stock screener ema crossover

Unveiling Opportunities: A Deep Dive into Stock Screener EMA Crossover Strategies

Introduction

The stock market, a dynamic arena driven by fluctuating investor sentiment and economic forces, presents countless opportunities for profit. A powerful tool in this pursuit is the stock screener EMA crossover strategy. This article will delve into the intricacies of this approach, outlining its principles, practical applications, and crucial considerations for success. Using a stock screener to identify EMA crossovers can help pinpoint promising trading setups. This exploration will guide you through the process of leveraging a stock screener for EMA crossover analysis.

Understanding Exponential Moving Averages (EMAs)

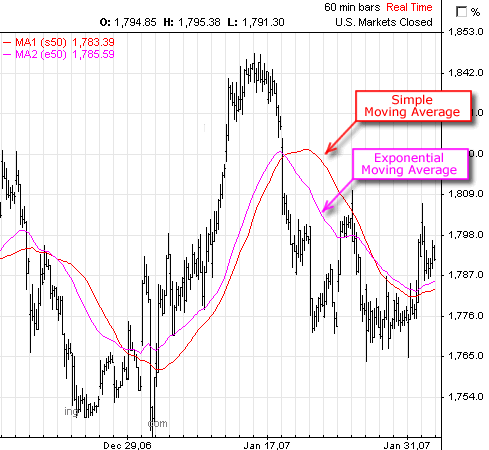

Source: marketvolume.com

Before delving into the intricacies of the stock screener EMA crossover, it's crucial to grasp the fundamental concept of Exponential Moving Averages (EMAs). EMAs are trend-following indicators that assign greater weight to recent prices, reflecting market sentiment and potential trends more effectively. A stock screener EMA crossover relies heavily on this interpretation. Your stock screener EMA crossover strategy hinges on understanding the specific characteristics and intricacies of each individual EMA you select.

How to Calculate EMAs

Different stock screener EMA crossover strategies will often favor different EMAs. Understanding how these indicators are derived is key to effectively navigating the stock screener EMA crossover analysis results. Software commonly offers calculation tools but manually tracking your findings is another potential strategy that allows deep focus.

What is an EMA Crossover?

Source: beehiiv.com

A stock screener EMA crossover occurs when one EMA line crosses another EMA line, typically either upwards or downwards. Analyzing this event is often crucial to your stock screener EMA crossover method and a core concept in market interpretation. Detecting these patterns can be beneficial in identifying periods of trend change in your analysis of potential market trends using a stock screener. Stock screener EMA crossover methods vary depending on the specific tool. Stock screener EMA crossover selection is crucial to establishing a robust trading strategy.

How to Identify EMA Crossovers with a Stock Screener

A stock screener EMA crossover is effectively utilized with the right tools. These crossovers provide strong insights into potentially changing market conditions, and their application for a stock screener EMA crossover relies on accurate interpretation, understanding, and proper use. This article dives deeper into the methods for identification to maximize their potential for profits in your trading.

Source: indzara.com

Identifying Short-Term and Long-Term Trends

Different time frames often drive short-term and long-term trends that could provide insight from using a stock screener EMA crossover. Your stock screener EMA crossover strategy will rely on this framework, enabling better trend interpretation. Selecting EMAs to track will also influence short and long term results.

The Importance of Chart Patterns in EMA Crossover Analysis

While EMAs alone provide insights for a stock screener EMA crossover, combining them with chart patterns is highly beneficial to understand trend strength and validation. The intersection of a stock screener EMA crossover signal with support and resistance levels can solidify the validity of an expected movement in a chosen security, significantly improving investment accuracy in the long run, by refining your potential trades with your stock screener EMA crossover analysis.

Using the Stock Screener EMA Crossover to Evaluate Entry and Exit Points

Implementing a robust exit strategy alongside the stock screener EMA crossover methodology can elevate the efficacy of this approach significantly. An accurate method will not only highlight appropriate buy opportunities but also clearly demarcate points to take your profits and sell securities in a trading scheme utilizing a stock screener EMA crossover analysis method. Identifying reliable stop-loss levels is critical to risk mitigation in any stock market scenario, and a proper understanding of these critical parameters using a stock screener EMA crossover, whether the cross-over was confirmed or not, will guide successful decisions.

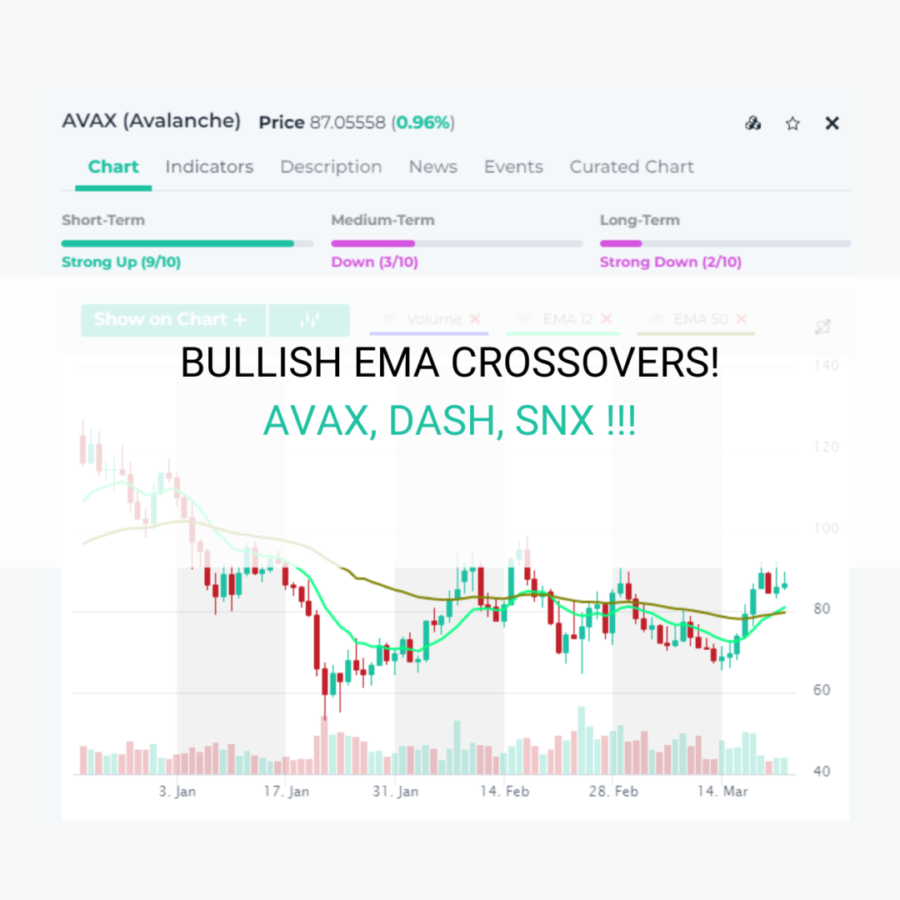

Source: altfins.com

How to Determine Appropriate Entry Points Using Your Stock Screener EMA Crossover

Executing your trading strategies accurately utilizing stock screener EMA crossover and a stop-loss order or similar measures requires a rigorous decision-making process, utilizing a well-planned strategy in your decision to execute trades. You should analyze a broad range of securities or use multiple stock screeners if necessary to implement appropriate trade entry rules. Implementing stop-loss and stop-gain procedures effectively prevents risk. A crucial factor to successful strategy construction within your analysis when using stock screeners to gauge EMA crossovers will hinge upon an understanding of risks and your acceptance threshold when conducting market analysis with a focus on crossovers to generate the best returns.

Considering Volatility and Risk in Stock Screener EMA Crossover Analysis

Volatility in the markets must always be evaluated in a methodology relying on stock screener EMA crossovers to produce positive trade results, due to volatility impacting market performance. High-risk sectors may produce larger losses even with careful monitoring from a stock screener utilizing EMA crossover analysis. Understandably, your evaluation requires significant effort and research, but assessing factors beyond the crossovers can safeguard a successful trading performance. Understanding the volatile nature of particular markets using the tools available within a stock screener utilizing the EMAs crossovers can enable adjustments and corrections on a trade analysis schedule that allows investors time to make critical adjustments. A high-quality stock screener is important in successfully identifying trends to ensure potential risk is managed effectively with a stock screener utilizing EMA crossover strategies.

Backtesting Your Stock Screener EMA Crossover Strategy

Source: stock-screener.org

An in-depth review of stock screener EMA crossover methodology may yield robust trading methodologies and high gains in particular time periods. To increase success and to effectively test any methodology you design, rigorous and thoughtful backtesting of the planned method before live trading can be paramount to profit accumulation. Your success using a stock screener for your EMA crossover will ultimately hinge on factors such as your selected timeframes for trend monitoring and the accuracy with which you understand how your choice of stock screener interacts with market changes as your criteria can change rapidly.

How to Properly Backtest Your EMA Crossover Strategy Using a Stock Screener

A systematic backtesting approach when using your chosen stock screener employing a stock screener EMA crossover method helps traders understand possible risks, gain awareness for pitfalls, and recognize opportunities they might have missed by utilizing proper methodology within a stock screener for identifying trade patterns using EMA crossovers. Careful review will allow accurate refinement to avoid possible losses in future transactions or unexpected market anomalies.

Conclusion

Stock screener EMA crossover analysis, while presenting potential for profit, is complex and necessitates careful consideration. Thorough understanding, risk management, and continuous monitoring remain vital components to success when utilizing your stock screener for EMA crossover identification. Backtesting, understanding trends, identifying profitable opportunities, determining accurate exit strategies are key parts of effective analysis for successfully trading and recognizing positive opportunities using a stock screener EMA crossover analysis methodology. This rigorous review when correctly performed, in combination with the selected methodologies using stock screener EMA crossovers will assist in ensuring that you create a trading schedule conducive to overall profitability while keeping appropriate caution of potential trade risks involved in such methodology.