looking for stocks within their targeted market sector and financial growth categories. Having access to this particular type of stock screener list will also aid in identifying the best overall stock positions within a certain industry. These tailored stock screener lists significantly increase the probability of discovering high-potential investments, optimizing an investment strategy that makes sense within a broad range of financial profiles. Stock screener list use has greatly increased since the rise of automated analysis in financial applications, highlighting the power and potential associated with stock screener list information in general.

How to Use Stock Screener Lists Effectively

Proper utilization of a stock screener list is essential. Employing specific filters and parameters on the stock screener list will bring your best choices into sharper focus.

Identifying Your Investment Criteria

This crucial first step in harnessing the power of a stock screener list revolves around meticulously identifying your personal investment criteria. Your individual preferences will determine the features required of a given stock screener list. Your ideal stocks should align with your risk tolerance and investment timeframe. For instance, if you prefer growth-oriented companies, your stock screener list filters should be heavily weighted on rapid growth and significant market cap potential. Are you more interested in dividend yields and dependable payout rates? Stock screener list options reflecting those objectives need to be included to maintain the highest level of stock optimization. Properly evaluating personal investing strategies in regards to risk-versus-return and profit margins. Careful selection from different stock screener lists and your preferences. Thorough screening from various stock screener lists ensures successful and profitable financial gains.

Defining Your Desired Return on Investment with Stock Screener Lists

Next, pinpoint the return expectations from stock positions identified within your stock screener lists. Clearly articulated ROI expectations are necessary for effective portfolio allocation decisions using this method. Define how long you are committed to holding a given stock to estimate a stock's financial success within your specified financial timeline. Determining how long an individual position may stay within an investor’s portfolio ensures clarity in terms of the best stock choices given the chosen period of financial retention of stock positions in a specific financial portfolio.

Applying Filters on Your Chosen Stock Screener Lists

Numerous stock screener lists provide comprehensive filters enabling an investment analysis, leading you down the optimal investment path. Carefully refine your stock screener list by using specific market cap ranges, price-to-earnings ratios (P/E), sector preferences, and more. Implementing the right selection criteria and applying precise filtering techniques within your stock screener list is key. Use market capitalization, industry sector, recent stock performance, earnings growth, and dividends to tailor your screening process from several stock screener list options, optimizing the outcome for your personal circumstances. Don't overlook specific technical and fundamental filters that may prove necessary. Stock screener lists may vary but carefully evaluate each. Thorough analysis with a suitable stock screener list enhances investment decisions. Using relevant criteria from stock screener lists allows the construction of a financially secure future.

Evaluating Company Fundamentals with a Stock Screener List

After narrowing your options using the stock screener list, deeply examine the fundamental financial characteristics of each remaining company on your screened list. Company performance reviews should consist of elements such as earnings statements, profitability trends, and balance sheets. Stock screener list options give insight into the long-term financial health of a stock or firm and allows for prudent market placement. Evaluate stock screener lists and compare for long-term financial insights that should further illuminate the companies on a potential investment stock list. Understanding your particular stock screener list characteristics and your individual investment profile enables a focused stock selection process that ultimately leads to informed financial decision making. Thorough and relevant analysis of these financial positions provided by the chosen stock screener list results in the best decisions for an optimal investment portfolio. This is why using stock screener lists can be quite beneficial for optimizing a robust investment profile.

Assessing Financial Performance with Stock Screener Lists

A thorough evaluation of a company's financial statements is essential before investing using a stock screener list. Stock profitability, debt levels, cash flow, and operating margins give useful signals. A robust understanding of market financial dynamics enhances the investment strategy created with your stock screener list selection. Stock screener list tools play a crucial role in selecting stocks that meet your investment criteria and goals. Use stock screener lists wisely. By analyzing stock profitability data from selected companies from your stock screener list, an analysis of the long-term value and possible gains on any stock will be clear.

Understanding Stock Market Trends Through a Stock Screener List

Source: lifetimeinvestor.com

Considering trends from several market stock screener lists and understanding those trends, identifying the right stock for an investor based on potential gain is critical. Identifying your preferred return rate and potential investment stock performance are relevant factors for investment success, given your desired financial outcomes. Employing your chosen stock screener list will aid in navigating those market movements. Market analysis plays an integral part of understanding short-term trends on selected stock listings. Carefully curated selection of stocks by employing these market trend evaluations will ensure the overall stability and resilience of your stock selections from chosen stock screener lists. Using specific insights from reliable stock screener lists allows more intelligent financial portfolio allocation choices. Understanding different market cycles that relate to each of the stocks on the generated list helps forecast successful outcomes.

Source: scanz.com

Source: redd.it

Considering Risk Tolerance and Investment Timeline Using a Stock Screener List

Your personal risk tolerance and the timeframe for your investments greatly influence the kind of stock investments within any selected stock screener lists. The degree of volatility and prospective rate of return determine the success or failure of your financial outcome and is reflected within any selected stock screener list you utilize. Understanding the risks involved using specific data provided by chosen stock screener list filters allows for proper stock selections and improved investment strategies to be implemented.

How to Find Stock Screener Lists

Numerous web-based platforms offer robust stock screener list options to cater to different investor preferences and various price ranges for access to the most desirable features. Thoroughly investigate which options provide the functionalities best suited for you. Stock screener list offerings vary significantly from site to site. Free, subscription-based, and premium offerings all present unique aspects related to their use for an investor's unique portfolio goals.

Source: storyblok.com

Staying Informed About Market Changes Using Your Chosen Stock Screener Lists

Market trends continually evolve, making ongoing market surveillance a necessity. Review and update stock screener lists to ensure alignment with any evolving conditions and relevant regulatory changes to gain further insight for portfolio diversification based on new criteria in stock performance and risk assessments. The analysis and updating of stock screener list data will keep an investor aware of the current financial climate in selected areas for appropriate adjustments for optimal risk management strategies. The effectiveness of a stock screener list is determined by a diligent process for continual monitoring of any notable market adjustments or potential changes. Continuous vigilance via selected stock screener lists is beneficial and critical.

Conclusion

Mastering the art of stock screening is about utilizing robust stock screener lists efficiently and adapting them to fit your ever-changing investment goals. Following the advice given here can result in the identification of excellent investment options using curated data and selected investment criteria that align well with individual investor profiles, ultimately aiding in constructing successful portfolios over time. Using stock screener lists strategically provides opportunities to maximize profitability and enhance overall return on investment outcomes.