stock screener gappers

Unveiling Hidden Opportunities: Deep Dive into Stock Screener Gappers

Stock screener gappers represent a fascinating niche within the stock market, offering potential for substantial returns for those willing to navigate the complexities. This article dives deep into the world of identifying and analyzing these gappers, providing a comprehensive guide to help you capitalize on these market movements.

Understanding Stock Screener Gappers: A Primer

Source: redd.it

Before we delve into the specifics of identifying and analyzing stock screener gappers, it's essential to understand the fundamental concept of gaps. A stock gap occurs when a stock's price opens at a level significantly different from its previous closing price, indicating a sudden surge or drop in investor sentiment. These price gaps are often accompanied by significant news or events, creating exciting opportunities for profit.

Source: techjockey.com

How Gaps are Formed: Market Psychology in Action

Stock screener gappers are created by large-scale shifts in investor behavior, and can be driven by various triggers such as positive earnings announcements, unexpected industry developments, major financial news releases or social media chatter . These events cause rapid, sudden movements, thus creating noticeable gaps on stock charts. A stock screener can be crucial for locating such gappers.

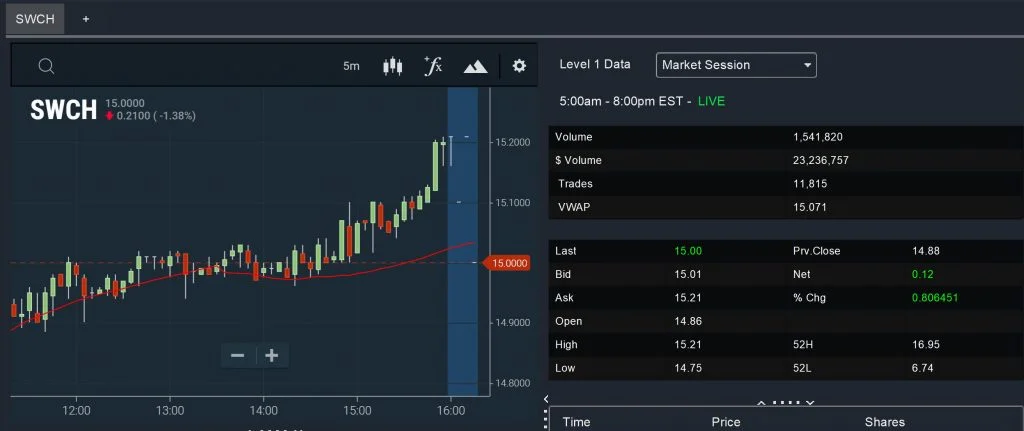

Essential Tools for Identifying Stock Screener Gappers: The Stock Screener Advantage

The use of a comprehensive stock screener tool becomes indispensable for sifting through the market noise and pinpointing stock screener gappers. These tools provide filtering capabilities allowing you to specify criteria such as gap size, industry sectors, trading volume, recent news items related to companies of interest and a variety of other essential data points.

Refining Your Search: Targeting Specific Stock Screener Gappers

A strong understanding of the financial world enables a more accurate filtration process using the various filters provided by stock screener gappers programs. For example, you can filter stocks that had their price gapped significantly but also consider other data, like company financial performance, industry trends and news sentiment, before considering investing. Mastering these filters can effectively reduce noise within your dataset of stock screener gappers to increase your chances of pinpointing profitable opportunities.

Source: scanz.com

Backtesting and Risk Management Strategies: Optimizing Your Results for Stock Screener Gappers

For any trading strategy using gapped stocks, essential risk management techniques are equally important as successful identification through a stock screener gappers program. You need to set a stop-loss order as an absolute bottom line defense to prevent drastic, unwanted price drops during unfavorable trading situations. Backtesting various strategies for trading stock screener gappers can help in quantifying returns in relation to risk tolerance, thus producing safer strategies and optimizing possible gains. This careful approach will significantly enhance your potential for profit when working with stock screener gappers.

Navigating Gaps: Identifying Bullish and Bearish Scenarios in Stock Screener Gappers

A deep dive into gap analysis involving stock screener gappers frequently involves carefully differentiating between bullish and bearish scenarios. Understanding the underlying motivations for the sudden movement (positive news versus negative news) in a gap context is a critical aspect. Careful attention is needed as stock screener gappers do not intrinsically define direction or quality and require substantial further investigation to interpret correctly.

Advanced Gap Identification Tactics with Stock Screener Gappers

Source: framerusercontent.com

Analyzing the volume during a stock screener gapper event offers vital clues for better interpretation. Comparing volumes across periods aids in deciphering strong trends by identifying whether current enthusiasm reflects a persistent force or just an anomaly and determining when there are larger underlying influences at work. This analysis should help refine choices involving stock screener gappers.

How To Use Technical Analysis With Stock Screener Gappers

Employing fundamental and technical analysis methodologies alongside stock screener gappers tools will be exceptionally beneficial. Examining supporting indicators will further clarify price movement interpretation within gaps. Examining factors that have generated such gaps will highlight a company’s ability to remain or become a positive player in the sector. Combining all of these perspectives regarding stock screener gappers with an enhanced understanding of the market will be incredibly beneficial to investors.

Staying Updated for Continued Success With Stock Screener Gappers

Navigating the dynamic nature of markets is of prime importance. Continuously updating information from reliable sources like financial news sites and company reports remains paramount in understanding evolving trends, influencing the dynamics related to your chosen stock screener gappers, enabling you to adapt your trading tactics accordingly. Understanding evolving sentiment will greatly enhance your strategy surrounding stock screener gappers.

Source: warriortrading.com

How To Evaluate and Select Profitable Stock Screener Gappers

Implementing effective investment strategy for specific stocks exhibiting a gapped trend requires specific evaluations regarding each asset that has opened above or below prior closing prices in question when filtering through a stock screener gappers application. The final result of this valuation method will help select the profitable opportunity with stock screener gappers and support trading efforts that rely on these criteria.

Conclusion: Gapping Opportunities in Stock Screener Software

Understanding stock screener gappers is crucial for any aspiring trader aiming to identify compelling opportunities. Through combined technical and fundamental analysis using specific stock screener gappers software solutions, one can approach the task systematically to produce results. While potential exists, proper diligence, continuous learning, and risk management practices should still be rigorously enforced within this stock market context to guarantee profits using stock screener gappers. Remember, investing involves risk, and no investment strategy guarantees success.