stock screener buy sell signals

Unlocking Investment Opportunities: Mastering Stock Screener Buy/Sell Signals

Stock markets are a dynamic arena, offering investors both enticing possibilities and potential pitfalls. Navigating this complex landscape requires a keen understanding of market trends and informed decision-making. Stock screener buy/sell signals play a crucial role in this process. They act as a compass, guiding investors toward promising opportunities while helping them avoid potentially damaging positions. This comprehensive guide will explore the power of stock screener buy/sell signals and provide actionable insights.

Understanding Stock Screener Buy/Sell Signals

What are Stock Screener Buy/Sell Signals?

Stock screener buy/sell signals are automated alerts generated by software or algorithms based on pre-defined criteria. These signals help identify potential investment opportunities. Essentially, stock screener buy/sell signals try to automate the stock selection process.

Stock screener buy/sell signals, however, aren't a guarantee of profits. They are tools that offer suggestions for your trading strategy, and shouldn't be relied upon alone for investment decisions. They are useful as a secondary analysis method or one element in a robust investment framework.

Identifying Key Indicators Used in Stock Screener Buy/Sell Signals

Technical Indicators for Buy/Sell Signals

Many stock screener buy/sell signals rely on technical indicators, including moving averages, relative strength index (RSI), and support/resistance levels. Understanding these technical aspects within your chosen stock screener buy/sell signals system is critical. For example, a crossover of a 200-day moving average can be a positive signal with some stock screener buy/sell signals.

Fundamental Indicators in Stock Screener Buy/Sell Signals

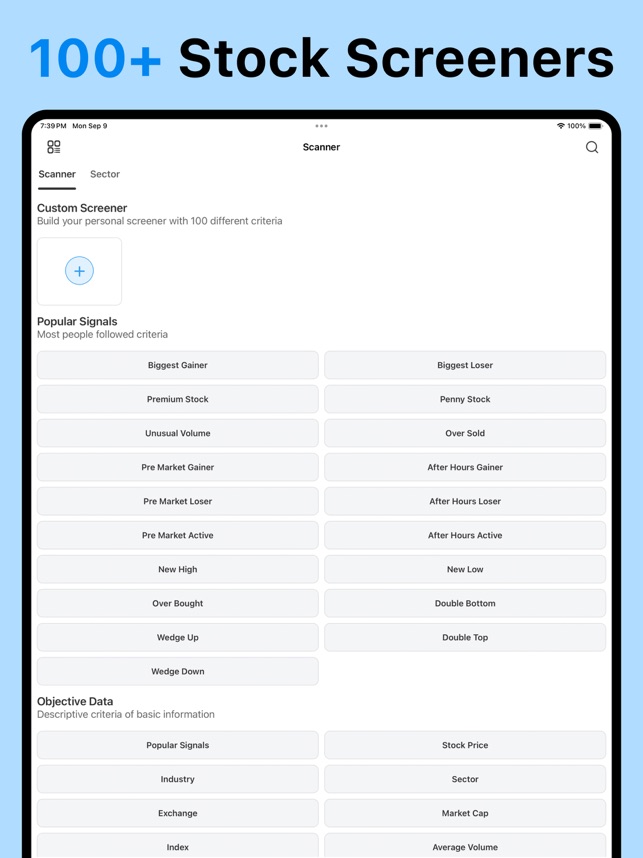

Source: mzstatic.com

Stock screener buy/sell signals also use fundamental indicators. Factors like price-to-earnings ratio, debt-to-equity ratio, and revenue growth often impact how certain algorithms interpret the current stock valuation as part of the buy sell signals you receive from your stock screener.

How to Use Stock Screener Buy/Sell Signals Effectively

Integrating Stock Screener Buy/Sell Signals into Your Investment Strategy

Stock screener buy/sell signals can supplement, but not replace, your comprehensive investment approach. Don't base all your buy or sell decisions on stock screener buy/sell signals alone! Carefully consider your personal financial goals, risk tolerance, and time horizon. These stock screener buy/sell signals are a component of a thorough strategy.

Assessing the Reliability of Your Chosen Stock Screener

Stock screener buy/sell signals vary significantly in accuracy and quality. Consider the specific criteria the screener uses and the historical performance of similar signals with the specific stock screener. Look for those providing insights into how their indicators performed across various market cycles or through market corrections in previous stock screener buy sell signals analysis.

Types of Stock Screener Buy/Sell Signals

Pattern Recognition Signals in Stock Screener Buy/Sell Signals

Many stock screeners highlight specific chart patterns like head-and-shoulders, double tops/bottoms that often lead to stock price action buy sell signals. Learn to recognize and utilize these insights when applying these particular stock screener buy sell signals into your decision making.

Source: tradingview.com

Algorithmic Signals based on predefined factors, in your stock screener buy sell signals

A plethora of signals derive from algorithms and specific criteria; stock screener buy sell signals leveraging such systems help you isolate the companies which best fit your goals within a given criteria of stocks. Stock screener buy sell signals like this allow for customization, allowing investors to align specific criteria with investment goals.

Crafting a Personalized Stock Screener Strategy

Creating Stock Screener Buy Sell Signals Filters

Crucial in a sound stock investment strategy; filter results by sector, market capitalization, volume, and other key stock screener criteria to precisely target potential stocks you're considering for a given stock screener buy/sell signals algorithm you've decided upon. Stock screener buy/sell signals can greatly improve investment processes, streamlining the choice criteria.

Source: tradingview.com

Backtesting and Validation of Stock Screener Strategies

Backtesting, applying your chosen stock screener buy/sell signals approach on historical stock data to assess past results and gauge possible future outcomes.

Using your stock screener buy sell signals effectively often requires adapting to certain market cycles to see its overall impact over extended market intervals. This provides a helpful gauge for evaluating how stock screener buy sell signals may perform, offering a valuable tool when selecting stocks based on given indicators and signals in a chosen stock screener strategy.

Key Considerations for Implementing Your Chosen Strategy

Source: media-amazon.com

Understanding Market Cycles in the Context of Stock Screener Signals

Stock screener buy/sell signals need to be utilized in the appropriate economic/market environment, taking note of important industry indicators for appropriate application and maximizing your opportunities for gains by using these stock screener buy sell signals as well.

Staying Updated with Market Conditions and Stock screener improvements

Keeping an eye on shifts in your market conditions, evaluating various types of signals. In turn, that evaluation can be made much more effective by using a well-designed stock screener, allowing investors to monitor signals to improve outcomes and maximizing use of stock screener buy/sell signals.

The Human Element: Risk Assessment and Portfolio Diversification

In any stock screener, you are bound to see buy/sell signals that match many of your characteristics you may desire as investors. Remember to critically think on a personal basis, taking your financial experience and knowledge into account for the best possible results of any particular stock screener buy/sell signals or trading strategy.

Conclusion

This deep dive into the world of stock screener buy/sell signals highlights their potential for enhancing your investment journey. While not a magic bullet, implementing these tools correctly into a broader, balanced strategy can provide significant advantages. These insights in applying a wide array of indicators of various market data can lead you down the best paths possible using your desired stock screener buy/sell signals method. This leads to efficient execution in the stock market, providing an effective framework that leads to sound financial goals when implementing any particular stock screener buy/sell signals systems you chose. Employ your strategy carefully to gain greater success.