stock pickers market

The Stock Pickers' Market: Navigating the Complexities of Investment

The stock pickers' market presents a thrilling, yet challenging, landscape for investors. Deciphering market trends, understanding company fundamentals, and assessing future potential require a nuanced approach. This article delves into the intricacies of the stock pickers' market, providing a roadmap for navigating its complexities. This exploration of the stock pickers' market goes beyond surface-level analysis, delving into the critical factors that separate successful stock pickers from the rest.

Understanding the Stock Pickers' Market Landscape

The stock pickers' market is characterized by a dynamic interplay of factors, from economic conditions to individual company performance. Successfully navigating this landscape necessitates a profound understanding of these elements. This crucial understanding is essential for successful participation in the stock pickers' market.

How to Identify Market Trends

One crucial aspect of the stock pickers' market is understanding market trends. Major market events like interest rate changes or geopolitical tensions can drastically alter investment opportunities. Monitoring these changes is vital for making informed stock pickers' market choices.

- Follow financial news closely. Keep an eye on economic reports, inflation rates, and global events that could impact the stock market.

- Analyze sector performance. See how various sectors within the stock pickers' market perform relative to one another and the overall market. Look for areas of opportunity.

The Crucial Role of Fundamental Analysis in the Stock Pickers' Market

Source: com.au

Beyond broad market trends, in-depth company analysis is paramount in the stock pickers' market. Evaluating a company's financials, competitive position, and future prospects allows for a deeper understanding of the potential rewards and risks.

How to Perform Fundamental Analysis

Understanding fundamental analysis in the stock pickers' market is essential to identifying promising investments.

- Study financial statements: Income statements, balance sheets, and cash flow statements reveal a company's performance and financial health. Use ratios and trends to analyze growth.

- Evaluate the competitive landscape. Understand the industry dynamics in the stock pickers' market, analyzing competitors, barriers to entry, and technological advancements.

- Assess management quality. Look at leadership and historical performance for crucial insights on the company’s trajectory in the stock pickers’ market.

Evaluating Risk and Reward in the Stock Pickers' Market

A fundamental aspect of stock selection lies in recognizing the inherent tradeoff between risk and reward within the stock pickers' market.

How to Measure and Assess Risk-Reward Profiles

Knowing the inherent tradeoffs within the stock pickers' market is vital to a sound approach.

- Calculate Price-to-Earnings (P/E) ratios: To ascertain valuation levels relative to market trends, determine this essential value measurement for evaluating a stock. This can indicate the potential and inherent risk in any given company within the stock pickers’ market.

- Explore beta metrics: Understanding how a company's stock reacts to overall market trends gives vital clues for assessing potential risk in the stock pickers’ market. Consider beta analysis in relation to valuation methods for full picture in any market selection.

Psychological Factors Influencing Stock Pickers' Decisions in the Stock Pickers' Market

Investor psychology plays a significant role in market fluctuations. Understanding these behavioral tendencies is critical for decision-making within the stock pickers' market.

Source: slidesharecdn.com

Recognizing Behavioral Biases

Different emotional inclinations, like fear and greed, heavily affect market decisions in the stock pickers’ market. Awareness of this helps to make calculated decisions in the unpredictable landscape of this market. This aspect in particular impacts stock pickers' market behavior greatly.

- Beware of herd mentality: Avoid making decisions influenced by prevailing sentiment and blindly following other investors in the stock pickers’ market.

Source: arcpublishing.com

The Power of Technical Analysis in the Stock Pickers' Market

Technical analysis involves looking at charts, patterns, and historical trading volumes to predict stock price movements. Use this in tandem with fundamental analysis within the stock pickers’ market for an improved understanding.

Using Technical Analysis for Decision-Making

Charts are valuable for recognizing trend momentum within the stock pickers’ market, but are a supplementary rather than primary aspect.

- Identify support and resistance levels: Analyze patterns and trading volumes to predict potential upward or downward movements. This methodology, in tandem with other techniques, can refine investment strategies within the stock pickers’ market.

Tools and Resources for Successful Stock Picking in the Stock Pickers' Market

Several tools can enhance decision-making in the complex world of stock selection in the stock pickers’ market.

Using Research Platforms

Explore publicly available stock research tools to gather valuable data and insights on stocks. Various resources provide essential analysis that informs market participation for the stock picker's market.

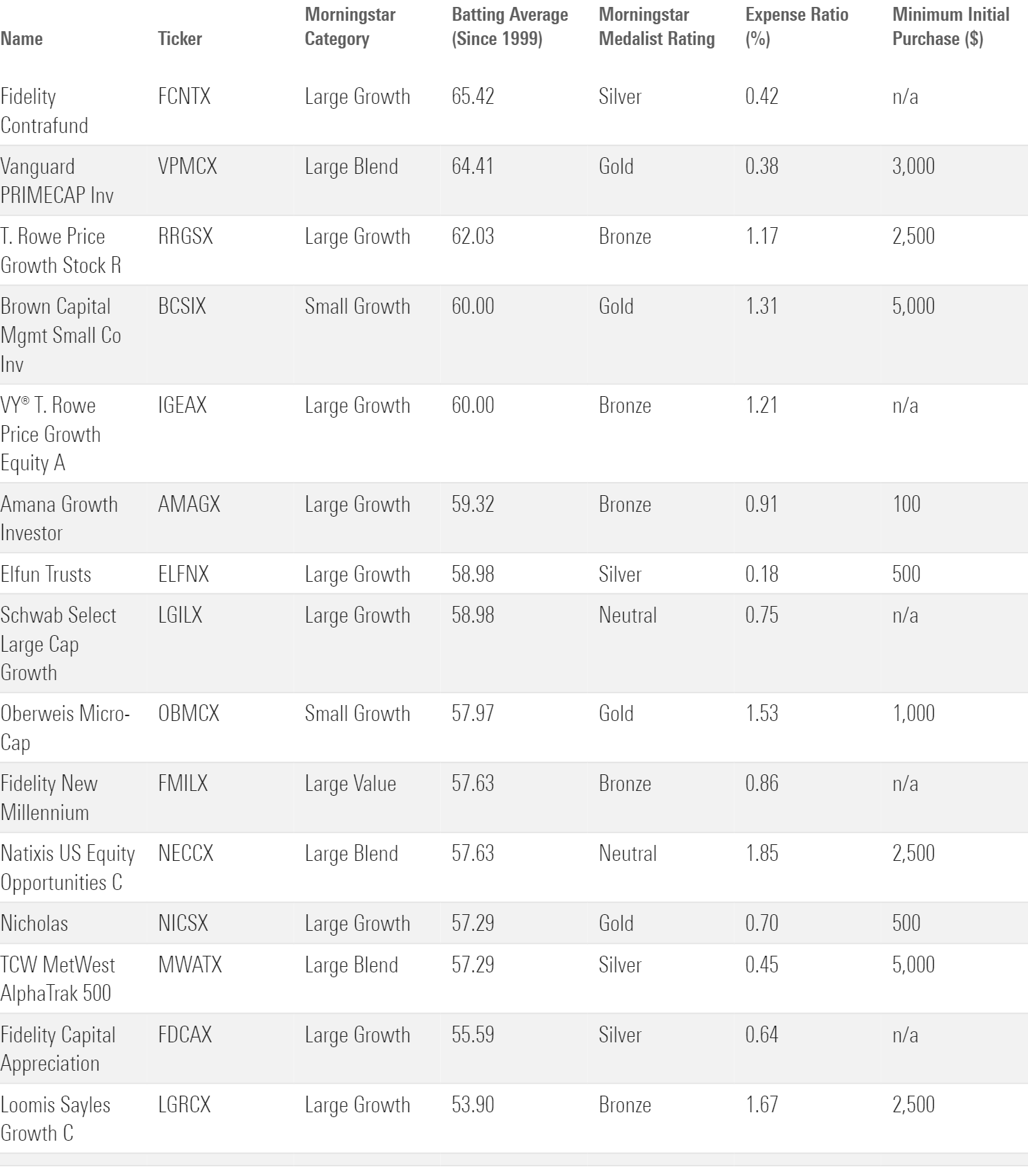

- Evaluate different platforms (e.g., Morningstar, Seeking Alpha)

Source: ytimg.com

Long-Term vs. Short-Term Strategies in the Stock Pickers' Market

Investors in the stock pickers’ market have varying approaches towards different strategies, both short-term and long-term.

Deciding Between Short-Term and Long-Term Investment Strategies

- Consider your financial goals: Aligning your chosen investment approach in the stock pickers’ market to your overall financial plan leads to more effective investments that serve your needs and risk tolerance within the stock pickers' market.

Developing a Risk Tolerance in the Stock Pickers' Market

Establishing Investment Risk Parameters

- Be conscious of inherent risk within stock markets: This understanding and conscious risk tolerance will allow more informed decisions within the stock pickers’ market.

- Align investment risk tolerance to broader financial risk factors: An approach should be individualized and well-defined as one of several investment approaches in the complex market environment for stock pickers.

Success and the Stock Pickers’ Market

Ultimately, consistent performance relies on mastering market understanding, and diligent analysis. Continuous learning is crucial in this dynamic arena known as the stock pickers’ market.