stock pick in

Stock Pick In: A Deep Dive into Successful Investment Strategies

This article explores the intricate world of stock picking, offering a comprehensive guide for investors seeking to build wealth through insightful stock pick in strategies. We'll delve into crucial aspects, offering actionable advice and illuminating potential pitfalls. Understanding the nuances of stock pick in is essential for navigating the ever-shifting market landscape.

1. Introduction to Stock Pick In: Defining Your Investment Objectives

Stock pick in, in its most basic form, involves selecting individual stocks based on your belief that they will appreciate in value over time. This strategy necessitates thorough research, analysis, and a keen understanding of the financial markets. Before embarking on a stock pick in journey, ask yourself fundamental questions like:

- What are your financial goals? (e.g., retirement savings, down payment, etc.)

- How much risk are you willing to accept?

- What's your investment time horizon? (short-term, mid-term, long-term)

Clearly defining your objectives will form the bedrock of your stock pick in approach. A well-defined stock pick in process is paramount to achieving success.

2. Fundamental Analysis for Stock Pick In Success

Source: etimg.com

Fundamental analysis is crucial in stock pick in. It focuses on assessing the intrinsic value of a company by examining its financial health and performance. Key areas of investigation include:

- Financial statements (income statement, balance sheet, cash flow statement)

- Company management

- Industry trends and competitive landscape

- Economic factors

Mastering fundamental analysis is crucial to any stock pick in strategy. A detailed look at a company's fundamentals before investing is an essential aspect of smart stock pick in.

3. Technical Analysis for Informed Stock Pick In

Technical analysis aids in stock pick in by using charts and patterns to anticipate future price movements. Key elements of this stock pick in strategy include:

Technical analysis, when integrated with fundamental analysis, enhances stock pick in insights. You must consider the impact of both in a well-rounded stock pick in plan.

4. Evaluating Risk Tolerance and Portfolio Diversification for a Solid Stock Pick In

Notably, stock pick in comes with a certain degree of risk. Diversification in a stock pick in approach mitigates potential losses. Consider your comfort level and financial goals when devising your investment strategy and approach to stock pick in. Understanding risk factors will assist with your stock pick in strategy.

- Risk tolerance assessment: how much volatility can your portfolio handle?

- Portfolio diversification: allocating investments across different sectors and asset classes to balance risk and reduce vulnerability.

A thorough understanding of how to manage risk is part of any effective stock pick in approach. This includes thorough research before picking a stock, then maintaining an ongoing stock pick in overview.

5. How to Identify Stocks in the stock pick in process

Identifying potential investments can be quite complicated, with various paths for a sound stock pick in strategy. Methods for potential investment exploration include:

- Scrutinizing financial news and reports to learn about potential stocks

- Sifting through industry trends and evaluating sector projections

- Analyzing economic factors relevant to specific sectors or stocks

Research is at the heart of a thorough stock pick in method. Using the above guidelines when thinking through stock pick in selection methods ensures better odds for an excellent return on investment.

6. Implementing Your Stock Pick In Strategies Effectively

Execute your investment strategy by following a disciplined approach. Buy or sell decisions must be justified and tracked thoroughly in a sound stock pick in system. This includes:

- Monitoring stock performance regularly

- Adapting the strategy when necessary

- Utilizing stop-loss orders

A clear and structured execution plan ensures consistency in your stock pick in.

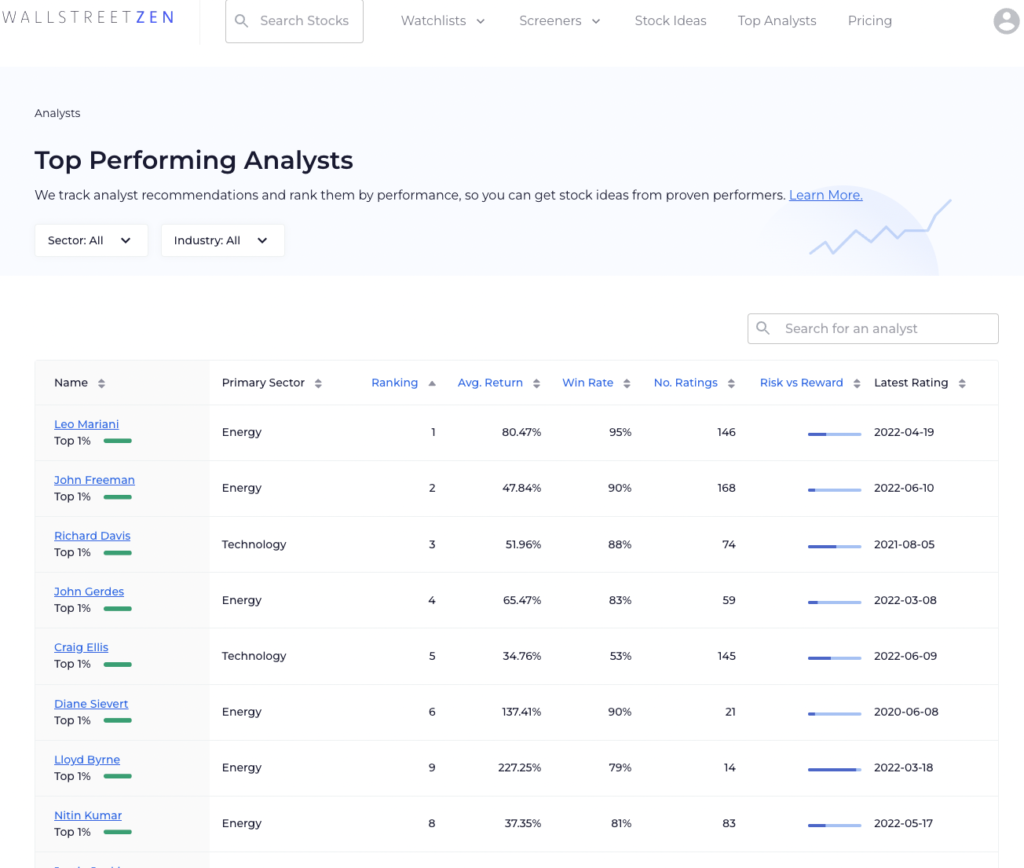

7. Navigating Market Volatility with Stock Pick In

Markets experience volatility, and adjusting your approach when the market changes will keep your stock pick in plan viable. Consider stock pick in strategies for both up and down markets. It will likely take different stock pick in choices based on how the market evolves.

Source: wallstreetzen.com

8. Learning from Past Stock Pick In Strategies (Lessons in Failures)

Evaluating prior mistakes will strengthen the ability of your future stock pick in efforts. Historical results of different investment methodologies can indicate possible improvements and mistakes that might appear again. Analyze any losses experienced to improve future stock pick in endeavors.

9. Ethical Considerations and Stock Pick In Due Diligence

Source: wallstreetzen.com

Conduct thorough due diligence. Do your research into financial regulations and follow industry best practices. Ethical investment practices are at the forefront of a thorough stock pick in system.

10. Stock Pick In – Utilizing Investment Tools and Resources

Numerous resources and tools are available to aid in stock pick in and general investment decision making. They can increase your knowledge of stock pick in analysis and investment planning.

- Online brokerage platforms

- Financial news websites and analysis

- Stock analysis tools

Use the right resources in the stock pick in approach to maximize investment knowledge.

11. Managing Stock Pick In Portfolio (Tax Implications)

Remember that tax implications must be part of your strategy to account for various implications across states, regions, and other political entities. Use tools that track taxes to prevent problems down the road and avoid stock pick in decisions that inadvertently incur a large financial penalty.

Source: howthemarketworks.com

12. Ongoing Stock Pick In Monitoring and Adjustments

Monitoring and updating your strategy is crucial. Continuously reviewing your chosen stock picks is integral. Evaluating your approach based on market shifts is an important stock pick in measure. A responsive strategy maximizes your profits with any potential new data, whether favorable or unfavorable.