stock screener ai

Unveiling the Power of Stock Screener AI: A Comprehensive Guide

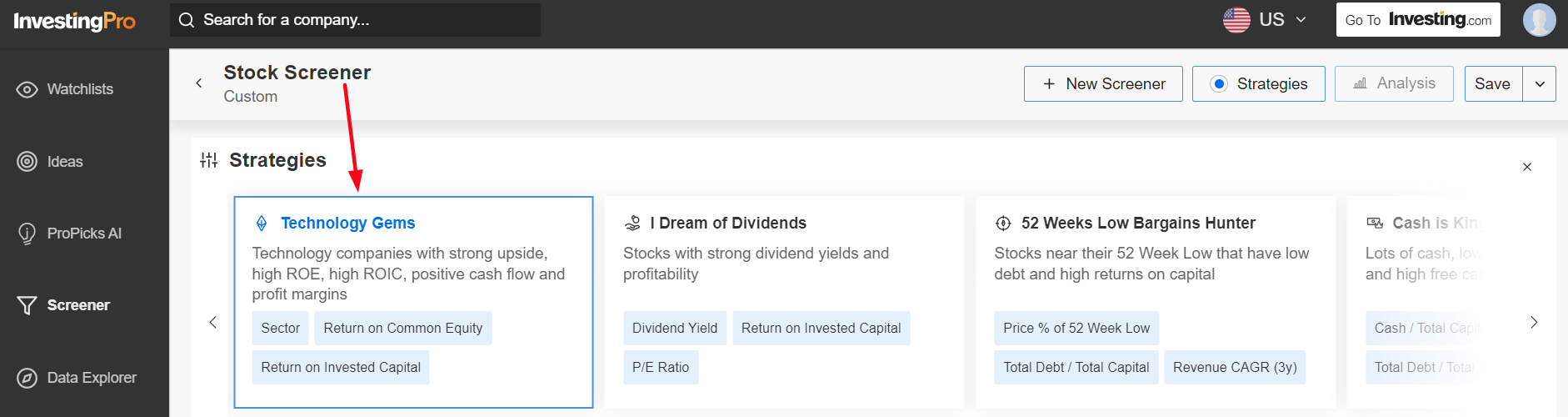

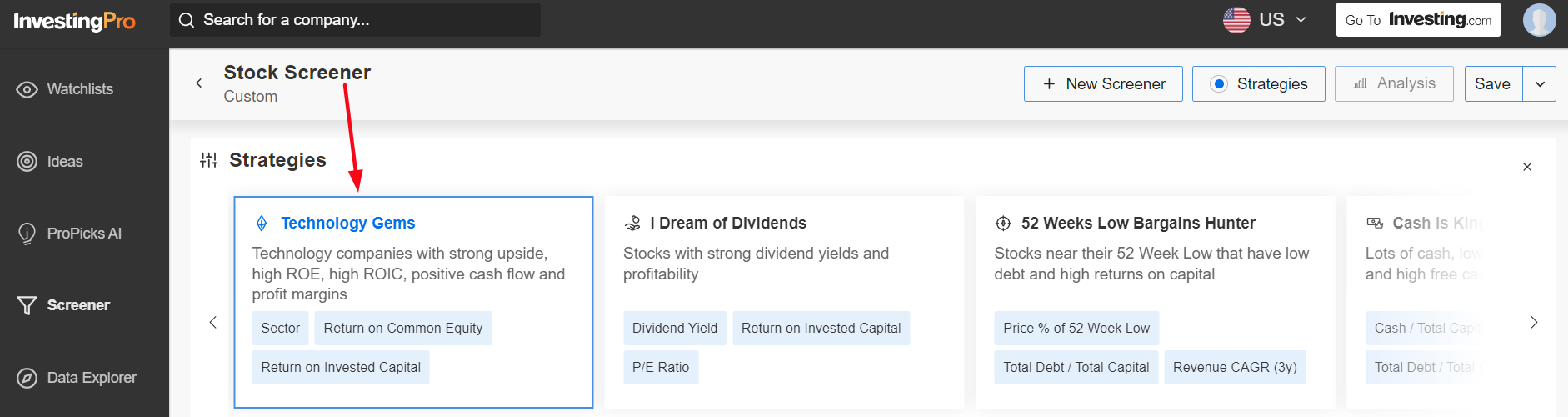

Source: investing.com

Introduction

The financial landscape is constantly evolving, demanding sophisticated tools to navigate the complexities of the stock market. This is where stock screener AI steps in, providing an intelligent and efficient approach to identifying potential investment opportunities. This comprehensive guide will explore the capabilities, benefits, and limitations of stock screener AI, helping you harness its power for informed investment decisions.

Understanding the Fundamentals of Stock Screener AI

What is Stock Screener AI?

Stock screener AI leverages artificial intelligence algorithms to analyze vast amounts of financial data, sifting through potential investments and highlighting those that align with your specific criteria. Unlike traditional methods, AI-powered stock screeners offer quicker and more comprehensive analysis, freeing you to focus on strategic investment decisions. This accelerated process empowers you to maximize potential profits, minimize risk, and significantly enhance overall decision-making in your stock portfolio management. The stock screener AI algorithms use sophisticated machine learning techniques to continuously improve their accuracy and identify trends that might be overlooked by human analysis.

How Does Stock Screener AI Work?

The stock screener AI functions through intricate algorithms, encompassing everything from fundamental data analysis (such as price-to-earnings ratios and dividend yields) to technical indicators and even sentiment analysis. Key components involve data collection, analysis, and ultimately, the identification of specific stock characteristics that meet predetermined criteria set by users. Stock screener AI tools vary widely, offering various customization options allowing tailored filtration based on your desired criteria and objectives. These options enable users to focus precisely on investment goals, whether that's finding undervalued assets, exploring growth potential, or securing income streams through dividend-yielding stocks. The sheer volume of data and diverse analytical tools employed by a modern stock screener AI is quite impressive, significantly elevating the speed and precision of the selection process.

Key Features of a Powerful Stock Screener AI

Advanced Filtering Options for Precise Screening

Powerful stock screener AI programs let you refine your searches to the maximum precision you require, leading to a focused analysis. Tailored parameters, from company size and sector to financial metrics like earnings per share and return on equity, help to find those unique "hidden gems" often missed by simpler methods. By using these advanced filtering capabilities of the stock screener AI tool, users gain more targeted insights and avoid unwanted risk exposure from improper market participation. This refined filtration empowers users to construct well-reasoned, tailored investment strategies to suit specific circumstances. This specificity is integral to making informed and data-backed investment decisions through a stock screener AI.

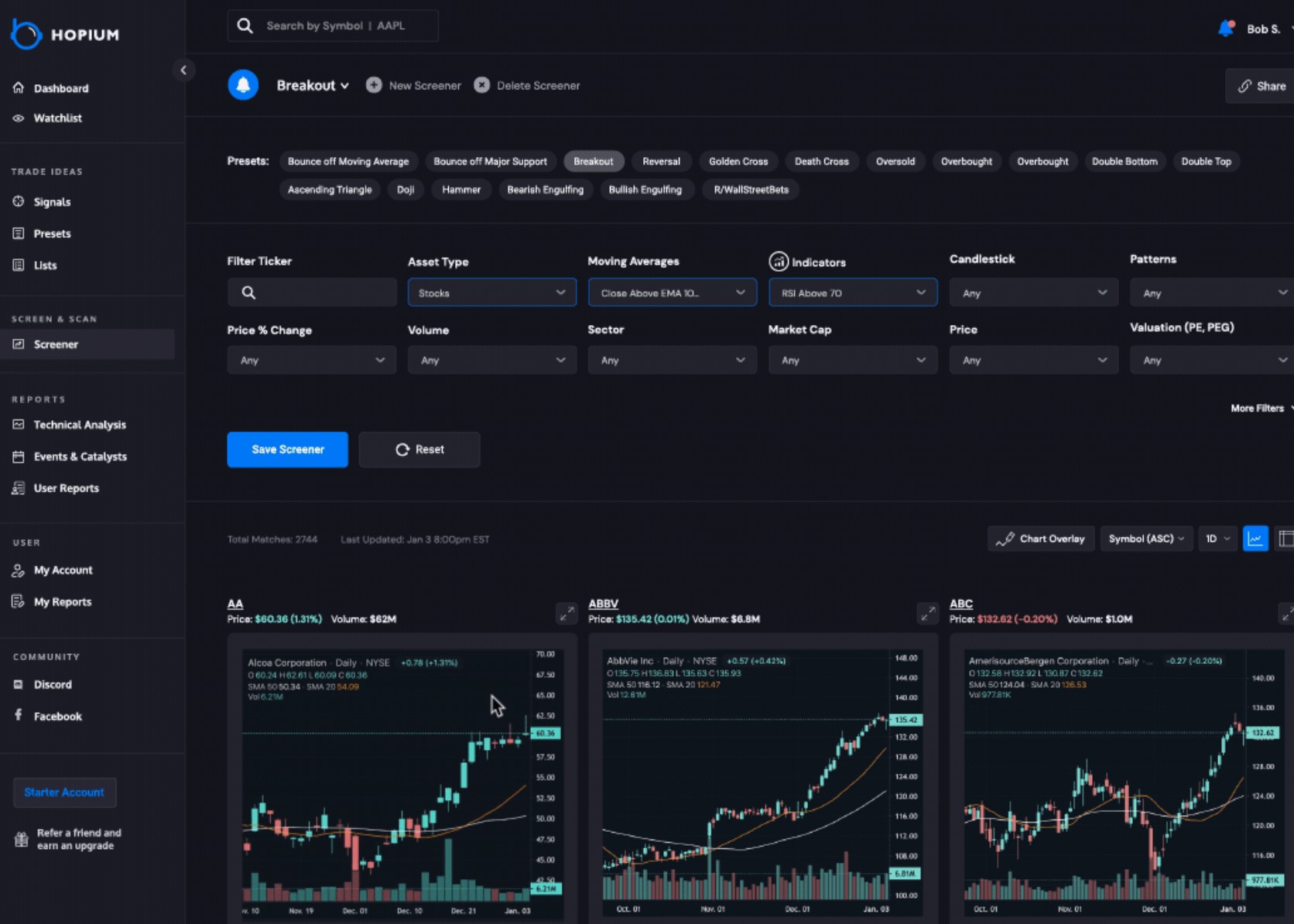

Source: forexa.info

Real-Time Data Integration for Current Market Insights

Real-time data integration, a core feature of advanced stock screener AI, is essential in today's volatile financial market. A superior AI solution enables immediate adjustments to analysis. This constant feed is indispensable to identifying timely patterns and trends and helping stock traders to swiftly make informed investment decisions, thereby taking the advantage in stock markets that are continually evolving in speed and intricacy. The real-time stock screener AI support provides a necessary responsive perspective, especially when seeking rapid responses in highly unpredictable markets. Integrating AI to this vital function in your investing tool greatly enhances your ability to capitalize on the advantages.

Performance Analytics & Historical Trends Assessment

This feature within stock screener AI algorithms examines past performance patterns. This deeper analysis reveals trends that a traditional analysis might miss. Stock screener AI equips investors with powerful tools to identify market patterns or predict future ones. Comprehensive historical trend assessments are crucial to a complete, well-balanced analysis for investors. Investors seeking to benefit from AI-driven analyses and insights in the stock market will gain from a thorough historical and ongoing pattern evaluation, making use of the advantages of stock screener AI programs to help them on their journey of better, informed decision making.

Understanding Stock Screener AI Limitations

Bias and Error in Algorithms

Although accurate, the results are contingent on the reliability of data that goes into algorithms. Inherent inaccuracies might present unforeseen and problematic implications if the information is flawed, biased, or simply incomplete. Utilizing multiple resources, along with human evaluation, mitigates some potential challenges. Stock screener AI's analytical tools are undeniably valuable in the investment landscape but it is prudent to recognize and mitigate the possibility of unforeseen implications when dealing with AI. Thorough verification remains an important step in confirming accuracy and usefulness from any stock screener AI-generated conclusions.

Source: stock-screener.org

Dependence on Accurate and Updated Data

Any AI tool depends heavily on accuracy and up-to-the-minute information. Incorrect data can skew results and produce unreliable or possibly misleading analysis using stock screener AI, affecting strategic investment choices and leading to unwelcome portfolio outcomes. A high level of precision in the raw data and an efficient AI tool will avoid errors for optimum investing strategies when using a stock screener AI.

Source: aptoide.com

Regulatory and Compliance Aspects

Stock screener AI needs to keep up with changes in regulations. Staying compliant with any pertinent financial laws is vital. Regulations for securities markets change frequently; it is very important that stock screener AI aligns with and adheres to any current standards and guidelines at all times.

How To Use Stock Screener AI

Setting Up Your Account and Preferences

How you use your AI-powered tool greatly affects its usability. Stock screener AI platforms often offer customizable profiles. These profiles allow you to define your investment criteria, parameters, and the parameters the AI is able to account for when filtering the choices in stocks for you. Investing success with the use of stock screener AI depends largely on careful setup and planning of your parameters, so invest your time well in building and tuning this section up to be as good as possible in order to derive the benefit and investment insight of your choice of stock screener AI.

Defining Your Investment Criteria for a Stock Screener AI

Source: mzstatic.com

Your investment criteria form the core foundation on which any stock selection process based on stock screener AI relies. By rigorously specifying requirements for each investment aspect, the stock screener AI filters the data efficiently to match specific investment desires in advance.

Interpreting Results from Stock Screener AI and Making Informed Decisions

Careful study of results from your stock screener AI is fundamental to making suitable decisions about investments in stocks. Thorough evaluation should allow investors to make better, informed investment selections, and reduce losses. Results that emerge should help support confident, wise investing. This feature can provide investors with much of what is needed.

Conclusion

Stock screener AI is transforming how investors approach the financial markets, facilitating more precise and potentially more profitable trading choices and analyses. A critical awareness of how the stock screener AI functions will make any user a wiser, more prepared investor and provide an invaluable advantage. With all of these available opportunities with stock screener AI, investors have a chance for an opportunity of a lifetime and great insights into financial strategies. Choosing to explore and implement stock screener AI tools and platforms will create a new and more advantageous style of trading. Stock screener AI has emerged as a powerful catalyst for improved financial planning. Utilizing AI's power is integral to future strategies in investing, both by investors as well as their financial planners. Utilizing stock screener AI may well become a central function in the successful evolution of both individual and institutional portfolios. Remember to thoroughly consider the potential risks before committing to any investment using stock screener AI-based strategies.