stock picking ai

Stock Picking AI: Revolutionizing Investment Strategies

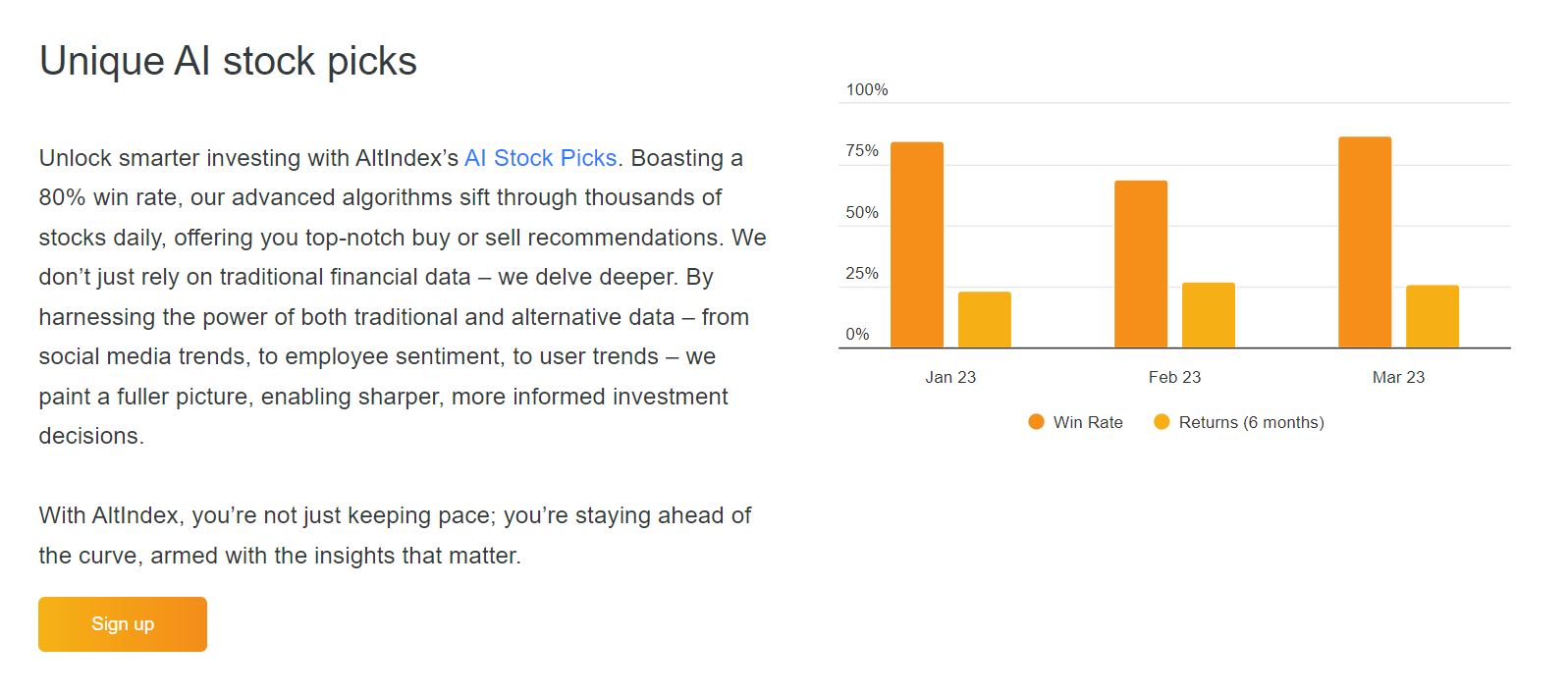

Stock picking AI is rapidly emerging as a powerful tool for investors, promising to streamline the complex process of identifying profitable stocks and making data-driven decisions. Leveraging sophisticated algorithms and vast datasets, these systems are capable of analyzing a multitude of factors to generate insightful predictions about future stock performance. This article explores the potential of stock picking AI, highlighting its benefits and drawbacks, and providing practical guidance for those interested in integrating it into their investment strategies.

Understanding the Mechanics of Stock Picking AI

What are the different types of Stock Picking AI models?

Stock picking AI models vary widely in their complexity and approach. Some focus on fundamental analysis, meticulously evaluating financial statements and company performance indicators. Others utilize technical analysis, dissecting historical stock price patterns and trading volumes to predict future trends. An important part of successful stock picking AI involves incorporating both fundamental and technical analysis. Hybrid models combining both strategies have shown the most promising results.

How do AI algorithms learn from market data?

Source: ytimg.com

These algorithms are trained on massive datasets, often encompassing historical stock prices, market news, economic indicators, and social media sentiment. The data is processed to identify correlations, patterns, and trends, which the AI uses to refine its predictive models and optimize its stock selection strategy. Continuous learning is critical to these AI models for success in stock picking.

Benefits of Implementing Stock Picking AI

Enhanced Efficiency and Speed in Stock Analysis

Stock picking AI can process an overwhelming amount of data far faster than any human analyst. This remarkable speed and efficiency allow for near real-time monitoring of market conditions and facilitate more rapid decision-making, thereby offering potential for substantial returns and avoiding potentially detrimental losses, and boosting your trading performance with speed and efficiency from stock picking AI.

Source: ytimg.com

Objectivity and Reduction of Bias in Stock Picking Decisions

One significant advantage of stock picking AI is its capacity for objectivity. By eliminating emotional biases and simplifying decision-making through stock picking AI analysis, human judgment is removed from the selection process, potentially resulting in better, more data-driven stock-picking outcomes.

Source: valuewalk.com

Deep Insights and Trend Spotting Through Large Datasets

By analyzing large datasets of market data, stock picking AI algorithms are more capable of discovering concealed trends and intricate patterns that might elude human analysts, which would also help investors identify investment opportunities.

Identifying High-Growth Stocks and Opportunities: Forecasting the Future of Stocks with AI in Investment

Utilizing powerful statistical models and machine learning algorithms, stock picking AI can provide more profound and complex insights into the probable evolution of a stock's performance.

Drawbacks of Stock Picking AI

Dependence on Data Quality and Accuracy

The effectiveness of stock picking AI models hinges significantly on the quality and accuracy of the input data. Inadequate data can lead to skewed insights and incorrect predictions, hindering stock selection efficacy.

Limitations in Understanding Complex Market Dynamics

Stock picking AI excels in spotting trends and correlations within historical market data. However, it can often struggle to decipher highly nuanced market phenomena such as economic downturns, political unrest, or shifting regulatory environments – areas of concern that should be mitigated, especially regarding Stock Picking AI's impact on trading choices.

Potential for Algorithmic Bias and Inherent Limitations

Just like human analysts, stock picking AI models are susceptible to algorithmic bias if not carefully constructed and trained on comprehensive, unfiltered datasets. Such biases can lead to discriminatory predictions and limit the true potential of stock picking AI.

How to Choose the Right Stock Picking AI Tools

Understanding the Specific Needs and Risk Tolerance

Before selecting a specific stock picking AI tool, it's crucial to comprehend one's specific investment goals, risk tolerance, and budget, considering that all these needs depend on different stock picking AI services. The complexity of stock picking AI may require different strategies for selecting stock picks for investment.

Evaluating the Performance Metrics and Track Record

It is critical to scrutinize and consider both the track record and the key performance indicators (KPIs) of a particular stock picking AI provider when conducting research or evaluating different stock picking AI tools. Stock Picking AI systems should include performance indicators and their evaluation criteria, for example, the total return or net profit in different scenarios for comprehensive performance evaluation.

Comparing Pricing Structures and Features for Various Stock Picking AI

Thoroughly comparing the various features and pricing structures of multiple stock picking AI platforms and tools is key before making any final selection decision. Considering the capabilities of the available platforms and their accessibility should always be kept in mind, which impacts user experience, potentially having a direct effect on the choice of Stock Picking AI to invest in or rely upon for financial assistance in managing funds or portfolios, as stock picking AI algorithms may lead to differing levels of accuracy and potential yield or risk, with considerable variation between their implementations.

Evaluating Risk Factors Associated with Stock Picking AI: Incorporating Different Perspectives from Stock Picking AI to Limit Loss Risks and Maximise Profits

Understanding how the stock picking AI tool handles risk is a necessary step for investors who are considering different stock picking AI products for investments. Investing involves risk; consequently, it's necessary to understand how to mitigate these risks appropriately when integrating Stock Picking AI tools to minimise potential harm and maximize rewards or profits by comparing different options.

Source: aiscout.net

Integrating Stock Picking AI into Your Portfolio Strategy

Diversifying Investment Portfolio Using Stock Picking AI Predictions

To optimize one's overall financial strategy with the insights offered by a stock picking AI solution, it is necessary to apply an effective diversifying portfolio strategy to mitigate investment risk with this tool. Implementing diversification for investment portfolio diversification, along with the assistance of stock picking AI solutions, could increase potential return without sacrificing safety through balanced investment portfolio strategies. Stock picking AI can predict more profitable diversification strategies than are normally available by combining diversified portfolio strategies and other tools with Stock Picking AI services.

Source: deepwatermgmt.com

Implementing AI-Assisted Trading Strategies with Cautious Adjustments for Results: Optimising Trading Strategy Integration

After researching a selection of suitable Stock Picking AI investment models and understanding its potential in optimizing investment portfolio results, cautious steps to integrating Stock Picking AI with existing investment practices need to be considered to maximize profitability by fine-tuning and adapting stock-picking AI and portfolio trading techniques with a methodical process. Consider integrating the strategies produced with AI through an incremental implementation plan. This step-by-step strategy enables one to adapt stock picking AI trading strategies without immediately disrupting their current portfolio allocation and balance of investments by focusing only on the chosen investment and trading strategies, minimizing unnecessary risk from the initial inclusion and implementation of stock picking AI tools and services into portfolios.

The Future of Stock Picking AI

Emerging Trends and Advancements in Stock Picking AI: Potential Improvements of Existing Stock Picking AI for Better Investment Decisions

AI continues to advance, leading to increasingly accurate stock picking AI algorithms capable of predicting investment trends and maximizing profits while mitigating potential losses. As data availability improves and the field continues to advance, even better and more nuanced models of stock picking AI will undoubtedly surface, offering even better prospects for achieving better investment returns. Stock picking AI algorithms will increasingly leverage advanced tools and advanced methods for increased prediction accuracy and portfolio maximization.

Ethical Considerations and Regulatory Implications: Preventing Unethical Applications with the Implementation of New Regulations

Despite the promise of stock picking AI, potential pitfalls like algorithmic bias, fraud and potentially misleading results need ongoing evaluation. Regulators play an important role in navigating the challenges involved in ensuring that stock picking AI systems promote equity and transparency in the financial industry, and maintaining public trust, to guarantee that Stock Picking AI tools remain reliable and that there are minimal fraudulent schemes utilizing Stock Picking AI solutions for financial gain.

Stock picking AI presents both promising opportunities and potential challenges. By understanding its workings, harnessing its potential effectively, and being mindful of its limitations, investors can potentially make more informed decisions, increase profitability while mitigating risk. Careful selection, robust verification, and careful monitoring are essential for maximizing success with any form of stock picking AI.