stock screener klse

Unlocking Investment Opportunities: A Comprehensive Guide to Using a Stock Screener on the KLSE

Navigating the KLSE Landscape: Why a Stock Screener Matters

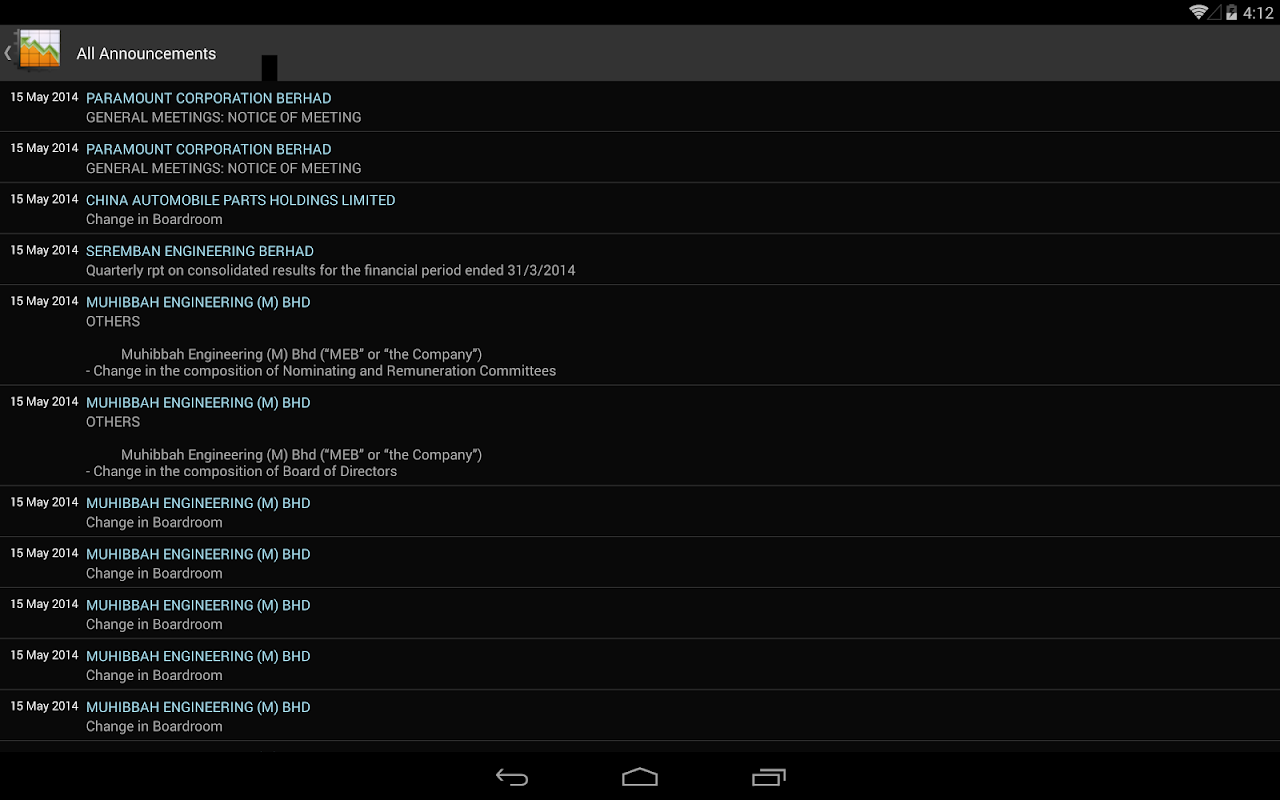

Source: aptoide.com

The Kuala Lumpur Stock Exchange (KLSE) boasts a diverse and dynamic market. Finding the right stock amidst the countless options can feel overwhelming. This is where a stock screener KLSE comes into play. A dedicated stock screener KLSE empowers you with the ability to sift through countless stocks, isolating those that align with your specific investment criteria. By identifying potential investments early, you increase your chances of success within the competitive KLSE arena. A solid understanding of using a stock screener KLSE is fundamental to intelligent investment strategies in today's market.

What is a Stock Screener KLSE, Anyway?

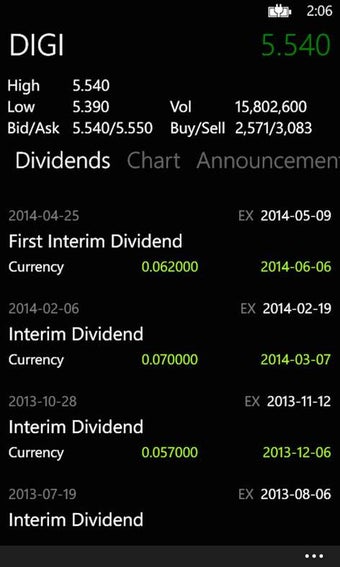

Source: dwncdn.net

A stock screener KLSE is a powerful tool for filtering stocks on the KLSE based on various pre-defined criteria. Think of it as a highly customizable search engine, letting you target specific companies meeting particular financial or operational profiles. These programs give investors the power to easily comb through a significant number of listed securities in order to focus on more promising targets and limit losses from poor or unwanted investments. A crucial function of a stock screener KLSE is this streamlined process.

How To: Setting Up Your KLSE Stock Screener

Using a stock screener KLSE isn't rocket science. A basic workflow is straightforward:

- Choose a suitable stock screener KLSE platform – these can be readily available free trials and paid software packages

- Select the desired filter criteria on the platform's interface. These choices will define the type and range of assets and shares you target. These filtering methods will define a robust set of criteria for any stock market selection process within the KLSE stock market environment. A quality stock screener KLSE will grant full and easy control over your filtering and analysis processes for any type of stock or share investment you would want to evaluate.

Exploring the Abundant Filtering Options on a KLSE Stock Screener

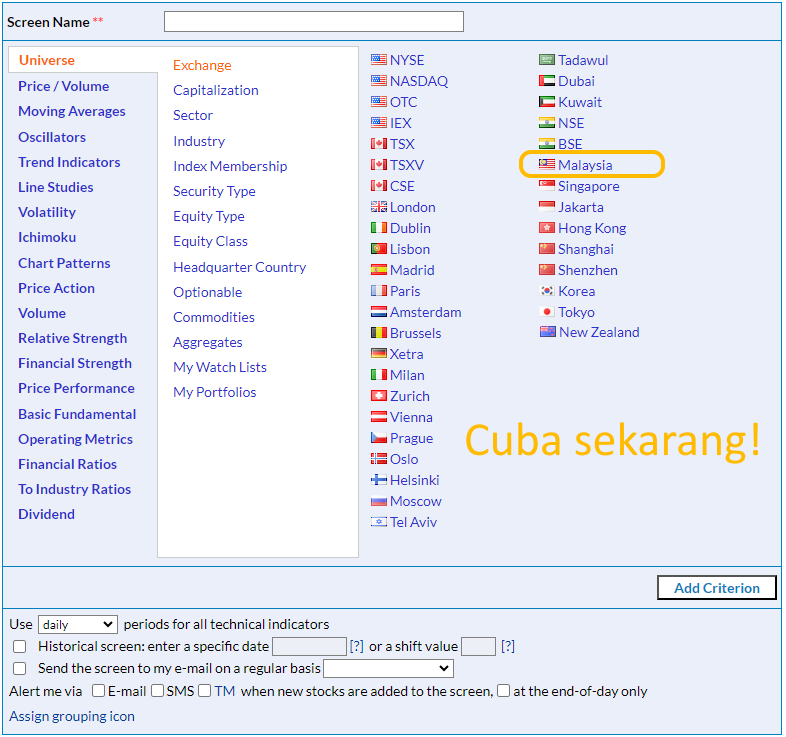

Now that you have selected a stock screener KLSE, let's delve into its potential. A typical platform will offer many avenues to sift and evaluate your prospective stocks for purchase within the Malaysian Stock Market. Filter categories might include:

- Market capitalization: Determining large-cap, mid-cap, or small-cap companies using the filtering capability available in the specific stock market environment provided by the stock screener KLSE.

- Price/Earnings (P/E) ratio: Screening companies that have reasonable valuations relative to profits.

- Dividend yield: Identify shares with attractive dividends, a core feature of using a stock screener KLSE to filter for investment objectives and portfolio diversification

- Revenue growth: Highlight companies exhibiting a clear upward trajectory. A strong stock screener KLSE tool will enable accurate evaluation and filtering.

- Profit margins: Selecting firms demonstrating solid profitability.

- Industry sectors: Targeting particular industries of interest like technology, healthcare, or finance in the stock market environments present via the stock screener KLSE.

These options in a well-designed stock screener KLSE can enable powerful analysis of various financial factors within your selections. A great stock screener KLSE will offer all these essential tools and functions to maximize stock market performance evaluation, filtration and investigation by an individual.

Essential Tips for Effective Use of KLSE Stock Screeners

Mastering your stock screener KLSE leads to more informed investment decisions. A proficient stock-market professional will typically combine quantitative metrics, with insightful qualitative analysis of various shares listed on KLSE using advanced stock screener KLSE methodology. Consider:

- Consistency: Implement a stock screener KLSE process consistently. This creates valuable comparative data between investments using your tool.

- Regular monitoring: Re-evaluate your criteria to fit evolving market conditions. Regularly use and refresh your investment metrics, stock and market valuations and parameters for your personal stock screener KLSE implementation. This feature is crucial in active stock portfolio evaluation, management, monitoring and development via your specific stock evaluation programs for use.

- Combination of filters: Using a single, specific investment filter might create unforeseen limitations on market share exposure. Don't ignore diversifying investment risk exposure parameters as crucial for a solid overall investment portfolio that will provide lasting stability. Combining multiple filters through the methodology you prefer within a stock screener KLSE platform greatly broadens market coverage opportunities.

Evaluating Company Fundamentals with the Stock Screener KLSE

Source: marketinout.com

A stock screener KLSE is valuable for fundamental analysis of individual shares. Understanding financial reports, market performance and forecasts, are crucial elements you need in a strong stock screener KLSE tool. Scrutinize company balance sheets, income statements and cash flows, crucial steps in the research of particular investments available on a stock screener KLSE

Source: dreamstime.com

Staying Updated with KLSE Market News

A quality stock screener KLSE might help you follow current news affecting the companies on your list. Use these insights, alongside other tools, for informed trading using the stock screener KLSE to inform investment considerations on KLSE listings.

Are Stock Screeners the Ultimate Solution?

While powerful, stock screeners KLSE aren't a substitute for extensive due diligence. These tools aid research. Remember to perform deeper analyses. Stock screening serves as a good starting point.

How To: Using Historical Data within the Stock Screener KLSE

The KLSE boasts substantial historical data accessible through effective stock screener KLSE methods and functions. Scrutinize past stock price performance (key part of your stock selection process).

Look at trends with suitable stock screener KLSE functions, to better define possible investing paths for individual and portfolio building purposes. Evaluate factors including overall economic conditions and potential investor reaction, which might not fully be reflected in your stock screener KLSE analysis. This can provide a more robust investment plan, along with improved potential returns using well chosen and validated stock screener KLSE options for individual and corporate stock portfolio evaluation, selection and evaluation. This is essential in maximizing future returns within KLSE's stock market environments and trends, as well as providing comprehensive insight for robust financial growth opportunities for individuals. This also allows you to gain full utilization of powerful data manipulation and application tools from the very robust and helpful tools provided by suitable and highly effective stock screener KLSE platforms and functions.

Can Stock Screeners Help you avoid common errors?

Yes, a proper stock screener KLSE should ideally minimize common investor mistakes. Your tools allow analysis of past patterns or significant company characteristics, providing helpful guidelines to minimize investor losses when evaluating your intended investment strategies. A key value from the stock screener KLSE is it helps avoid overpaying and other misjudgments made when investment selections aren't carefully thought-out and considered.

Conclusion: Embracing the Power of Stock Screeners on the KLSE

The KLSE's diverse investment universe requires structured methods to navigate successfully. Using an appropriate and suitably configured stock screener KLSE empowers investors to systematically filter their selections. You gain a greater chance of successfully evaluating and determining potential future earnings on each possible KLSE investment selection. Properly utilized, your stock screener KLSE becomes a robust decision-making tool for future success within the Malaysian Stock market. This comprehensive exploration demonstrates the vital role that stock selection plays for investors using a dedicated stock screener KLSE. Remember that no investment strategy guarantees profitability, and these points and this material are simply to aid in investor exploration, not act as a sole definitive plan for investment actions, as only your research should form such a definitive actionable financial strategy.